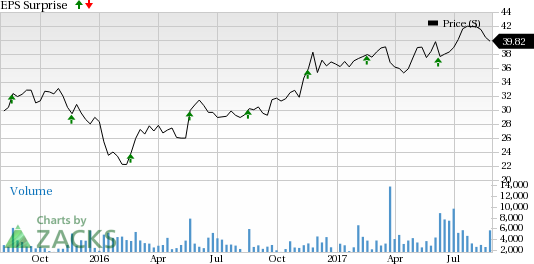

Keysight Technologies Inc. (NYSE:KEYS) is set to release third-quarter fiscal 2017 results on Aug 30. The company has delivered positive earnings surprises in the trailing four quarters, with an average beat of 5.13%.

Last quarter, the company delivered a positive earnings surprise of 10.34%. Earnings increased 3.3% from the year-ago quarter to 64 cents per share, driven by solid top-line growth.

Non-GAAP revenues were $758 million, which was better than the Zacks Consensus Estimate of $753 million. The figure increased 3.1% from the year-ago quarter.

For third-quarter fiscal 2017, Keysight forecasts non-GAAP revenues in the range of $840-$880 million. The Zacks Consensus Estimate is currently pegged at $860 million. Non-GAAP earnings are projected in the range of 51-65 cents per share.

The stock has gained 8.9% year to date, substantially outperforming the 6.4% rally of the industry it belongs to.

Let’s see how things are shaping up for this announcement.

Factors to Consider

Keysight is well positioned to benefit from increasing investments in next-generation technologies including 5G, Internet of Things (IoT), high-speed datacenters, electric car, autonomous driving and next-generation process technologies.

During the last quarter, the company’s solution was selected by Qualcomm (NASDAQ:QCOM) for validating the chipset technology and the higher-layer protocols needed for 5G.

However, uncertain federal spending can hurt order growth from the aerospace, defense and government end markets.

Earnings Whispers

Our proven model does not conclusively show that Keysight is likely to beat earnings in the soon-to-be-reported quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

Zacks ESP: The Earnings ESP for Keysight is 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 60 cents per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Keysight has a Zacks Rank #3 which increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are a couple of stocks you may want to consider as our model shows that they have the right combination of elements to post an earnings beat:

Coupa Software (NASDAQ:COUP) has an Earnings ESP of 25.29% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Nutanix (NASDAQ:NTNX) has an Earnings ESP of 2.35% and a Zacks Rank #3.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

COUPA SOFTWARE (COUP): Free Stock Analysis Report

Nutanix Inc. (NTNX): Free Stock Analysis Report

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Keysight Technologies Inc. (KEYS): Free Stock Analysis Report

Original post