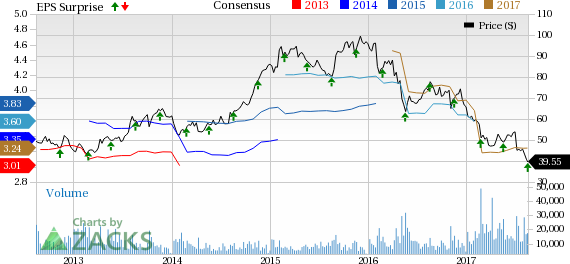

L Brands, Inc. (NYSE:LB) came up with eighth-straight quarter of positive earnings surprise, as it reported second-quarter fiscal 2017 results. However, the company’s revenues lagged the Zacks Consensus Estimate for the fourth quarter in row.

The company posted quarterly earnings of 48 cents per share beating the Zacks Consensus Estimate of 45 cents and also came above the company’s initial guidance of 40-45 cents, on account of cost optimization as well as non-operating income gains. However, the company’s earnings declined 31% year over year.

Despite reporting better-than-expected bottom-line, the company’s shares declined more than 5.5% in after-hour trading session on Aug 16, as investors were hurt by guidance cut. In fact, the Columbus, OH-based company’s shares have tanked 20.4% in the past three months, wider than the industry’s decrease of 12.9%.

This specialty retailer of women’s intimate and other apparel reported net sales of $2,755 million, down 5% from $2,889.7 million in the prior-year quarter. The figure was also below the Zacks Consensus Estimate of $2,764 million. L Brands comparable sales (including direct sales) were down 8% during the quarter. Further, store only comps also decreased 6% year over year. During the quarter, the exit of the swim and apparel categories had an adverse impact of 6% and 9%, respectively to total company comps and Victoria’s Secret comps.

Sales at Victoria’s Secret Stores declined 8% to $1,351 million, while Victoria's Secret Direct sales decreased 26% to $295.3 million. Total Victoria’s Secret sales dropped 12% to $1,646.3 million, while comparable sales declined 14%. Decrease in total Victoria’s Secret sales can be attributable to high-single digits fall in lingerie sales in comparison with the prior-year quarter. However, PINK registered sales growth in mid-single digits. Meanwhile, excluding the impact of the exit of the swim and apparel categories Victoria’s Secret comps declined 5%.

In an effort to streamline Victoria’s Secret business, the company made some strategic changes in 2016. L Brands stated that the strategic efforts will persist in 2017, which is likely to put pressure on the results. However, it is confident of achieving growth in the long run and envisions annual operating income increase of 10%.

Bath & Body Works’ total sales rose 7% to $860.3 million, with 6% rise in comparable sales. Strong performances of the company’s home fragrance assortment drove the segment sales. Victoria’s Secret and Bath & Body Works International’s sales were up 14% to $113.9 million. Other revenues increased 11% to $134.5 million.

Adjusted gross profit dropped 8% to $1,027.9 million, while gross margin contracted 120 basis points (bps) to 37.3% primarily due to buying and occupancy expenditure deleverage during the quarter. Adjusted operating income decreased 26% to $300.9 million, while the operating margin fell 320 bps to 10.9%. Decline in operating income was chiefly due to Victoria’s Secret.

Store Update

During the quarter, L Brands opened six Victoria’s Secret stores in total and shuttered nine outlets, consequently taking the total count to 1,174 stores. During the period, 17 Bath & Body Works stores were opened and 12 were closed, which took the total count to 1,698 stores. The company had 16 Victoria’s Secret U.K. and 29 Henri Bendel stores at the end of quarter. As of Jul 29, 2017, L Brands operated 3,077 stores.

Total franchised stores as of Jul 29, 2017, were 794 that comprised 236 Victoria's Secret Beauty & Accessories, 27 Victoria’s Secret, five Pink, 155 Bath & Body Works and 198 La Senza stores.

Other Financial Details

The company the quarter with cash and cash equivalents of $1,360.3 million, up from the prior-year quarter’s figure of $1,272.7 million. The long-term debt decreased to $5,703.6 million from $5,705.8 million in the year-ago period. Moreover, shareholders’ deficit is pegged at $912.3 million.

During the second quarter, management incurred capital expenditures of $207 million, and now projects the same to be roughly $800 million for fiscal 2017. The company now anticipates generating free cash flow of $650-$700 million during the fiscal year, down from the prior estimate of $750-$850 million.

In reported quarter, the company repurchased 1 million shares for $49.2 million. At the end of quarter, it had $120.8 million remaining under the current share buyback program of $250 million.

Guidance

The company trimmed fiscal 2017 guidance. Management now projects earnings in the band of $3.00-$3.20 per share for fiscal 2017, down from the previous guidance of $3.10-$3.40 and also below the fiscal 2016 earnings of $3.74 and fiscal 2015 earnings of $3.99. Moreover, the company expects the fiscal third-quarter earnings in the range of 25-30 cents, compared with prior-year quarter earnings of 42 cents.

Analysts polled by Zacks anticipate earnings per share of 37 cents and $3.24 for third-quarter and fiscal 2017, respectively.

L Brands now anticipates comparable sales (excluding Victoria's Secret swim and apparel) in the third quarter to be in the range of flat to down low-single digit. For fiscal 2017, the company envisions comparable sales to be down low-to-mid-single digits, and anticipates total sales growth to be about 3 points higher than comps on account of square footage growth and also due to a 53rd week.

Gross margin is anticipated to deteriorate year over year during the third quarter as well as fiscal 2017.

Zacks Rank

Currently, L Brands carries a Zacks Rank #3 (Hold). Better-ranked stocks in the retail sector include The Children's Place, Inc. (NASDAQ:PLCE) , Burlington Stores, Inc. (NYSE:BURL) and Dollar General Corporation (NYSE:DG) . All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Children's Place delivered an average positive earnings surprise of 16.3% in the trailing four quarters and has a long-term earnings growth rate of 9%.

Burlington Stores delivered an average positive earnings surprise of 22.6% in the trailing four quarters and has a long-term earnings growth rate of 15.9%.

Dollar General delivered an average positive earnings surprise of 1.4% in the trailing four quarters and has a long-term earnings growth rate of 10.6%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

L Brands, Inc. (LB): Free Stock Analysis Report

Dollar General Corporation (DG): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post