The Zacks Large Cap Pharmaceuticals industry comprises some of the largest global companies that develop multi-million dollar drugs for a broad range of therapeutic areas such as neuroscience, cardiovascular and metabolism, rare diseases immunology and oncology. Some of these companies also make vaccines, animal health, medical devices and consumer related healthcare products. All these players invest millions of dollars in their product pipelines and line extensions of their already marketed drugs.

Here are the industry’s three major themes:

- Demand-driven growth in sales of new products, successful innovation and product line expansion, strong clinical study results, frequent FDA approvals, continued strong performance of key products, growing demand for drugs, especially for rare-to-treat diseases, an aging population and increased health care spending are some of the factors boosting this industry’s growth. A faster drug approval process and the proposed removal of outdated regulations, which are escalating costs and slowing down innovation, are the other positives.

- Mergers and acquisitions (M&A) activity is increasing following the tax reform. Big players are on the lookout for companies with innovative pipelines/technology. Meanwhile, in-licensing deals continue to be popular with several big companies collaborating with smaller and mid-sized players on promising mid-to-late stage pipeline candidates or interesting technology. These deals make sense for both larger and smaller companies. While the big shots are able to improve their pipelines with prospective candidates, the smaller entities gain access to a non-dilutive source of funds that allows consistent investment in the pipelines.

- Headwinds for the industry include government scrutiny of high drug prices, pricing pressure, intensifying branded competition, rising rivalry from biosimilar and generic products, a slowdown in growth of legacy products and major pipeline setbacks.

Overall, we believe that pipeline success, cost-cutting measures, share buybacks, product launches, ramped up M&A and collaboration activities should keep the sector afloat, going forward.

Zacks Industry Rank Indicates Bright Prospects

The group’s Zacks Industry Rank is basically the average of the Zacks Rank of all the member stocks.

The Zacks Large Cap Pharmaceuticals industry currently carries a Zacks Industry Rank #96, which places it at the top 38% of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few large drug stocks that are well positioned to outperform the market based on a strong earnings outlook, let’s take a look at the industry’s stock-market performance and its current valuation.

Industry Underperforms Sector & S&P 500

The Zacks Large Cap Pharmaceuticals industry is a 14-stock group within the broader Medical sector. It has underperformed the S&P 500 and the Zacks Medical Sector on a year-to-date basis.

While the stocks in this industry have collectively risen 3.7% year to date, the Zacks S&P 500 Composite and the Zacks Medical Sector have rallied 12.6% and 9.2%, respectively.

Year-to-Date Price Performance

.jpg)

Industry’s Current Valuation

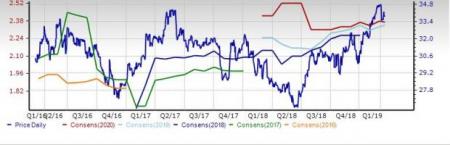

On the basis of the forward 12-month price-to-earnings (P/E) ratio, a commonly used multiple for valuing large pharma companies, the industry is currently trading at 15.43X compared with the S&P 500’s 16.76X and the Zacks Medical sector's 20.53X.

Over the last five years, the industry has traded as high as 18.10X, as low as 13.94X and at a median of 15.84X as the chart below shows.

Forward 12 Month Price-to-Earnings (P/E) Ratio

Bottom Line

In order to succeed in a changing global market and evolving healthcare landscape, pharmaceutical companies need to adopt innovative business models, invest in new technologies, raise investments in personalized medicines and seek external partners and collaborators for complementary strengths.

The sector may face some volatility due to the drug pricing issue, pricing/re-imbursement pressure, stiff competition, sluggish legacy product sales, loss of patent exclusivity of some key drugs and pipeline related setbacks. Also the fourth-quarter results were mostly below expectations and the earnings and sales outlook for 2019 was rather soft.

However, pipeline success in innovative and important therapeutic areas, cost-controlling, share repurchases, product introductions, heightened M&A activity and appropriate utilization of cash should put the sector on a firm footing as the year progresses.

In the Large Cap Pharmaceuticals universe, four companies have a Zacks Rank #2 (Buy). Most of these have witnessed positive earnings estimate revisions in the past 60 days.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bayer (DE:BAYGN) Aktiengesellschaft (BAYRY): This Leverkusen, Germany-based drug giant has seen a 9.2% rise in share price so far this year. The Zacks Consensus Estimate for this #2 Ranked stock's current-year EPS has been inched 0.5% up over the past 60 days.

Price and Consensus: BAYRY

Bristol-Myers Squibb Company (NYSE:BMY) (BMY): The Zacks Consensus Estimate for this New York-based drugmaker’s current-year EPS has been revised 6.5% downward over the past 60 days. Bristol-Myers has a Zacks Rank of 2. However, the stock has declined 4.1% so far this year.

Price and Consensus: BMY

AstraZeneca plc (AZN): The stock of this Cambridge, United Kingdom-based drugmaker has moved 12.1% north year to date. The Zacks Consensus Estimate for this Zacks #2 Ranked company’s current fiscal EPS has been raised 1.7% over the past 60 days.

Price and Consensus: AZN

Roche Holding (SIX:ROG) AG (RHHBY): Shares of this Swiss drugmaker have gained 8.9% this year so far. The Zacks Consensus Estimate for current-year EPS has been revised 1.3% upward over the past 60 days. Roche carries a Zacks Rank #2.

Price and Consensus: RHHBY

Roche Holding AG (RHHBY): Free Stock Analysis Report

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Bayer Aktiengesellschaft (BAYRY): Free Stock Analysis Report

AstraZeneca PLC (AZN): Free Stock Analysis Report

Original post

Zacks Investment Research