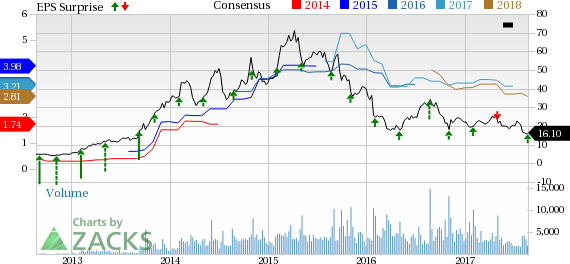

Lannett Company, Inc. (NYSE:LCI) reported earnings of 40 cents per share in fiscal fourth quarter of 2017, which were in line with the Zacks Consensus Estimate. The company had reported earnings of 73 cents per share in the year-ago quarter.

Lannett’s shares rose 1.8% in after-hours trading on solid revenue guidance for 2018. However, shares have traded lower than the industry so far this year. The stock has lost 27% while the industry registered a decrease of 2.6%.

Revenues were $139 million in the reported quarter, down 17.6% from the year-ago period. Revenues were also in line with the Zacks Consensus Estimate.

In the second quarter, research and development expenses decreased 13% to $11.4 million from the year-ago period. Selling, general and administrative expenses were down 9% year over year to $16.2 million.

Generic Approvals

During the quarter, the company received approvals for generic version of several drugs.

In May 2017, the FDA approved the abbreviated new drug application (ANDA) for levocetirizine dihydrochloride oral solution, generic to UCB Inc’s Xyzal, a treatment for perennial allergic rhinitis and chronic idiopathic urticarial.

Moreover, in June, the company received approval for amantadine hydrochloride capsules USP for treating signs and symptoms of infection caused by various strains of influenza A virus. The drug is a therapeutic equivalent of Novartis AG’s (NYSE:NVS) generic drug approved for the indication.

The company’s ANDA for hydrocodone bitartrate and acetaminophen tablets was also approved in June for treating opioid addiction.

Subsequent to the quarter in July 2017, Lannett received approval from the FDA for cyproheptadine hydrochloride syrup as a treatment for allergic reactions.

2018 Outlook

Lannett expects a substantial increase in revenues in the next fiscal compared with 2017 on the back of planned product launches. The company expects net sales to be in the range of $655 million-$665 million. Research and development expense is expected between $46 million and $48 million while expected selling, general and administrative is expected in the range of $73 million to $75 million.

Zacks Rank & Stocks to Consider

Lannett carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks in the pharma sector are Corcept Therapeutics Incorporated (NASDAQ:CORT) and Recro Pharma, Inc. (NASDAQ:REPH) . Both the stocks carrya Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Corcept’s earnings estimates increased from 26 cents to 42 cents for 2017 and from 49 cents to 70 cents for 2018 over the last 30 days. The company delivered an average earnings beat of 29.17% in the four trailing quarters. The stock is up 100.5% so far this year.

Recro Pharma’s loss estimates have narrowed from $2.59 to $2.35 for 2017 and from $2.60 to $2.59 for 2018 over the last 60 days. The company delivered an average positive earnings surprise of 21.16% in the trailing four quarters.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Novartis AG (NVS): Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT): Free Stock Analysis Report

Lannett Co Inc (LCI): Free Stock Analysis Report

Recro Pharma, Inc. (REPH): Free Stock Analysis Report

Original post

Zacks Investment Research