Kraton Corporation (NYSE:KRA) and some of its fully-owned subsidiaries declared the closure of a term loan of €260 million, priced at EURIBOR plus 2.50% with a floor of 0.75%. Proceeds from the transaction has been used to prepay part of the $886 million outstanding balance under the company’s USD Tranche (or USD-denominated term loan facility).

Kraton also repriced the remaining balance of the USD Tranche along with closing of the Euro Tranche. The new interest rate applicable for USD Tranche is LIBOR plus 3.00% with a 1% floor, which represents a 1% reduction from the previous interest rate of LIBOR plus 4.00%.

According to Kraton, the company is diligently improving overall capital structure since the acquisition of Arizona Chemical in Jan 2016. The latest move is expected to save annual cash interest of roughly $13 million. It will also be able to eliminate the covenant of financial maintenance that existed under the Term Loan facility.

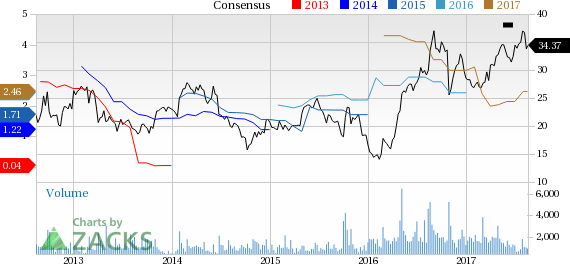

Shares of Kraton have moved up 0.7% in the last three months, marginally underperforming the industry’s 0.8% growth.

Kraton reported net income of $25.5 million or 81 cents per share in second-quarter 2017, up 40.9% year over year. Barring one-time items, adjusted earnings were 82 cents per share, which beat the Zacks Consensus Estimate of 55 cents.

Revenues for the quarter increased 15.5% year over year to $525.3 million. The figure also topped the Zacks Consensus Estimate of $496 million.

According to Kraton, both Chemical and Polymer segments witnessed robust end market demand and sequential expansion of margin.

Kraton also benefited from the acquisition of Arizona Chemical in the form of cost reduction and operational improvements. The company also delivered incremental cost improvement synergies worth $13 million in the second quarter, marking an aggregate $26 million for the first half. Kraton expects to realize transaction synergies of $65 million related to the Arizona Chemical acquisition by the end of this year.

Kraton currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Other Stocks to Consider

Some other top-ranked stocks in the basic materials space are Smurfit Kappa Group PLC (OTC:SMFKY) , POSCO (NYSE:PKX) and Kronos Worldwide Inc (NYSE:KRO) . All three stocks sport a Zacks Rank #1.

Smurfit Kappa has expected long-term earnings growth rate of 4%.

POSCO has expected long-term earnings growth rate of 5%.

Kronos Worldwide has expected long-term earnings growth rate of 5%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Kraton Corporation (KRA): Free Stock Analysis Report

SMURFIT KAPPA (SMFKY): Free Stock Analysis Report

POSCO (PKX): Free Stock Analysis Report

Original post

Zacks Investment Research