Are lagging mid-caps about to send a bullish message to the broad markets? Looks like we will find out soon.

The S&P 500 is over 9% above the highs of last September. The same can not be said for mid-caps.

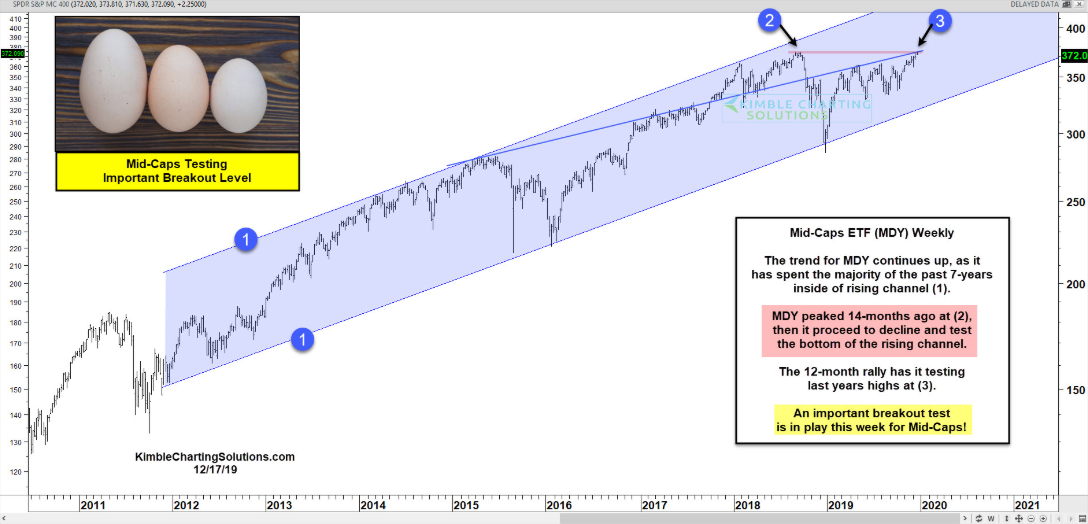

This chart looks at the mid-cap ETF (NYSE:MDY) over the past 10 years. MDY has spent the majority of the past 7 years inside of rising channel (1).

The ETF peaked last September at (2) and then it quickly declined by nearly 20%, taking it down to test the bottom of this bullish rising channel.

The rally over the past year has MDY testing its all-time highs again at (3), which shows that it has underperformed the S&P 500 by 9% since September of last year.

Lagging mid-caps are testing a key breakout level this week.

What they do at (3) will most likely send an important message to large-, mid- and small-caps stocks.