The past few days have been tough for the venerable kiwi dollar with a fall in global dairy prices affecting the pair strongly. The Global Dairy Trade (GDT) Auction saw a 2.2% fall in dairy prices overnight, in a move that set the pair tumbling back towards support at 0.7335. The dairy industry is an important sector of New Zealand’s economy andrepresents 35% of global dairy output. Subsequently, any fall in dairy prices has a direct impact locally and typically affects GDP expectations strongly.

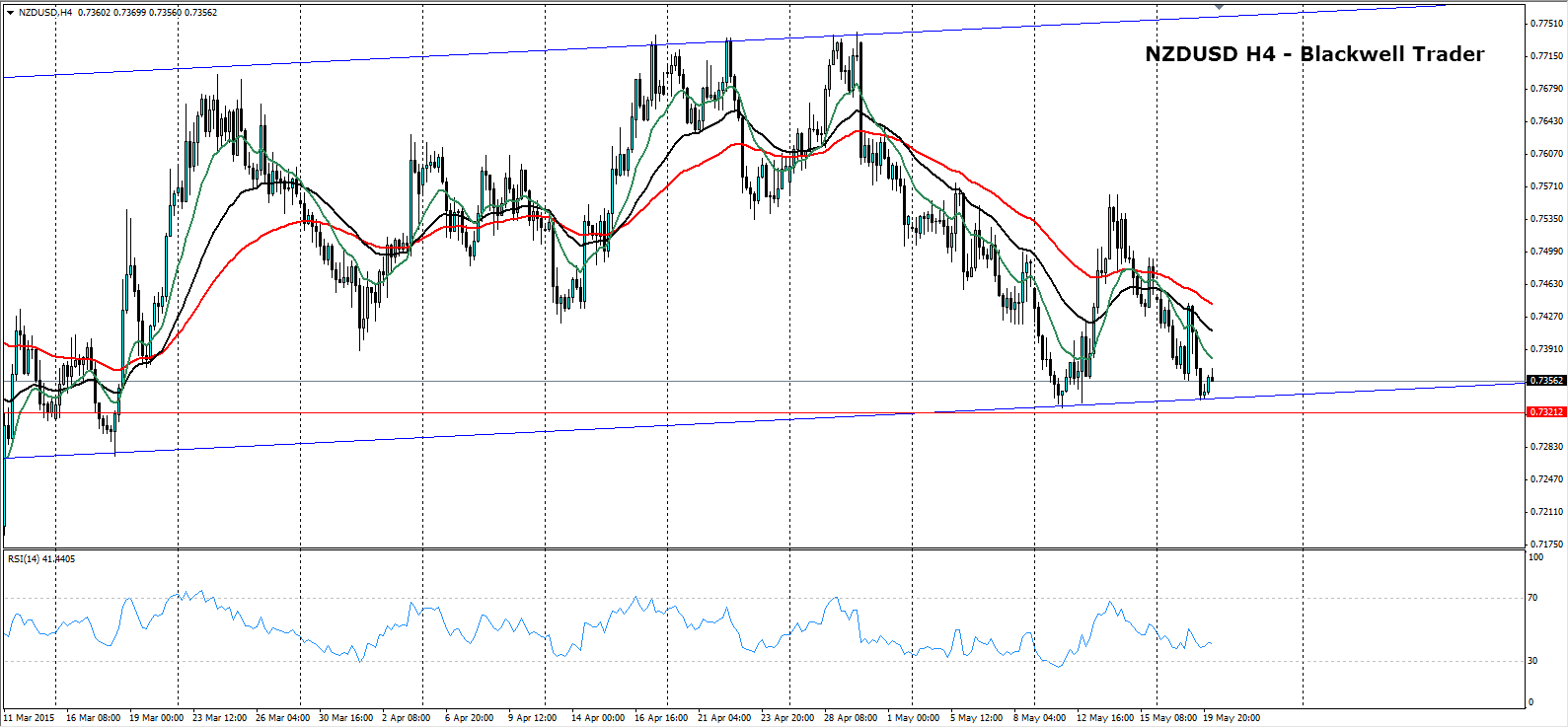

However, the New Zealand dollar appears to have found some support, after a night of strong selling, and has formed a base at 0.7340. Despite the sharp fall, what is currently forming on the chart is starting to suspiciously appear like a double bottom. Price action is currently supported within a slightly bullish channel, which both swing candles have touched upon before reversing.

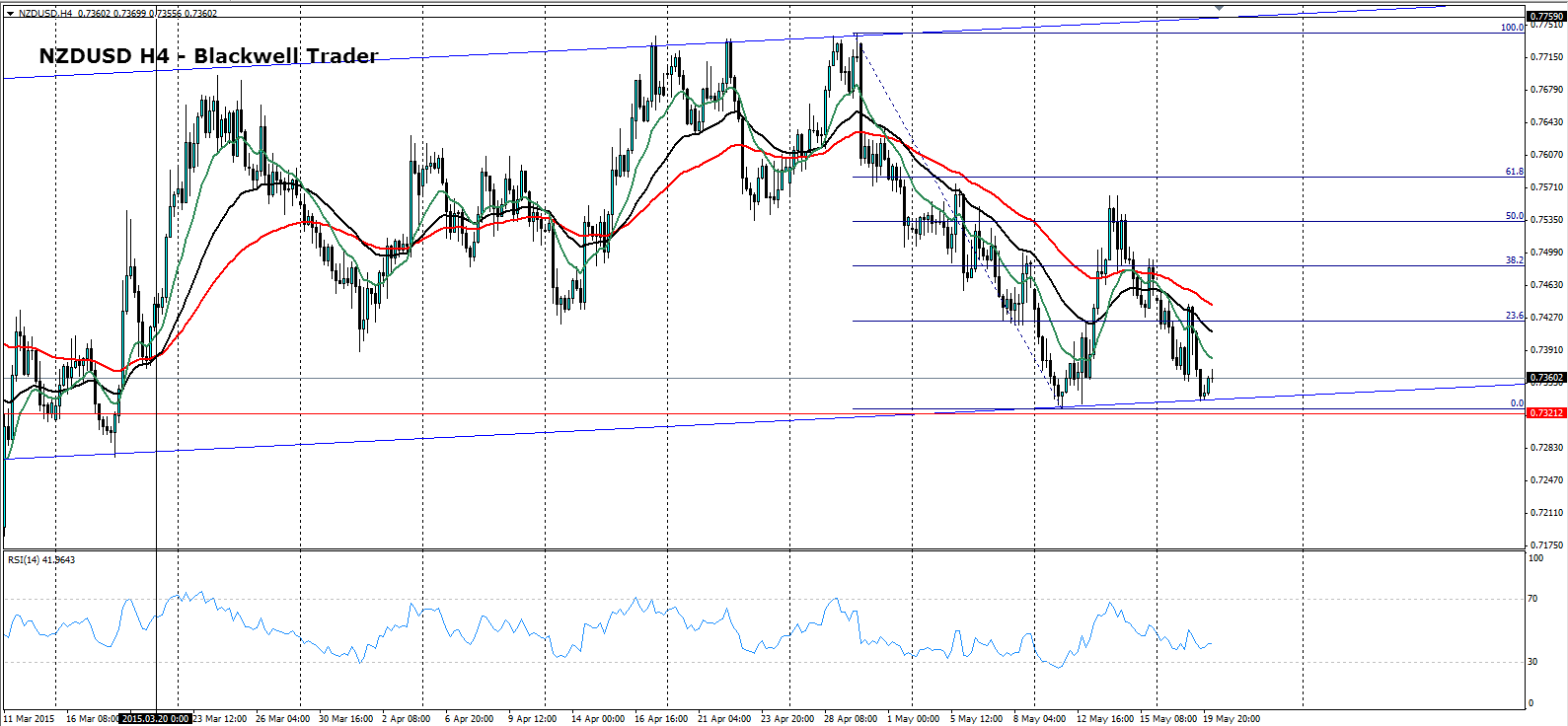

Looking at the Fibonacci Retracement levels tells an interesting story, with the potential neckline of the pattern, showing a massive retracement to the 50% level. To confirm a double bottom, the currency pair will need to climb beyond the 23.6% level, at 0.7425, at which point traders will likely be eyeing the neckline with great interest.

Taking a quick look at relative strength shows the oscillator still within neutral territory, towards the oversold range. However, hourly charts show a definite trend to the long side as RSI starts to climb higher.

Ultimately, keen eyes will be watching the price action for further confirmation. Any move above the 23.6% level is likely to signal a confirmed double bottom, whereas a break of the equidistant channel will see the pair move quickly to form a new base around 0.7280.

On the news front, US economic data is likely to remain the major driver of the currency within the coming days. In particular, the US Unemployment Data and Flash Manufacturing PMI, is expected to impact the pair strongly.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.