- Grocery retailer Kroger shares are up over 5.5%

- KR may continue to outperform in today’s high inflationary environment

- Long-term investors could consider buying KR shares at current levels

- For tools, data, and content to help you make better investing decisions, try InvestingPro

Shareholders of the grocery retailer Kroger (NYSE:KR) have seen the value of their investment increase by 32% over the past 12 months. By comparison, the S&P 500 has lost more than 16.5% so far in 2022.

Source: Investing.com

On Apr. 8, KR shares went over $62 to hit an all-time high. Now, they are changing hands at $47.90. The stock’s 52-week range has been $35.91-$62.78, while the market capitalization currently stands at $36.9 billion.

The Cincinnati-based food retailer operates more than 2,700 stores, including about 2,200 pharmacies and 1,600 fuel centers. Kroger currently has an 8% market share among US grocers. Readers may be interested to know that with a 25% market share, Walmart (NYSE:WMT) leads the sector.

Kroger currently relies on four different formats: Supermarkets (including, Kroger, Ralphs, Dillons, and QFC), multi-department stores (Fred Meyer), price impact warehouse stores (Food 4 Less and Foods Co), and marketplace stores (such as Dillons Marketplace, Fry’s Marketplace and King Soopers Marketplace).

Analysts concur that Kroger's e-commerce, pickup and delivery options continue to generate inflation-resistant revenue. Meanwhile, long-term shareholders have enjoyed years of returns and dividend hikes. The current price supports a dividend yield of 1.73%.

How Recent Metrics Came In

Kroger released Q4 and full-year 2021 metrics on Mar. 3. Quarterly revenue hit $33 billion, a 7.5%-year-over-year increase. Identical sales without fuel went up by 4% to $28.9 billion. Adjusted net income stood at $566 million, or 91 cents per share, compared with an adjusted loss of $77 million, or 81 cents per share, in the same quarter in the previous year.

On the results, CEO Rodney McMullen stated:

“Our strategy of leading with fresh and accelerating with digital propelled Kroger to record performance in 2021, on top of record results in 2020.”

For the full year 2022, management anticipates identical sales growth to come in between 2%-3%. Meanwhile, adjusted EPS is expected to come in between $3.75-$3.85.

Prior to the release of the Q4 results, KR stock was changing hands around $50. At the time of writing, it is at $48.60, down roughly 3%.

What To Expect From Kroger Stock

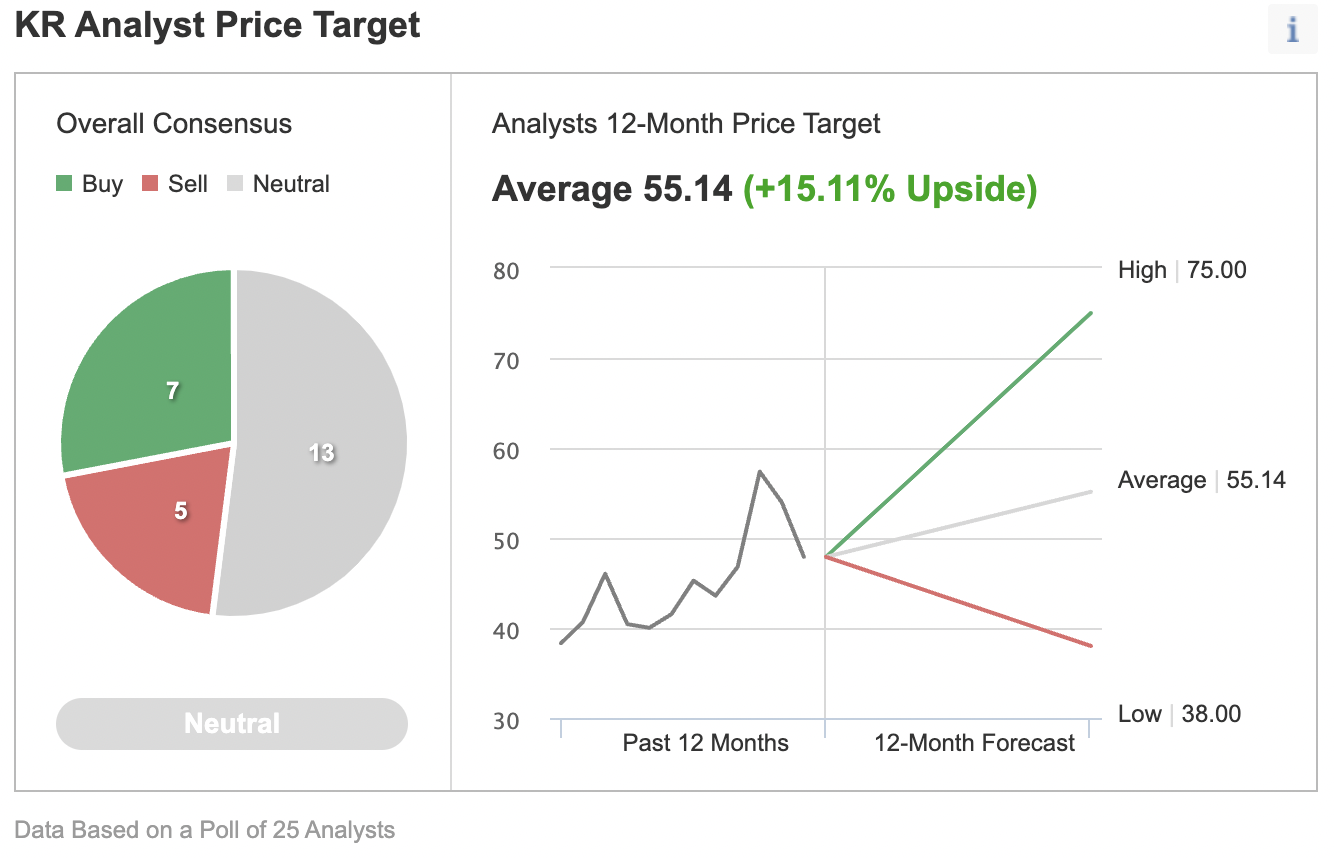

Among 25 analysts polled via Investing.com, KR stock has a "neutral" rating with an average 12-month price target of $55.14 for the stock. Such a move would suggest an increase of more than 13.5% from the current price. The target range stands between $38 and $75.

Source: Investing.com

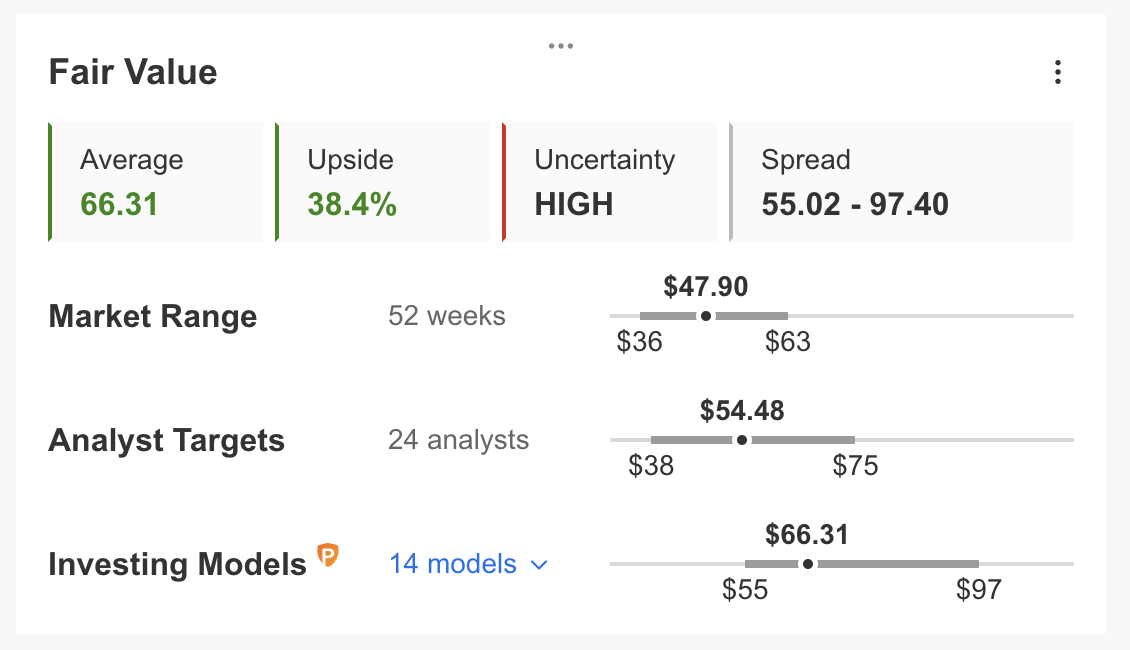

Similarly, according to a number of valuation models, including those that may consider P/E or P/S multiples or terminal values, the average fair value for KR stock on InvestingPro stands at $66.31.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase more than 36.5%.

At present, KR’s P/E, P/B, and P/S ratios are 21.3x, 3.7x, and 0.3x. Comparable metrics for peers stand at 19.4x, 2.3x, and 0.4x. These numbers reveal that KR stock may be slightly overvalued at the current stock price.

As part of the short-term sentiment analysis, it would be important to look at the implied volatility levels for Kroger options as well. Implied volatility typically shows traders the market's opinion of potential moves in a security, but it does not forecast the direction of the move.

KR’s current implied volatility is about 19.5% higher than the 20-day moving average. In other words, implied volatility for Kroger is trending higher, while options markets suggest increased choppiness ahead.

Our expectation is for KR stock to build a base between $45 and $55 in the coming weeks. Afterwards, shares could potentially start a new leg up.

Adding KR Stock To Portfolios

Kroger bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $55.14, as per the target provided by analysts.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has KR stock as a holding. Examples include:

- John Hancock Multifactor Consumer Staples ETF (NYSE:JHMS)

- Principal Millennials ETF (NASDAQ:GENY)

- iShares Focused Value Factor (NYSE:FOVL)

- Invesco Dynamic Food & Beverage ETF (NYSE:PBJ)

Finally, investors who expect KR stock to bounce back in the weeks ahead could consider selling cash-secured puts on Kroger shares.

Most option strategies are not suitable for all investors. Therefore, the following discussion on KR stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Cash-Secured Puts On KR

Price: $48.60

This bullish trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own KR shares for less than their recent market price of $48.60.

A put option contract on KR stock is the option to sell 100 shares. Cash-secured means the investor has enough money in his or her brokerage account to purchase the security if the stock price falls and the option is assigned. This cash reserve must remain in the account until the option position is closed, expires, or is assigned, which means ownership has been transferred.

For instance, if investors sold the $45 strike put that expires on July 15, they could collect about $1.85 in premium.

Therefore, the maximum return for the seller on the day of expiry would be $185, excluding trading commissions and costs, if the option expires worthless.

But if the put option is in the money (meaning Kroger stock is lower than the strike price of $45) any time before or at expiration on July 15, this put option can be assigned.

The put seller would then be obligated to buy 100 shares of KR at the put option strike price of $45 for a total of $4,500 per contract.

If the put seller gets assigned Kroger shares, the maximum risk is similar to that of KR stock ownership. In other words, the stock could theoretically fall to zero. But this risk is partially offset by the KR option premium received ($185 for 100 shares).

The break-even point for our example is the strike price ($45) less the option premium received ($1.85), i.e., $43.15. This is the price at which the KR put seller would start to incur a loss.

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company (here, Kroger stock) outright at the current market price.

Investors who end up owning KR shares as a result of selling puts could further consider setting up Kroger covered calls to increase the potential returns on their shares. Thus, selling cash-secured KR puts could be regarded as the first step in Kroger stock ownership.

The current market makes it harder than ever to make the right decisions. Think about the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »