Retailer Kohl’s Corporation (NYSE:KSS) posted impressive second-quarter fiscal 2017 results. Shares of the retailer moved up more than 2.5% in the pre-market trading.

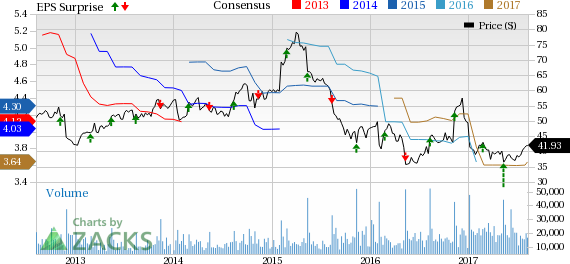

Kohl’s reported adjusted earnings of $1.24 per share, beating the Zacks Consensus Estimate of $1.19 by 4.2%. Earnings also grew 2% from the prior-year quarter owing to improved sales trend in all lines of business, strong inventory and expense management.

Sales and Margins

Net sales of $4.144 billion marginally beat the Zacks Consensus Estimate of $4.138 billion. However, it dipped 0.9% from the prior-year quarter due to a challenging sales environment and lower comparable store sales (comps). This signals that the company’s strategic initiative Greatness Agenda is failing to deliver results. The initiative, which commenced in first-quarter 2014, was designed to increase transactions per store and sales. Though the plan has helped the company to deliver positive comps in all the four quarters of fiscal 2015, the quarterly growth rates were declining, thus posing a concern. Further, comps started declining since first-quarter fiscal 2016 and plummeted consecutively for the next six quarters, including the current one.

Encouragingly, the 0.4% drop in comps in the second quarter was narrower than the preceding quarter’s decline of 2.7% and prior-year quarter’s decline of 1.8%, owing to increased traffic momentum witnessed in the second quarter. Though transactions for the quarter were lower than last year, they increased in the month of July, which also benefited the quarter.

Gross margin declined only 6 basis points to 39.4% in the reported quarter. Selling, general and administrative expenses fell 0.3% to $983 million in the quarter.

Other Financial Details

As of Jul 29, Kohl’s had $552 million of cash and cash equivalents, $2.79 billion of long-term debt and $5.03 billion of shareholders’ equity. Cash flow from operations were $376 million, while capital expenditure were $399 million.

On Aug 8, the Kohl's board declared a quarterly cash dividend of 55 cents per share, which will be paid on Sep 20, to shareholders of record as of Sep 6.

Kohl’s ended the year with 1,154 Kohl's stores, 12 FILA Outlet stores, and four Off/Aisle clearance centers in 49 states.

Our Take

We note that Kohl’s has been struggling for the last few quarters to boost its sluggish top line. Lower spending on apparel and accessories and a general slowdown in consumer spending are hurting sales at department stores. Kohl's and its competitors have struggling in an intensely competitive market from online retailers.

Nevertheless, Kohl’s has been making continuous efforts to improve its base business. Lately, the company has started offering more outside famous brands and cutting down on the number of in-house clothing brands it sells. The addition of Under Armour workout tights, sneakers and other gear in March was a great success and well-accepted among customers. It also helped to boost sales of the entire active apparel department in the first quarter despite decline in women's, children's and accessories units. Kohl's plans to start selling Clarks shoes for the back-to-school shopping season and is looking for other brands to add to store aisles. The company also plans to continue selling the best-selling of its private-label brands, such as Sonoma, Croft & Barrow and Apt. 9, in order to drive traffic.

Kohl’s has also undertaken several initiatives to reduce its inventory to boost profits. During first-quarter fiscal 2017, the company made additional progress on its initiatives and as a result, inventory per store decreased 1%, while units per store were 5% lower. Lower inventory levels thus boosted earnings. The company continues to expect inventory to be down low to mid-single digits for the fiscal year 2017.

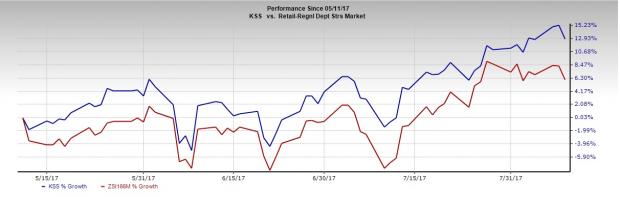

We believe these efforts are well reflected in the share prices of the company. Notably, in the last three months, the stock has moved up 12.8% in comparison to the industry and the broader Retail and Wholesale sector. While the industry grew 6.0% in the last three months, the sector increased 2.9% in the said time frame.

Zacks Rank & Other Key Picks

Kohl’s currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the apparel industry include J.C. Penney Company, Inc. (NYSE:JCP) , Canada Goose Holdings Inc. (NYSE:GOOS) and The Gap, Inc. (NYSE:GPS) . While J.C. Penny sports a Zacks Rank #1 (Strong Buy), other two stocks carry a Zacks Rank #2 (Buy). You can seethe complete list of today’s Zacks #1 Rank stocks here.

While J.C. Penny has an expected long-term earnings growth of 16.0%, Canada Goose and Gap have an expected earnings growth of 47.0% and 8.0%, respectively, for the next three to five years.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Canada Goose Holdings Inc. (GOOS): Free Stock Analysis Report

J.C. Penney Company, Inc. Holding Company (JCP): Free Stock Analysis Report

Kohl's Corporation (KSS): Free Stock Analysis Report

Original post

Zacks Investment Research