With more than three quarters of Q4 results already in, we can confidently say that overall earnings picture continues to improve. As we indicated here last week, these quarterly results continue to show earnings growth on track to turn positive in Q4 and momentum on the revenues side.

The revisions trend, which earlier on appeared to be shifting favorably, has been on a negative trend for the last few weeks, with the virus outbreak adding to the historical pattern. That said, the magnitude of negative cuts to current-period estimates still compares favorably to the recent past.

We share below the three main takeaways from the results thus far. Please note that through Friday, February 14th, we have seen Q4 results from 388 S&P 500 members or 77.6% of the index’s total membership. We aren’t quite that further along in the Q4 reporting cycle for the small-cap stocks, with results from only 43.8% of the S&P 600 index out through Friday, February 14th.

First, momentum on the revenues side: For the 388 index members that have reported already, total earnings and revenues are up +1.3% and +4.8%, respectively. The proportion of these companies beating EPS and revenue estimates is 72.9% and 66.2%, respectively.

The comparison charts below put the earnings and revenue growth rates and the EPS and revenue beats percentages in a historical context.

And here are the Q4 EPS and revenue beats percentages.

It is possible to focus only on the revenue performance in the above comparison charts, but we will make it even easier for you by just showing how the Q4 top-line performance stacks up relative to the first three quarters of 2019.

As you can see here, a much bigger proportion of companies are beating top-line estimates, with the EPS beats percentage actually tracking below historical periods. The revenues growth rate doesn’t show the same level momentum, but it has nevertheless held up fairly well.

Second, earnings growth is on track to turn positive in Q4: As we saw earlier, earnings for the 388 index members that have reported already are up +1.3% from the same period last year. For the quarter as a whole, combining the results that have come out with estimates for the still-to-come companies, Q4 earnings are expected to be up +0.8% on a year-over-year basis.

This blended Q4 earnings growth rate turned positive last week for this earnings season and modestly nudged up this week. This would follow the -1.7% decline in S&P 500 earnings in the preceding period (2019 Q3) and growth rates of +0.6% and -0.1% in 2019 Q2 and Q1, respectively.

Please note that the anemic earnings growth pace in 2019 is primarily because of tough comparisons to the 2018 numbers that were boosted by the tax cut legislation. ‘Normal’ growth resumes in the current period (2020 Q1) and accelerates into the back half of the year and beyond.

Third, current period estimates are coming down, with the Coronavirus outbreak adding to the typical negative revision that would take place any way. We got off to a good start with respect to estimate revisions for 2020 Q1, but that has clearly reversed over the last few weeks, as the chart below shows.

It is totally normal for current-period estimates to be coming down as companies release their quarterly results and the magnitude of negative revisions to Q1 estimates still compares favorably to historical periods. But the additional factor this time around is the Coronavirus outbreak that has clear negative earnings implications, as many companies like Nvidia (NVDA), Royal Caribbean (RCL), Starbucks (SBUX), Disney (DIS) and others have publicly acknowledged. The full extent of the virus outbreak will only become clearer over time. We don’t know at this stage whether the outbreak’s negative impact will be a one quarter phenomenon or will it seep into the following periods as well.

This week’s docket of earnings releases include a number of companies whose results can be expected to be significantly exposed to the outbreak. These include logistics operator Expeditors International (EXP) and cruise line operator Norwegian Cruise line (NCLH).

Overall, we have more than 450 companies on deck to report results this week, including 49 S&P 500 members. Wal-Mart (NYSE:WMT) (WMT) and Deere (DE) are some of the other notable companies reporting results this week.

Tech Sector Scorecard

We now have Q4 results from 92.4% of the Tech sector’s total market capitalization in the S&P 500 index. Total earnings (or aggregate net income) for these Tech companies are up +7.2% from the same period last year on +5.8% higher revenues, with 85.7% beating EPS estimates and 87.5% beating revenue estimates.

This represents a notable improvement in the sector’s earnings performance, as the comparison charts below show. Here is the Q4 earnings and revenue growth rate relative to the first three quarters of the year.

And here is the Tech sector’s Q4 EPS and revenue beats percentage relative to the first three quarters of 2019.

Q4 Expectations for the S&P 500 Index

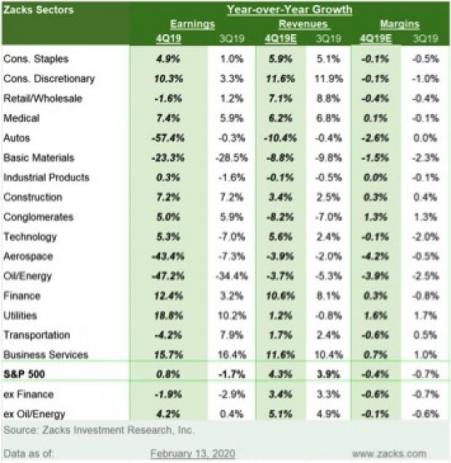

Looking at Q4 expectations as a whole, combining the actual results that have come out with estimates for the still-to-come companies, total earnings (or aggregate net income) for the S&P 500 index are expected to be up +0.8% from the same period last year on +4.3% higher revenues.

The table below shows the summary picture for Q4, contrasted with what was actually achieved in the preceding earnings season.

The chart below shows Q4 earnings and revenue growth expectations contrasted with what is expected in the following four quarters and actual results in the preceding 4 quarters. As you can see, the growth pace is expected to start improving from next quarter onwards.

For an in-depth look at the overall earnings picture and expectations for Q4, please check out our weekly Earnings Trends report >>>> A Positive Earnings Picture

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Walmart Inc. (WMT): Free Stock Analysis Report

Starbucks Corporation (NASDAQ:SBUX): Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL): Free Stock Analysis Report

NVIDIA Corporation (NASDAQ:NVDA): Free Stock Analysis Report

Norwegian Cruise Line Holdings Ltd. (NCLH): Free Stock Analysis Report

Eagle Materials Inc (EXP): Free Stock Analysis Report

The Walt Disney Company (NYSE:DIS): Free Stock Analysis Report

Deere & Company (NYSE:DE): Free Stock Analysis Report

Original post