China, India, Indonesia, Russia, Canada, Sweden, Denmark. Those are just some of the nations that felt compelled to lower rates in 2015. Several rate-cutting countries may genuinely warrant stimulus to bolster economic activity. Others have engaged in currency depreciating tactics in reaction to electronic money creation by the Bank of Japan (BOJ) and European Central Bank (ECB). Either way, the currency wars have been getting uglier by the minute.

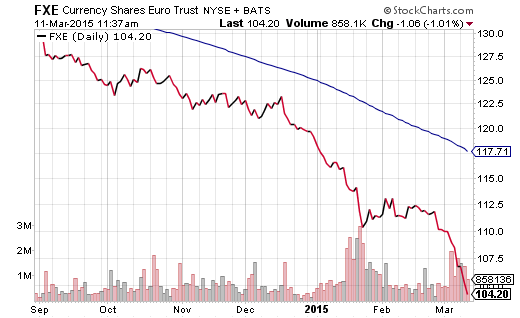

How bad is it getting? The euro has slumped roughly 20% against the dollar in a mere seven months. And that’s just the deterioration of the euro-zone’s medium of exchange for goods/services since the president of the ECB, Mario Draghi, pledged to create hundreds of billions of euro “credits.” Chart enthusiasts can visualize the decimation by following CurrencyShares EuroTrust (NYSE:FXE).

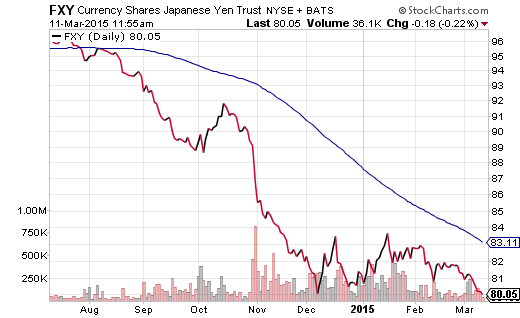

The timing of Japan’s massive yen-creating gambit may be different, but the results are the same. CurrencyShares Yen Trust (ARCA:FXY) aptly depicts the erosion in value of Japan’s currency.

Why is this so troubling for U.S. stock investors? The pace of the dollar's rise against worldwide currencies suggests a number of undesirable outcomes for the U.S. economy. First, there’s the loss in export competitiveness. In fact, the U.S. trade deficit just hit a record high (excluding oil). Secondly, corporations have to endure the disintegration of profits made in foreign currencies. Indeed, forward earnings estimates for the initial two quarters of 2015 have turned negative. (Note: Projections have moved from 7%-10% year-over-year earnings growth to 0% or less, yet the U.S. stock market is still within 3.5% of all-time records.)

Granted, stock investors did not seem to mind strength in the greenback in 2013 or 2014. After all, the almighty buck had been coming off decade-long lows just a few years earlier. Now, however, the dollar’s supreme strength against all comers is destructive for U.S. stocks. Need proof? Through 3/10, U.S equities had fallen on nearly 72% of this year’s trading sessions when King Dollar gained ground. Comparing PowerShares D.B. U.S. Dollar Bullish (NYSE:UUP) to the S&P 500 on a year-to-date chart provides a spectacular view of the current dynamic.

Indeed, policy makers at the Federal Reserve appear to have boxed themselves into a corner. They hitched their rate-hiking wagon to headline unemployment and they’ve practically guaranteed moves to tighten in 2015. It follows that if the rest of the world is aggressively easing while the Fed is modestly tightening, the U.S. dollar may continue to climb. By extension, it is hard to see how the relationship between the dollar and U.S. stocks will change from the pattern depicted in the chart above.

One should anticipate a 10%-plus U.S. stock correction in the months ahead. One should not expect the Fed to deviate from its implicit and explicit guidance, at least until a corrective phase comes to fruition. At such a crossroad, Janet Yellen’s Fed could offer up a dovish blink; a Federal Reserve Open Market Committee (FOMC) member could emphasize a significant modification to the pace of overnight lending rate moves. Heck, if a correction begins turning bearish with enough ferocity, members might mention freshly discovered threats to the domestic economy. With that, they might stop the talk of raising overnight lending rates altogether, or even hint at a need for a more neutral or accommodating posture. Anything is possible (even an actual recovery in Europe and/or Japan).

At this moment, currency-hedged foreign stock ETFs represent the only dip-buying opportunity in the equity space. I have been adding exposure to iShares Currency Hedged Germany (HEWG) and/or WisdomTree Europe Hedged Equity (NYSE:HEDJ). You get stock momentum, the dollar over the euro, as well as investor faith in quantitative easing experimentation. (”Hey, it worked for the U.S., didn’t it?” he said sarcastically.)

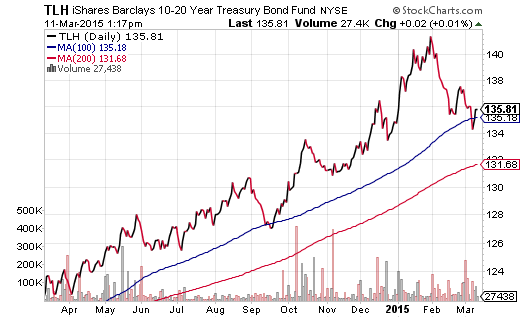

Finally, do not rule out further flattening of the yield curve. I might have reduced some exposure to extended-duration treasuries due to my investing discipline. Still, it is not inconsistent to expect long-term rates to fall even as short-term rates climb, especially if U.S. stocks react poorly to Fed tightening. Even economic under-performance and/or geo-political unrest would benefit longer-term Treasuries.

Investors looking to buy any dips might concentrate some cash in iShares 10-20 Year Treasury (NYSE:TLH), a component of the FTSE Custom Multi-Asset Stock Hedge Index (MASH). TLH appears to be holding onto support at its intermediate 100-day trendline.