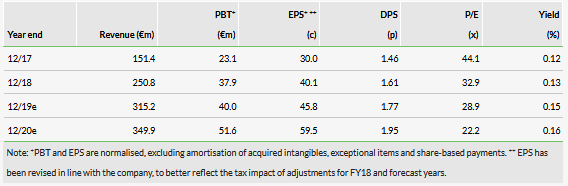

Keywords Studios Plc (LON:KWS) saw strong revenue growth in H119 (17.5% like-for-like, l-f-l) and although investment and some one-off factors compressed margins, the company looks well placed to sustain double-digit EPS growth in the future. We upgrade our FY19 revenue estimates by 5.2% and FY20 by 4.3% and although H1 investment, together with a revision to the adjusted tax calculation, compresses FY19 earnings by 15.8%. FY20 EPS reduces by 2.5% as margins normalise on a higher sales figure. The FY20 P/E of 22.2x is in line with peers, before factoring in the potential for organic upside and further accretive acquisitions.

Robust growth continues; investment to sustain this

Keywords saw strong revenue growth in H119 (17.5% l-f-l, 39% with acquisitions) to €153.2m, with accelerated investment in recruitment and training, together with the costs of early-stage investments and a one-off acquired project compressing operating margins to 12.6% from 15.5% last year. Adjusted PBT growth was 15% to €18.4m (H118: €16.0m). Net debt was €9m (vs €0.4m at end-2018), reflecting peak working capital commitments at the end of H1, higher capex for investment in new infrastructure (€5.1m vs €1.4m in H118) and €6.9m outflows on acquisitions (H118: €12.6m). The company’s new €100m debt facility (extendable to €140m) gives it plenty of headroom to continue its consolidation strategy.

Revenues upgraded; FY19 EPS pared back

H2 trading has started well and progress in H1 gives us confidence that Keywords remains well placed to sustain robust double-digit organic growth trajectory; with increased capacity in place, we expect margins to normalise. The business is well balanced across service lines, geographies and game formats and benefits from an accelerating trend towards outsourcing. We upgrade our FY19 revenue estimates by 5.2% and FY20 by 4.3%, and although H1’s investment, together with a revision to the adjusted tax calculation, compresses FY19 earnings by 15.8%. FY20 EPS reduces by 2.5% as margins normalise on a higher sales figure.

Valuation: In line with peers, with M&A upside

With its shares trading on a 2019e P/E of 28.9x that falls to 22.2x in 2020e, Keywords is trading in line with peers. However, we see scope for organic upside while further accretive acquisitions (such as the latest acquisition of TV Synchron in Berlin) should bring the 2020e P/E down, potentially to c 18–20x based on our assumptions. With strong underlying growth, we continue to believe sustained execution should drive robust returns for shareholders.

Business description

Keywords Studios is the leading and most diverse supplier of outsourced services to the games industry. Through regular acquisitions, the company is building its scale, geographic footprint and delivery capability. Its ambition is to become the ‘go to’ supplier across the games industry.

Investment summary

Company description: Clear market leader

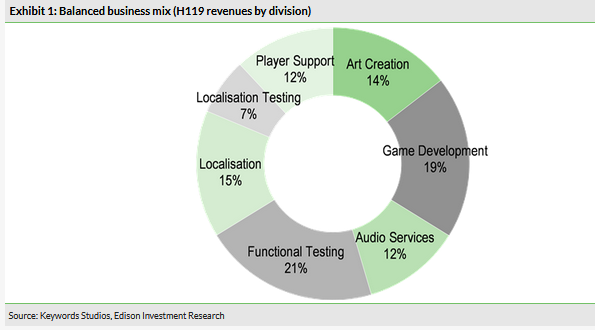

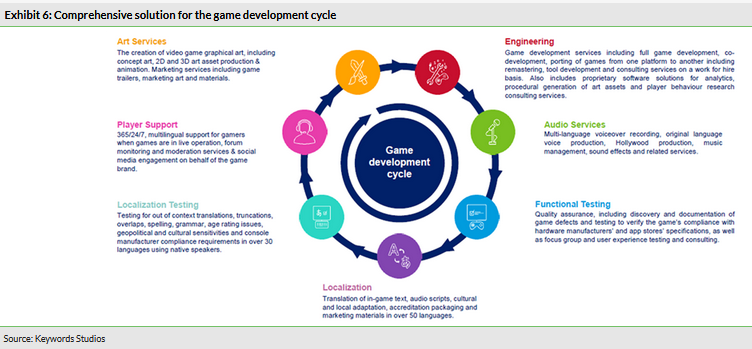

Keywords is the largest supplier of outsourced services to the global video games industry. By consolidating a highly fragmented industry landscape, the group has built a unique portfolio of services that spans the breadth of the games development cycle, from original concept through to go-live and post-launch support (see ‘Divisional overview’). Based on H119 revenues, the group now has a good balance across its seven service lines, with an investment bias towards higher-margin areas including Game Development and Art Creation.

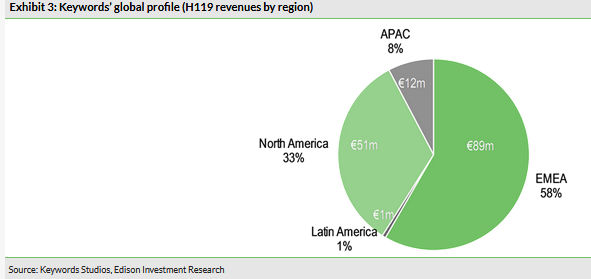

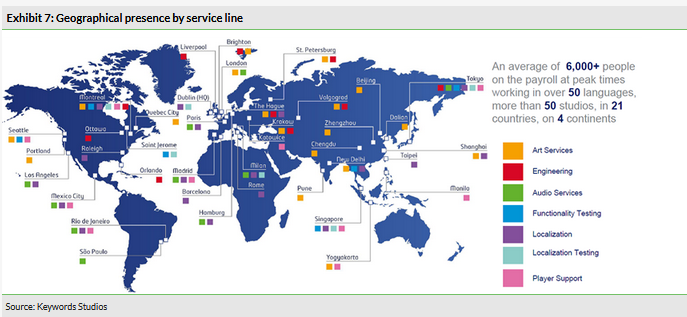

Keywords has a presence in most of the major games development hubs globally and provides services to many of the major games companies (PC, console and mobile) worldwide.

The games industry’s shift away from hit-or-miss product sales to a much more recurring, franchise-based subscription model lends itself to retained multi-service engagements and Keywords is progressively developing strategic, multi-service relationships with most major publishers.

At its core, Keywords offers investors exposure to the growth of the video games market, without taking on the risk of the success or failure of individual game titles.

Attractive dynamics in a growth market

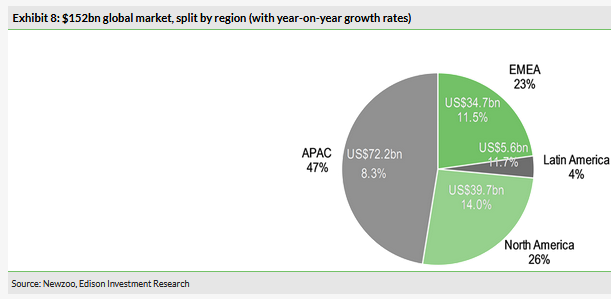

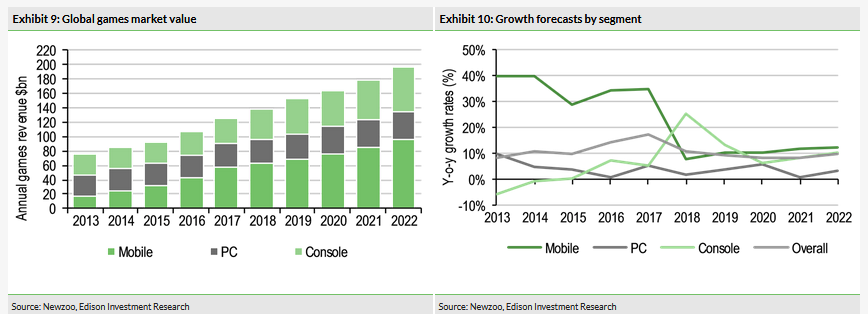

Gaming has established itself as a mass-market media format, estimated to be worth more than $152bn globally and continuing to grow at c 9% overall to 2022 (source: Newzoo).

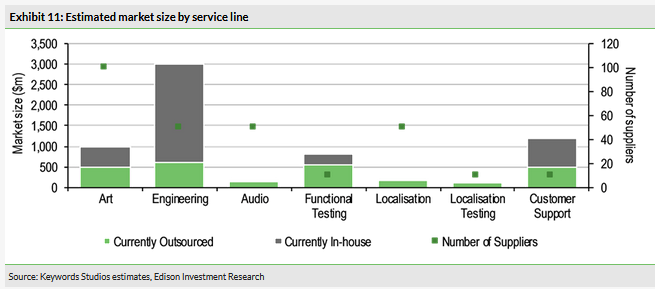

As game complexity increases, there is a continuing trend towards outsourcing to manage the risk and cost of the large team sizes required to create market-leading titles. This complexity is only likely to increase as we head towards the next console cycle. Consequently, we expect the market for outsourcing (estimated by Keywords to be worth c $6bn+) to grow more rapidly than the overall games market (we estimate c 11%) as developers increasingly outsource to focus on their core operations and improve flexibility.

A number of drivers underpin the growth of the games sector. Keywords continues to benefit from the trend towards games-as-a-service (GaaS), which necessitates ongoing content creation to expand the core game release and drive continuing player engagement. As streaming services are rolled out (eg Google’s Stadia), support for a growing list of back-catalogue titles is likely to offer new opportunities for Keywords. Another driver is the growing maturity of e-sports, requiring the production of marketing content, customer support materials and ‘live translation’ of event content.

Keywords also enjoys a strong position in the fast-growing mobile games segment of the market, offering continuous localisation work in as many as 50 languages. Mobile games continues to be the fastest-growing games segment (Newzoo forecasts double-digit growth to 2022), with Asia the driver of much of this growth, where Keywords continues to expand its presence.

Compelling business model

The key attraction of Keywords’ investment case is that, as the ‘go to’ global games services platform, in our view the company can continue to generate double-digit organic earnings growth, supplemented by an active M&A agenda in a highly-fragmented market, without expanding beyond its core games industry customer base. Despite potential concerns behind the share price consolidation seen in September, this proven and consistent strategy has delivered a five-year EPS CAGR of 53% and a free cash flow CAGR of 64% FY13–18.

Financials: Consolidating a fragmented space

End H119 net debt of €9.0m (FY18: €0.4m) and a new revolving credit facility of up to €140m over five years leaves ample firepower for future acquisitions. Management reports a healthy M&A pipeline that is not factored into our base forecasts, which should further support growth and earnings accretion.

The company’s M&A strategy is supported by the very fragmented competitive landscape for service providers to the games industry. This has enabled Keywords to acquire studios at attractive multiples and achieve synergies through cross-selling and/or cost efficiencies (see ‘Consolidating a fragmented industry’ below).

Management has highlighted Art Creation (including Marketing), Audio Services and Game Development as service lines that are likely to see M&A activity over FY19 and into FY20 as Keywords continues to move up the value chain, offering higher value-added services. In addition to the latest acquisition of TV Synchron, a Berlin based dubbing and voice over studio in the German language with a long history in the film industry, Keywords invested €6.9m of cash in four acquisitions in the first half of 2019: Art Creation (Sunny Side Up), Game Development (GetSocial, Wizcorp) and Audio Services (Descriptive Video Works).

Keywords’ acquisition pipeline remains healthy and management continues to review opportunities that could add critical mass, capacity and extend the service offering or geographical reach.

Outlook: Strong H219 anticipated

We expect a strong H219 performance from Keywords, benefiting from a number of factors:

1. H219 margins will recover from the accelerated investment in H119, with the remainder of the 1,459 new seats under preparation becoming available in H219;

2. an accelerating trend towards outsourcing;

3. following its acquisition in 2017, VMC has contributed to the growth of Functional Testing in H119, with normalising margins in H219 and beyond;

4. the company should continue to benefit from increasing investment in streaming services, as well as increasing spend for next-generation console development in the run-up to launch in Q420; and

5. Keywords continues to see a healthy acquisition pipeline, with management expecting to complete deals in FY19 and FY20, with an emphasis on game development and marketing services.

Sensitivities: Sustained execution should drive robust returns

With its shares trading on a 2019e P/E of 28.9x, falling to 22.2x in 2020e, Keywords is trading in line with its peers however, as with prior years, as it executes its strategy, we expect the company to trade at a premium to better reflect its market leadership, international reach, track record and superior growth potential.

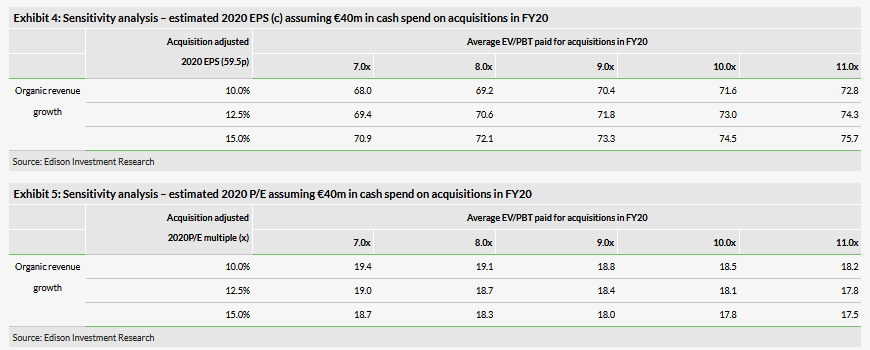

Although our base case estimates do not reflect any material contribution from M&A, our sensitivity analysis in Exhibits 4 and 5 suggests that if management retains historical price discipline (ie paying 7–11x PBT for acquisitions) and deploys at least €40m in cash (plus equity), then FY20 P/E multiples could potentially fall to c 18–20x, based on our assumptions.

Other than the availability of M&A targets at attractive multiples, other key sensitivities that might have an impact on Keywords include the growth of the global games industry, a continuing industry trend towards outsourcing, the retention of key management, Keywords’ equity remaining an attractive acquisition currency, foreign exchange rates to the euro and the continuation of a benign interest rate environment.

A leading global specialist in the games industry

Comprehensive coverage of the game development cycle

Keywords is the largest and most diverse supplier of outsourced services to the games industry by some margin. Through consolidation of a fragmented industry landscape, the company has built a breadth of service offering covering most of the games development cycle, from the original conceptual phase through to customer support, managed through seven service lines (Exhibit 6).

Building out its global platform – by accretive acquisition

Keywords is building a global footprint (50 studios in 21 countries across four continents) to ensure its service hubs are located close to the end client.

The company started its build-out strategy by acquiring positions in domains such as localisation, localisation testing, functional testing and audio services, all of which are vital ancillary functions in the game development cycle. The company continues to strengthen its position in these services through acquiring companies with complementary skill sets, customers or geographical presence.

More recently, the company has intensified its acquisition activity in domains that are closer to the core games creation process – building out its engineering and co-development offering and strengthening its position in the Asian markets.

As well as consolidating its current service offering (particularly in Game Development, Audio Services and Art Creation – including Marketing) and infill acquisitions (Asia and the Americas), we would expect Keywords to position itself to benefit from future trends including e-sports, GaaS and streaming, as well as investing in developing analytics and AI capabilities. However, the timing of any future acquisitions is likely to remain opportunistic.

Building out its global platform – by accretive acquisition

Keywords is building a global footprint (50 studios in 21 countries across four continents) to ensure its service hubs are located close to the end client.

The company started its build-out strategy by acquiring positions in domains such as localisation, localisation testing, functional testing and audio services, all of which are vital ancillary functions in the game development cycle. The company continues to strengthen its position in these services through acquiring companies with complementary skill sets, customers or geographical presence.

More recently, the company has intensified its acquisition activity in domains that are closer to the core games creation process – building out its engineering and co-development offering and strengthening its position in the Asian markets.

As well as consolidating its current service offering (particularly in Game Development, Audio Services and Art Creation – including Marketing) and infill acquisitions (Asia and the Americas), we would expect Keywords to position itself to benefit from future trends including e-sports, GaaS and streaming, as well as investing in developing analytics and AI capabilities. However, the timing of any future acquisitions is likely to remain opportunistic.

Opportunity in a fragmenting industry

H119 has seen a slew of announcements, both in terms of new technologies and investment, which look set to support the growth of the industry for the foreseeable future. These investments have included a number of new initiatives by the tech majors targeting the games market (eg Google’s Stadia streaming service and Apple’s Arcade subscription service for premium mobile games). In April, initial news around Sony’s next-generation console emerged (launch anticipated Thanksgiving 2020) and in May, Sony and Microsoft (NASDAQ:MSFT) announced a collaboration to develop future cloud solutions for streaming services. At E3 in June, Microsoft confirmed the launch date for its next-generation console, Project Scarlett, as ‘Holiday 2020’, as well as details of its streaming services (Project xCloud). Ubisoft, another major games publisher, announced its own streaming platform, uPlay.

The following quotes help underline that the games industry is at a nexus, where it operates at a global scale, but is fragmenting with multiple channels into diverse markets:

‘I would go as far as to say [gaming] is the single most important thing happening right now in our culture’, Herman Narula, CEO, Improbable Worlds.

‘What we are seeing with the evolution of this technology [Stadia] is gaming is getting more and more fragmented’, Andy Kleinman, founder of Wonder.

‘Just as the arrival of Netflix (NASDAQ:NFLX), Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) has driven up the price of Hollywood’s top talent, in the near term games developers are likely to see a windfall as tech companies vie for content. But developers should remember that after buying up Hollywood’s archives, Netflix turned itself into the studios’ biggest competitor. Content makers love the idea of a “Netflix for games” and a new way of getting paid, I worry a lot of them are not realising the deal with the devil they are doing’, Nicholas Lovell, Electric Square (NYSE:SQ).

This fragmentation is likely to bring about a polarisation of winners and losers, with top-rated teams, potentially financed by money from outside the industry, able to spend increasing amounts on development of global titles, be that on PC, console or mobile – or increasingly, cross-platform.

Keywords is likely to benefit from this trend, given its global presence and the fact that it provides services to most of the main games companies worldwide. It enjoys a strong position in the fast-growing mobile games segment of the market, offering localisation solutions in as many as 50 languages. The mobile games sector continues to be the fastest-growing games segment (Newzoo: double-digit growth forecast to 2022), with Asia a driver of much of this growth, where Keywords continues to consolidate its presence through its ‘One China’ initiative, integrating its five production studios and implementing a single operating system.

Supportive industry dynamics

Games: A global industry offering double-digit growth

Market analyst Newzoo estimates that more than 2.2 billion gamers will generate c $152bn of revenues in 2019, with Western markets representing c 49% of global revenues and 45% of total revenues on mobile devices. Overall revenues are forecast to grow at c 9% (2018–22), building to a total market size of over $196bn by 2022. Mobile offers double-digit revenue CAGR, whereas PC and console offer single-digit growth (Newzoo).

To put this into context, the games market is already more than three times the value of global box office movie receipts, estimated to be $42bn (source: Statista), and seven times the size of the recorded music industry at $19bn (source: IFPI), but remains some way behind the Pay TV market, which ABI Research forecasts will reach $295bn by 2022, making the likes of Netflix (NASDAQ:NFLX) increasingly nervous of the challenge from games for users’ screen time.

Drivers of Keywords’ future growth

On top of the games industry’s growth of c 9%, we believe the market for outsourced services could grow at a premium, driven by increased use of outsourcing (see ‘Will games follow the TV and film outsourcing model?’ below). Given these dynamics, Keywords remains well placed to consolidate its market position, both organically – as business is attracted to the market leader, with a footprint matching its international clients – and through further acquisitions, as the company consolidates an over-fragmented landscape.

As we have highlighted, we see Keywords’ future growth coming from three principal sources:

the underlying growth of the games sector (c 9% to 2022, Newzoo);

augmented by an increasing industry trend towards outsourcing; and

overlaid by inorganic growth from M&A at attractive multiples.

Strong underlying growth

As an entertainment form, the games industry is now truly mainstream, spanning all geographies and most demographics. Supported by the rise of mobile gaming, 45% of US gamers are now female (Entertainment Software Association), with the balance in mobile games c 50/50. The average age of a US gamer is 34 (and ageing) and 64% of households are home to at least one person who plays video games.

Outsourced services should continue to outgrow the games sector

Sizing the market for outsourced services is difficult, but Keywords’ management estimates that total spend on the services it offers is conservatively c $6bn pa, of which 30–50% is outsourced. The degree to which outsourcing has been adopted varies across service lines, but management estimates that, on a blended basis, this percentage will trend upwards towards 70% over the next five years (a comparable figure for the film industry might be close to 90%). This would imply an outsourcing CAGR of 10%+ over the next five years on top of industry growth, or conservatively, 15–20%.

The trend towards outsourcing is likely to be supported by a number of specific factors:

Shift to a service revenue model: the industry is rapidly adopting more recurring revenue models (ie GaaS). Downloadable content (DLC) is fundamental to the drive to maximise and prolong game lifetime and lifetime value (LTV), driving demand for specialist outsourced services for post-launch DLC and support.

Increasing richness and complexity: similarly, games are getting bigger and production values are going up – and likely to increase further as next-generation game development starts in earnest. Known and unknown initiatives by the tech majors looking to carve a foothold in the games industry are only likely to increase investment further.

Supply chain disaggregation/adoption of leaner structures: vertically integrated industries typically disaggregate over time (ie the Hollywood model), stratifying into a supply chain of businesses with specialist marketing, production and creative/technical skills.

Keywords consolidating the outsourced services market

Industry newsflow in 2019 highlights the rapid evolution of the games industry and the disruption taking place, but we believe Keywords remains well placed to benefit from this disruption. As seen in H119, strong demand for services led to constant currency like-for-like revenue growth of 17%, up from €124.8m in H118 to €146.4m in H119. As the ‘go to’ global games services platform, Keywords expects to lead the consolidation of a highly fragmented market, benefiting from the accelerating trend towards outsourced services in the video games market.

Looking ahead, even before factoring in future M&A activity, we believe Keywords should continue to capture market share from its smaller competitors through its ability to offer:

Scale: proven ability to take on large multi-disciplinary projects, handle peaks in demand and deliver projects professionally across geographies and time zones, matching clients’ international footprints.

End-to-end solutions: the capability to become a developer’s retained outsourcing partner, working with the developer at different stages of the development cycle across titles, genres, platforms and disciplines.

Innovation: increased ability to invest, with excellent visibility over future industry innovations.

Lower risk: through scale, diversity, professionalism and financial solidity.

In addition, given the disruption and rapid evolution of the various markets in which it operates, we would expect a continuing supply of acquisition opportunities at attractive prices from which Keywords can benefit.

Will games follow the TV and film outsourcing model?

Leading voices in the games industry continue to question the viability of the current model of developing AAA games – as mentioned by Amy Hennig (ex-creative director at Naughty Dog) in a recent interview: ‘In my career, I’ve gone from a two-person team to 15 or something, then 30, then 70, and up to now… it’s amplified by having a 300-person team versus a 10-person team... What doesn’t change is the challenge of trying to do a creative endeavour with a group of human beings, and that only gets more complicated as the teams have gotten bigger and bigger.’

The issue identified is the size of games teams and the difficulty of scaling resource up and down over the game development lifecycle. Managing this resource internally within a developer is a significant issue that has led to studio closures (Capcom Vancouver, Telltale Games) as well as recent lay-offs, for example by Electronic Arts (NASDAQ:EA), Activision Blizzard (NASDAQ:ATVI), Starbreeze and Take-Two (NASDAQ:TTWO).

The solution proposed is a decentralised model, with a smaller core team and many of the traditional elements outsourced. The games industry is looking to the TV and film industries as a model that makes sense, relying less on in-house production and more on external contractors.

‘Obviously that would require a big sea change in the industry… but you would have a lot more external partners or freelance developers as part of a team, do more things as distributed development rather than have everything in-house,’ Hennig says. ‘It would allow for a lot more flexibility rather than feeling that constant pressure, that churn of salaries.’

Consolidating a fragmented industry

Headroom to continue building a global platform

Keywords has been the main driver of consolidation within the games service provider industry (Exhibit 12), and typically aims to make one or two large strategic acquisitions each year, supplemented by a number of smaller bolt-ons.

To read the entire report Please click on this pdf File..