Wall Street was closed on Friday for the U.S. Independence Day holiday leaving global markets very quiet which continued to the balance of the weekend. Meanwhile European markets edged lower in quiet dealing on Friday, as investors booked profits from this week’s gains. The best way to sum up last week’s action was resilience, recovery and new highs have been the keywords for global exchanges this week.

The emergence of positive economy data from the US markets has cheered the equity markets internationally. the S&P 500 index has closed on Thursday at a record high of 1985.44; the index has appreciated by an incredible 22.91 percent in the last one year. Other equity markets, including emerging markets are trading near or over their 52 week high and marching towards levels’ that have not been seen before. The previous weeks’ concerns about the Iraqi tensions have had minimal or no effect on the financial markets this week. This morning Asian markets are mixed but quiet with very little guidance on Friday and a lack of global data Friday and this morning.

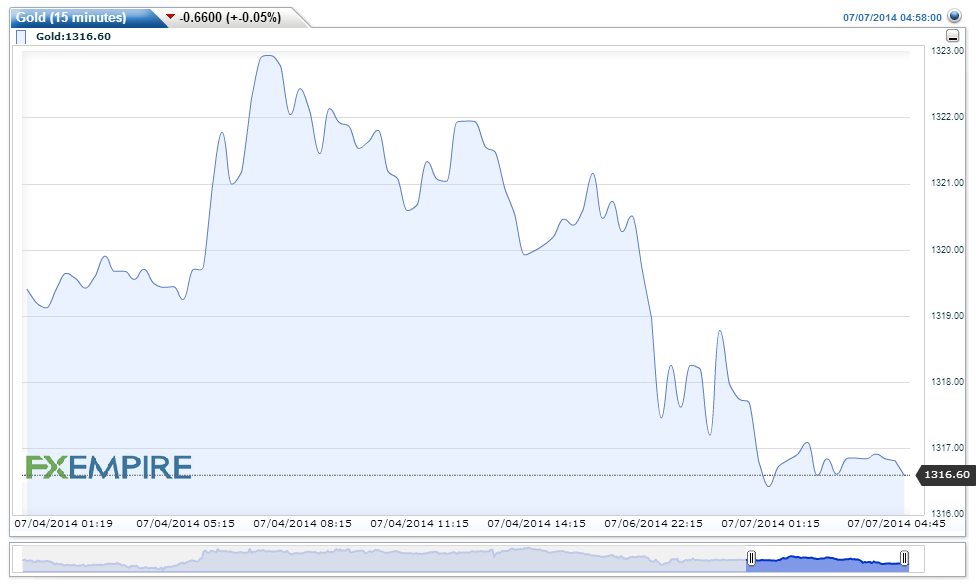

As global tensions eased and traders sentiment remain in a positive mode Gold reversed its course of last week to give up $3.60 this morning to trade at 1317.70 as the US dollar continues to slowly gain since the release of jobs data on the last trading day. The dollar climbed to a one-week high versus the euro before the Federal Reserve releases minutes this week of its last meeting amid speculation it will bring forward the timing of interest-rate increases. The dollar gained last week versus most of its Group of 10 peers as U.S. Labor Department figures showed employers added 288,000 workers in June, more than the 215,000 median forecasts of economists surveyed by Bloomberg News. The jobless rate dropped to 6.1 percent from 6.3 percent in May. The Fed will release minutes of its June 17-18 meeting on July 9.

Gold extended a decline from a three-month high as the outlook for higher borrowing costs in the U.S. strengthened the dollar. Palladium traded near the highest price since 2001 and Silver dropped. Silver is following gold closely easing by 97 points to trade at 21.103. Palladium traded at 864.10 an ounce from 864.88 on July 4, when the metal climbed for a 10th day to 867.15, the highest price since February 2001.

Gold ended a 12-year rally last year on expectations the Federal Reserve would reduce stimulus as the economy improved. International Monetary Fund Managing Director Christine Lagarde said yesterday U.S. growth is set to accelerate in the coming months even as she signaled a cut in the bank’s global forecast. The Bloomberg Dollar Spot Index rose for a fourth day today as the greenback reached a one-week high against the euro.

Copper eased by 16 points to trade at 3.254 as traders booked profits and the strengthening US dollar weighed on the commodity. Copper prices slipped on Friday but still posted their biggest weekly rise in more than nine months. Confidence was boosted after data showed U.S. employment growth jumped in June and the unemployment rate declined, allaying fears about the economy´s health after a weather-hit start to the year. That came after a survey showed that global business activity picked up in June, with new orders pouring in at their fastest rate in over three years. Some analysts expected the metal used in power and construction could tick lower following its recent gains.