Manufacturing and services data dominate next week, giving us an insight into how businesses are coping with trade concerns and weakening economic momentum in Europe.

US: Weather takes its toll?

We get a raft of key September data next week, but there is a lot of uncertainty over the numbers given the potential for distortions related to hurricane Florence. Economic activity will undoubtedly have been impacted in the US East Coast region given evacuations and subsequent disruption, but the extent of the impact is also dependent on when the data was collected, adding to the level of uncertainty.

As such, we feel it makes sense to prepare for soft figures, but to “look through” them, given the underlying strength of the US economy. Indeed, any weakness is likely to be followed by a sharp rebound – similar to what we saw in jobs data, retail sales and industrial activity following Hurricanes Irma and Harvey last year.

The key data will be the jobs data, and the ISM reports. Wages will be in focus with another strong month-on-month rise likely. We probably won’t get a break above 3% year-on-year growth this month, but we certainly expect it next month. Meanwhile, the ISM reports should continue to indicate that business activity remains very robust. We will also hear from several Federal Reserve officials. They may provide more colour on why the Fed is looking for four more rate rises over the next twelve months and evaluating the risks to their predictions.

UK: Focus on PMIs as no deal risks increase

While we may see a slight improvement in the UK manufacturing PMI next week, it’s clear firms are beginning to struggle from the weaker momentum in Europe, while concerns surrounding trade may be starting to bite at the margin. The service sector appears to be in slightly better shape, but as the day-to-day realities of what ‘no deal’ might involve become more evident to consumers and businesses, we think there’s a risk activity begins to slow as we head into the winter. For that reason, we don’t expect any further Bank of England tightening before the UK leaves the EU next year.

Germany: Will trade tensions impact industrial data?

Germany will celebrate reunification day on Wednesday, which should bring a relatively quiet week, with many people taking half a week off. On Friday, industrial orders data will provide more evidence of any possible impact from ongoing trade tensions on German industry.

Sweden: PMIs in focus as political stalemate continues

PMI surveys for September in Sweden, Norway, and Denmark provide an early read on economic momentum going into autumn. We expect another soft figure in Sweden; 51 – just slightly above the 50 level that indicates growth. In Norway, the survey should return to trend around 55 – suggesting a solid expansion, after a couple of erratic readings over the summer.

Meanwhile, negotiations on forming a new government in Sweden will kick off, as Parliament’s speaker will decide whether to give the first chance to form a government. The situation remains muddled, and we expect a compromise could take weeks, or even months, to hammer out.

Canada: Job market still shows signs of slack

With the Canadian jobs report somewhat disappointing in August, we hope to see a minor pick up in September given that business confidence is holding up - despite NAFTA insecurities. Nonetheless, August wage growth (2.9% YoY) was the third month we’ve seen a slowdown; an indication that there is still slack in the jobs market.

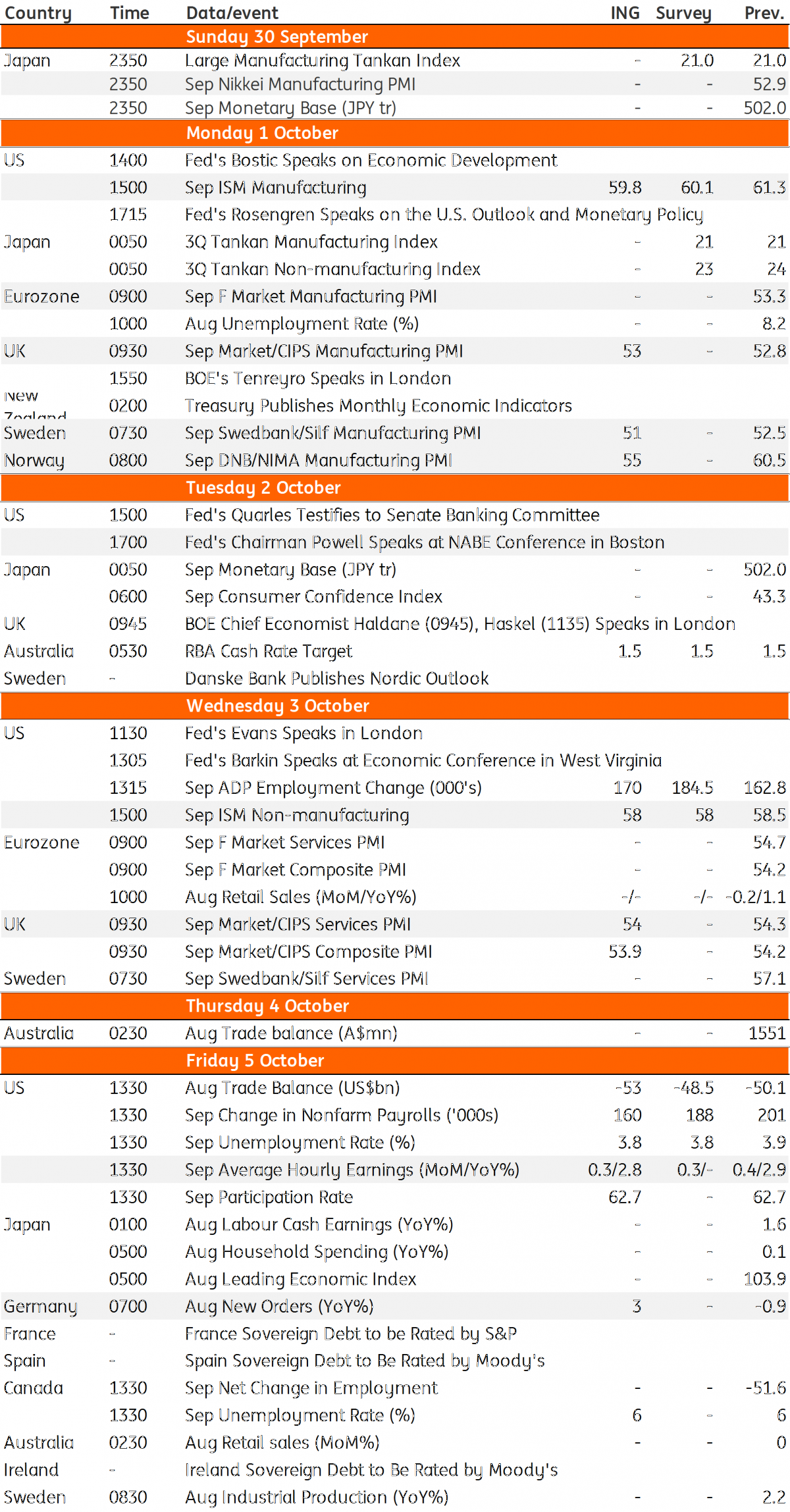

Developed Markets Economic Calendar

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here.”