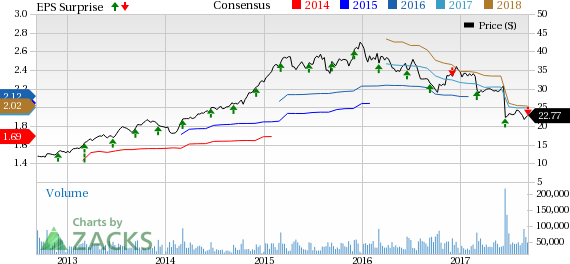

The Kroger Co. (NYSE:KR) , one of the largest grocery retailers, came out with second-quarter fiscal 2017 results, wherein earnings of 39 cents per share missed the Zacks Consensus Estimate of 40 cents and also declined from 47 cents recorded in the prior-year quarter.

Kroger reiterated its fiscal 2017 earnings guidance of $2.00–$2.05 per share. The Zacks Consensus Estimate for the year is currently pegged at $1.99.

Earnings Estimate Revision: The Zacks Consensus Estimate for fiscal 2017 has been stable over the past 30 days. In the trailing four quarters (excluding the quarter under review), the company has outperformed the Zacks Consensus Estimate by an average of 1%.

Revenues: Kroger generated total revenue of $27,597 million that increased 3.9% year over year and also came ahead of the Zacks Consensus Estimate of $27,380 million. The company’s identical supermarket sales, without fuel, inched up 0.7%.

Kroger envisions identical supermarket sales (excluding fuel) to increase in the range of 0.5-1% for the balance of fiscal 2017.

Zacks Rank: Currently, Kroger carries a Zacks Rank #4 (Sell), which is subject to change following the earnings announcement.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stock Movement: Kroger’s shares are down nearly 4.2% during pre-market trading hours following the earnings release.

Check back later for our full write up on Kroger’s earnings report!

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Kroger Company (The) (KR): Free Stock Analysis Report

Original post

Zacks Investment Research