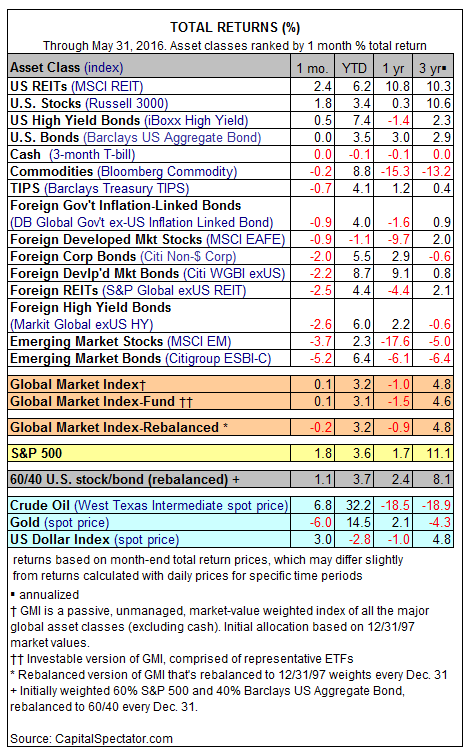

The recent rebound in global markets stumbled in May. Other than gains in US REITs, US equities, and US high-yield bonds, the rest of the field for the major asset classes suffered losses last month.

The big winner in May: real estate investment trusts in the US (MSCI REIT), which posted a 2.4% total return last month. For the year so far, US securitized real estate is ahead by a solid 6.2%. Note, however, that 2016’s current year-to-date leader is broadly defined commodities: the Bloomberg Commodity Index is higher by 8.8% so far this year.

The main loser last month: bonds in emerging markets (Citigroup (NYSE:C)), which shed 5.2%. Emerging-market stocks were the runner-up for red ink in May via a 3.7% loss.

The negative bias in markets last month kept a lid on the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. The index posted only a fractional gain of 0.1% in May. For the year so far, however, GMI is still ahead by a respectable 3.2%.

Note, too, that GMI’s trailing 3-year annualized total return inched up to 4.8% through last month (vs. 4.4% in April). That’s still near the weakest 3-year rolling return for GMI in several years. On the other hand, a 3-year return that’s close to 5% looks encouraging relative to the subdued long-run risk-premia forecasts for GMI of late.