Next week in developed markets US domestic data should reiterate the fact the economy is still going strong despite some uncertainties. We'll also look at German industrial data to see whether optimism will be further dampened.

US still going strong

Suggestions that the Federal Reserve is approaching “neutral” in terms of monetary policy, coupled with growing criticism of higher interest rates from President Trump, has seen markets become more cautious on the prospect of additional increases in the Fed funds target range. There will certainly be more headwinds for growth next year, but the underlying story remains strong, and this should be backed up by next week’s data. Moreover, monetary policy is still some way from being restrictive, and as such, we look for the Fed to hike rates in December with three more rate moves in 2019. Note that Fed Chair Jerome Powell will be testifying on monetary policy again next week.

ISM indices are likely to remain close to their recent levels. There is obvious uncertainty relating to trade protectionism and recent equity market weakness, but the US economy has strong momentum and a robust labour market, so the indices are likely to remain consistent with above-trend economic activity – certainly, the regional indices do. This robust domestic demand story means we don’t expect any meaningful improvement in the trade balance this week, with imports continuing to hold up while weaker global demand growth and a strong dollar is a constraint on export growth.

As for the jobs market, unemployment is likely to remain at a 49 year low, and this is likely to see continued upward pressure on wages. We look for annual wage growth to stay at 3.1% this month, but given growing evidence of pay pressures in various surveys, we look for wage growth to pick up again in coming months. Indeed, payrolls are likely to rise strongly with consumer spending continuing to be the key driver of growth in the US economy.

Germany: Will optimism be dented further?

October industrial data will be an important barometer of the state of the German economy in the final quarter of the year. The latest Ifo reading has already dented optimism about a v-shaped rebound after a disappointing third quarter performance.

Canada: All eyes on wage growth - again

For next week, the highlight is the Friday employment report and more importantly wage growth. We see the relative slackness in the labour market fading, but the real question is when?

Average hourly wages have been declining since June, but with some irony, the Bank of Canada’s 3Q business outlook survey reported shortages of labour as a major production constraint and were intending to extend hiring plans. To us, this shouts out the need for some upward wage pressure to attract workers, but as of yet, we’ve seen none of this.

We don’t expect much from the central bank’s meeting next Wednesday, but still confidently price in a 1Q19 and 3Q19 hike – a third probably ruled out if weak wage growth persist.

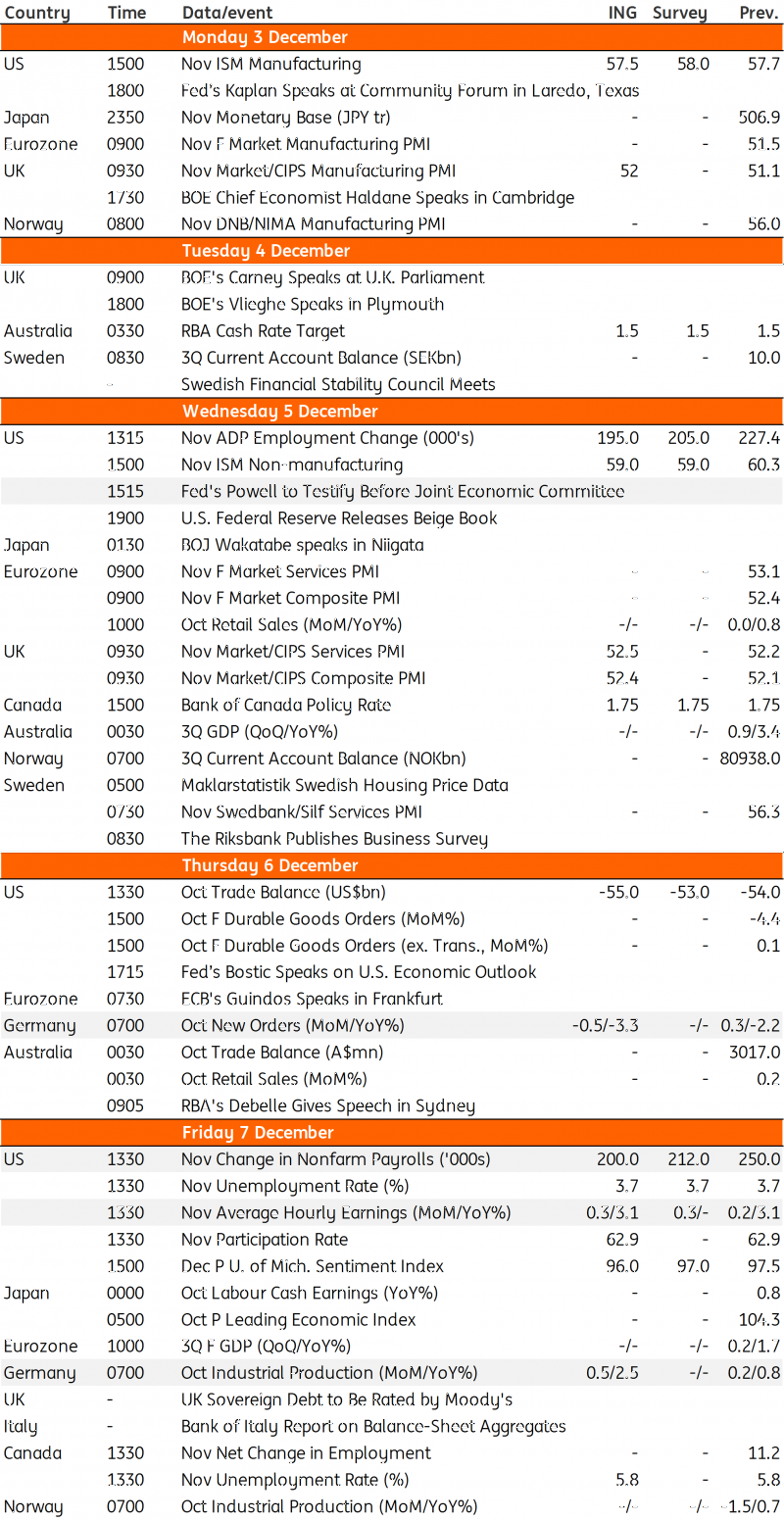

Developed Markets Economic Calendar

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”