Selloff in equities continued while dollar extends it's pull back against European majors. DJIA tumbled -268.05 pts, or -1.51% to close at 17533.15 overnight, comparing to historical high of 17991.19 made last week. S&P 500 also lost -33.68pts, or -1.64% to close at 2026.14, comparing to historical high of 2079.47 made last week. Asian equities followed with Nikkei down nearly -1% at the time of writing. Dollar index breached 88 handle briefly as recent pull back extends. Technically, it should be noted that EUR/USD broke 1.2455 support while USD/CHF broke 0.9648 support. The development argues that dollar has bottomed in near term already and we'd likely see deeper pull back ahead.

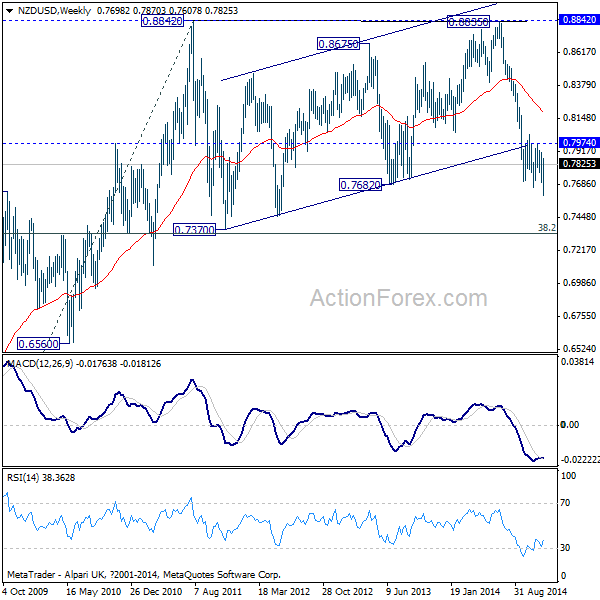

New Zealand dollar rebounds strongly after RBNZ left interest rate unchanged and maintained tightening bias. The Official Cash Rate was held at 3.50% as widely expected. Also, the central bank noted in the statement that "some further increase in the OCR is expected to be required at a later stage". Nonetheless, RBNZ governor Graeme Wheeler said that he was "surprised" by Kiwi's rebound to the statement given that he signed longer pause in the tightening cycle. He also noted that the lower dairy prices were not reflected in the exchange rate, which is "unjustifiably and unsustainably high". The NZD/USD is back trading above 0.78 today after dipping to 0.7607 earlier this week. Overall, near term outlook stays bearish with 0.7974 resistance intact. The fall from 0.8835 is expected to extend lower later to 0.7370 support as the pattern from 0.8842 extends.

Australian dollar also recovered following better than expected job data. Employment grew 42.7K in November, much stronger than expectation of 15.0k. Nonetheless, that was mainly driven by 40.8k growth in part time positions. Full time jobs just added 1.8k. Prior month's figure, though, was revised lower from 24.1k to 13.7k. Unemployment rate rose from 6.2% to 6.3%. The participation rate rose from 64.6% to 64.7%. Also from Australia, consumer inflation expectations rose 3.4% in December. Elsewhere, Japan tertiary industry index dropped -0.2% mom in October while machine orders dropped -6.4% mom. UK RICS house price balance dropped to 13 in November.

Looking ahead, SNB rate decision is a major focus today. Attention will be on whether SNB president Thomas Jordan would finally adopt negative interest rates to counter the expected quantitative easing of ECB. Or, Jordan would just repeat the pledge to maintain the EUR/CHF 1.2 floor with "utmost determination". SNB will also release new growth and inflation forecast today. Also to be featured today include German CPI, ECB monthly bulletin, Canada new housing price index. From US, retail sales, import price, jobless claims and business inventories will be featured.