Precious Metals traded up to the resistance levels we noted a week ago but reversed lower to start the week.

Precious metals have rebounded with the broader market. There needs to be a transition in which they lead and perform in real terms. But I digress.

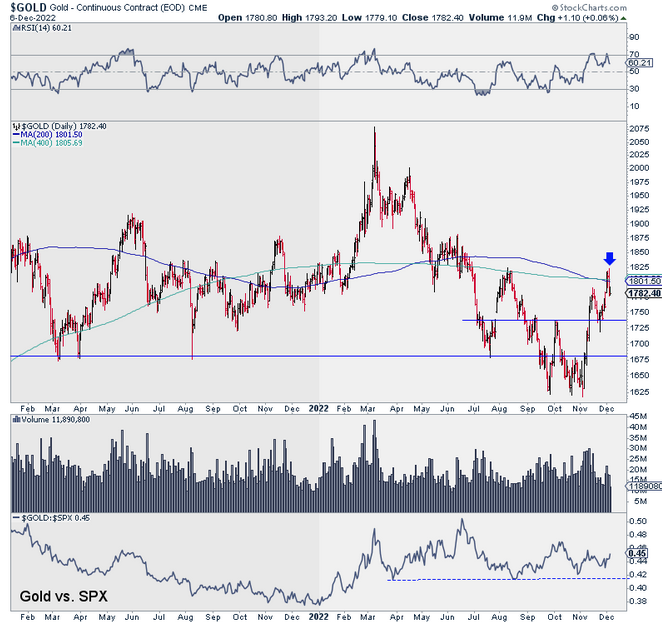

Let’s look at the key levels in these markets, starting with gold.

Gold reversed course after trading up to the 200-day and 400-day moving averages just above $1800.

Initial support is $1735, with the strongest support around $1680. If gold loses $1735, look for a test of the upper $1600s.

The gold to the S&P 500 ratio has traded sideways for the last nine months. A push to the upside while all markets decline would be a bullish omen for precious metals for the next 12 months.

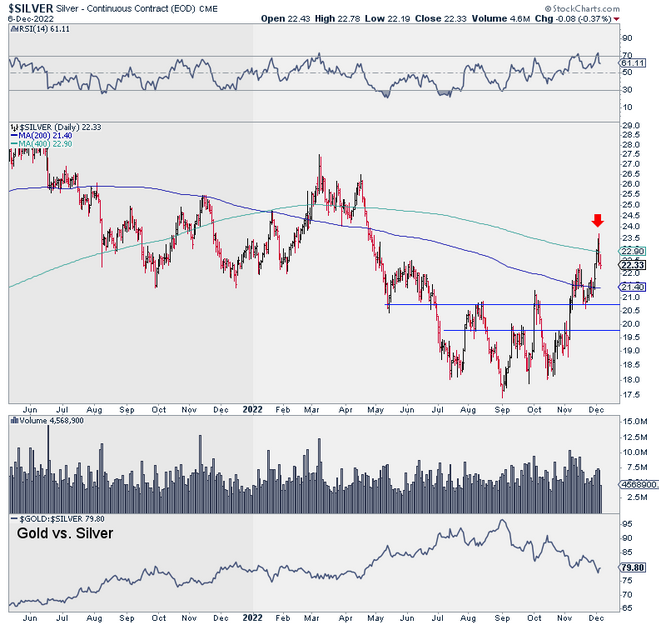

Silver rallied up to and reversed course at its 400-day moving average. The next support levels are $20.75 and $19.75.

Silver has strongly outperformed over the past few months, which is a good sign for the sector. However, silver could underperform gold for a while if a recession sets in and the S&P 500 trades towards and below 3,500.

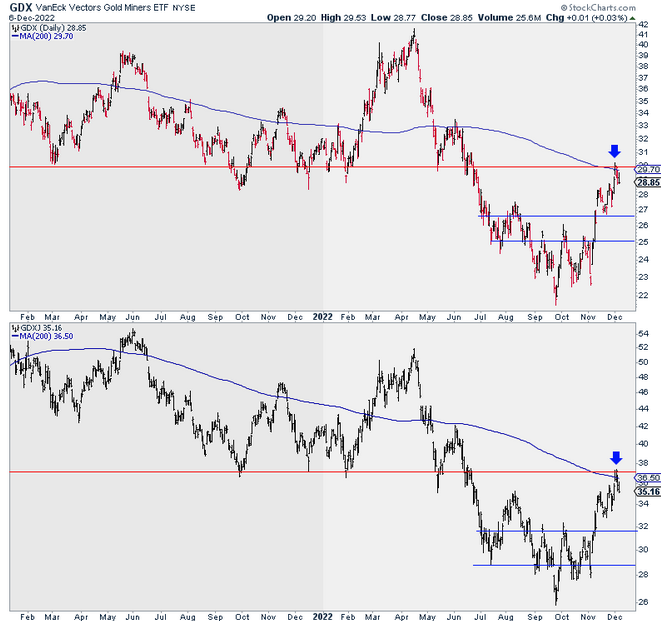

GDX (NYSE:GDX) and GDXJ reversed course at their strong resistance targets of $30 and $37.

GDX has support at $25 and $26.75, while GDXJ has support at $29 and $31.50.

The rebound in the miners compares better to the rebounds of late 2000, mid-2005, and summer 2018 than the rebounds of 2008, 2016, and 2020.

GDX has rebounded by roughly 40% since its September low. After a similar rebound off 2000, 2005, and 2020 lows, gold stocks corrected approximately 20%, 15%, and 15%. A 15% decline from the peak takes GDX to the $25s.

The length and severity of a correction could depend on how soon the Fed has to reverse course and how soon the stock market threatens a retest of its lows. Those factors could hit precious metals initially, but they would set up the start of a real bull market in earnest.