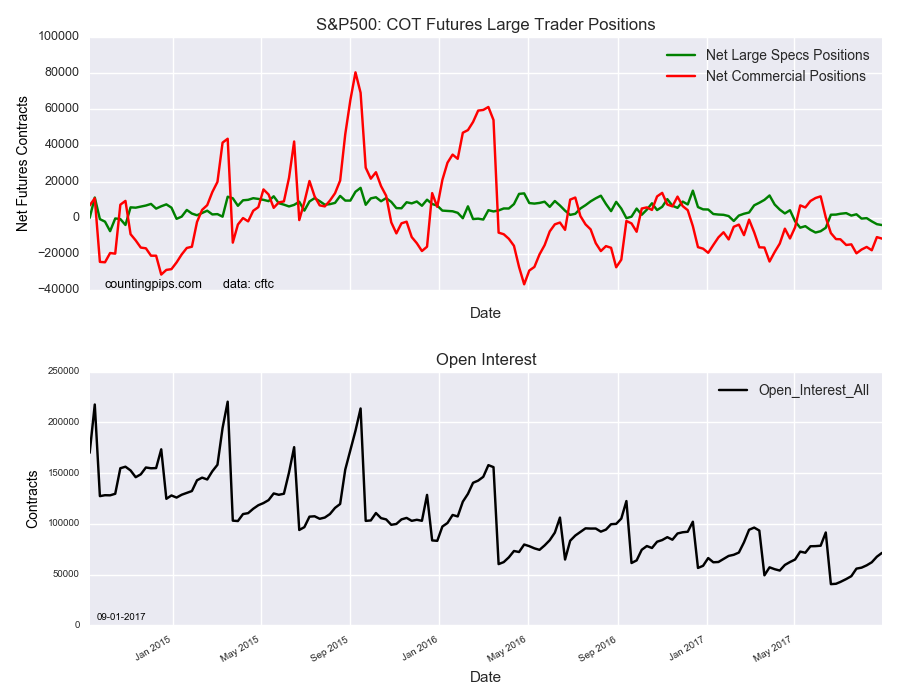

S&P 500 Non-Commercial Speculator Positions:

Large speculators increased their bets against the S&P 500 futures again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of S&P 500 futures, traded by large speculators and hedge funds, totaled a net position of -3,955 contracts in the data reported through Tuesday August 29th. This was a weekly lowering of -486 contracts from the previous week which had a total of -3,469 net contracts.

Speculators have now increased their bearish positions for a third straight week and the overall bearish level is at the most bearish stance since June 13th when net positions totaled -5,466 contracts.

S&P 500 Commercial Positions:

The commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -11,430 contracts on the week. This was a weekly decline of -821 contracts from the total net of -10,609 contracts reported the previous week.

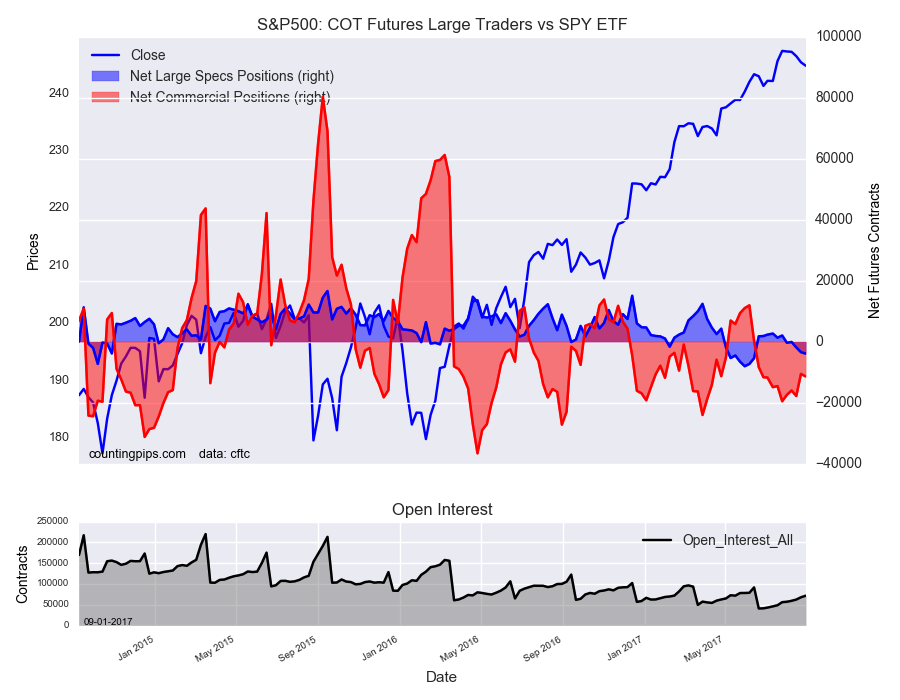

SPY (NYSE:SPY) ETF:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the SPY ETF, which tracks the price of S&P 500 Index, closed at approximately $244.85 which was a decrease of $-0.59 from the previous close of $245.44, according to unofficial market data.