King dollar

The markets continue to trade on the backdrop of the FOMC meeting. While the US dollar remains king of the hill, the USD and US Treasuries sold off the ”yield” tops after the US core CPI for November came in a whiff lower than expected. But this was more a case of data inspired profit taking as the big dollar dips remain very shallow.

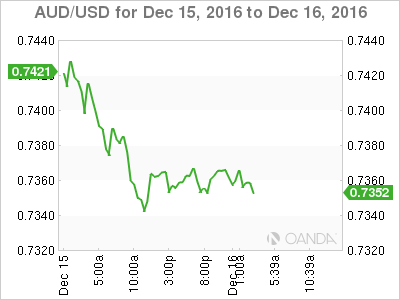

Yesterday’s stellar jobs report offered little more than a lifeline for the Aussie as the uptick was quickly faded as the UST 10 year yields sizzled. But again, activity in AUD has remained tepid with both JPY, and EUR hogging the limelight as both of those currencies offer a clearer path for long USD plays.

Clearly, De Yellen resonance suggest the USD bull trend will remain intact for the foreseeable future, but perhaps less so against the commodity bloc which at this stage are lagging the G-3 dollar moves, given just how well risk assets classes have been trading

The break below .7375 support was rather shallow, which suggests dealers are viewing the current dip as value, but given the proximity to year end, participation on the Aussie is rather low

For the Aussie bulls, there’s far more monetary worth holding longs versus the majors (EUR and JPY) provided support from commodity prices, particularly iron ore, remains convincing. However, this trade requires thick skin given the over the top gyrations in iron ore prices.

Japanese yen

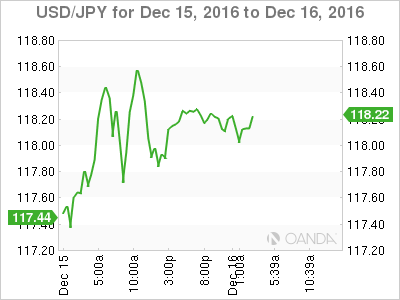

The sizable layered exporter offers have pulled off the Tokyo order books as the market slices through significant top side levels like a hot knife through butter as 120 USD/JPY looks only a matter of time. The key driver, US-Japan yield differential was in full bloom when UST 10 year yields rocketed to 2.6 % level in early London leaving what was thought to be the significant 2.5 % level in the rear view mirror as USD/JPY continues to be the favoured trade to express a long USD bias among G-10 traders.

Dealers have abandoned a buy in dip mentality if favour of “mine” at the market psychology. Whatever early holiday departure plans G-10 desks had will likely remain on hold as dealers are having far to much fun to worry about recalibrating year end risk at this stage.

While the post FOMC drop in S&P had the USDJ/PY temporarily resigned, the ensuing stoutness in the equity complex has also provided a decent tailwind for long positions.The higher rates are bad for stocks story is holding little water in this environment.

While I was always cautious about exceedingly quick and sudden currency moves, that pitch is starting to sound like a broken record as there appears no stopping this upward momentum and in the absence of any foreseeable risk event in the near-term, the USD bulls should continue to have their way.

Euro

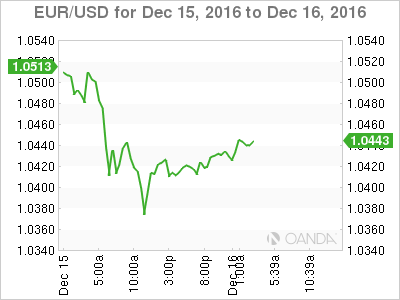

Euro parity, is it real? Traders are certainly getting their last licks in for the year driving the EUR/USD to 1.0370 overnight before pulling back above 1.04 on profit taking. The writing is certainly on the wall as Q1 is shaping up to be a political hotbed of sorts as the Brexit fallout debate will continue amidst mounting political risks as the new year brings a wave of highly contentious elections. So ECB policy debate and political risks surrounding upcoming Euro Zone elections will accelerate.

However, weak growth, low inflation and high government debt, makes it very unlikely the ECB will move off easy money policy. So I think it comes down to the short date rates which will continue to drive sentiment. With inflation alarm bells ringing in the US, one should expect US short-term interest rates to move higher, so the clear-cut differential play will unquestionably favour USD strength.

While the parity party invitations remain on hold, the writing is all but on the wall for the euro to succumb to the surging USD.

Pboc and EM Asia

Asia Bond markets continue to reprice higher in the wake of the Hawkish Fed, but liquidity remains fragile as the market reassesses amidst what is typically the wind-down period entering the holiday season. However, overall EM FX risk was not sold as aggressively as anticipated.

Much of the regional focus is centred on USD/CNH which flirted the 6.95 level before selling off aggressively towards 6.92. While we see some decent and outsized moves, much of the action is occurring in thin markets amid extremely volatile funding conditions, as overnight offshore yuan rates are getting squeezed as the long USD/CNH trade remains intact. But we see a market in desperate need of CNH funding to cover the shorts.

Sure we all know the yuan is going to weaken, but the Pboc is making this perhaps the most uncomfortable short in town. As we enter year end rolls, I can only expect dealers to take note of current funding costs and begin to take back CNH shorts with positioning kept to a minimum as we head into year-end.

Clearly, the Pboc has some challenging times ahead of then given the significant USD boost to the Hawkish Fed has offered the markets. Do they continue to intervene via overt currency intervention at the risk of depleting reserves and possible sovereign risk erosion? Is it time for the Pboc to step back and let the currency find its market and not manipulated peg? Alternatively, continue to clamp down on outflows?

The landscape is not looking much better across the region as while the interest divergence story is playing out, here are still many questions unanswered when it comes to Asia.

While the possibility of 3+ interest rate hikes looms in the US, in all likelihood one could only argue for one hike anywhere across the ASEAN space. However, once we factor in the political headwinds from the pending US trade policy story line, not only will the pinch be felt across the regional high yielders but the lower yielding global trade sensitive pairs like KRW add TWD are looking extremely vulnerable at this stage.

Disclaimer: This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.