Growth stocks tend to get most of the attention in bull markets, such as the nearly uninterrupted stock market rally over the past 10 years. But with the stock market showing signs of weakening, steady dividend stocks become all the more attractive. The S&P 500 Index is up just 1% so far in 2018, and volatility has returned to the market in recent months.

Kellogg Company (NYSE:K) stock has underperformed the market for an extended period, going back to the years of the Great Recession. Food stocks are not usually associated with high growth, but Kellogg is a pillar of value and income. The stock has a modest valuation, and an attractive dividend yield of 3.6%. Over the next five years, Kellogg stock could return 10% per year.

Food and beverage stocks tend to be overlooked when stock markets are rallying higher. But investors should consider buying blue-chip dividend stocks like Kellogg if the market rally loses steam.

Strong Brands, Steady Profits

Kellogg is a large food company. The company has its roots in breakfast, with several cereal brands. But in recent years, the company has broadened its product portfolio to include snacks like Cheez-It, Keebler, Pringles, Carr’s, and Famous Amos. Kellogg generates annual revenue of $13 billion, with a market capitalization of $22 billion.

Kellogg shares have performed poorly—in fact, the stock is lower today than it was five years ago. This comes as the company invests heavily in new products and acquisitions. At the same time, Kellogg is dealing with higher raw materials costs that have weighed on profit margins. These headwinds were on display when Kellogg reported its third-quarter earnings report. Total sales rose 6.8% thanks largely to the acquisitions of RX and Multipro. Organic net sales increased a more modest 0.4%.

However, operating profit declined on a currency-neutral adjusted basis by 2.6% despite the sharp rise in revenue, reflecting higher packaging and marketing expenses. Despite these pressures, Kellogg still managed earnings growth last quarter. Modest revenue growth, combined with share repurchases and a lower tax rate, fueled 3.9% earnings growth.

The threat of cost inflation is a potential risk for Kellogg’s bottom line performance moving forward. Fortunately, Kellogg’s top-tier brands give the company pricing power, meaning it has the ability to pass on those costs to consumers through higher prices. The company is also boosting efficiency by cutting costs, which is another positive for the bottom line. And, an aggressive acquisition strategy is providing a major lift to Kellogg’s sales growth.

Acquisitions Provide A Growth Boost

Kellogg is in the process of shifting its business model away from breakfast, due to sagging demand for cereal. Instead, it has invested heavily in snacks. There is good reason for this—shoppers are buying less cereal in recent years, but demand for snacks is still strong.

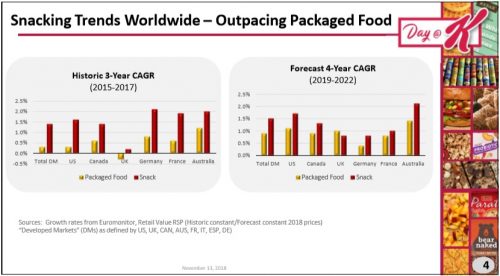

Growth of the global snacks category continues to outpace the broader packaged foods industry. Kellogg has built a large snacks portfolio, largely through acquisitions. Since 2000, Kellogg has acquired Keebler, Pringles, Kashi, and more recently RX and Multipro.

Acquisitions have also given the company additional exposure to the emerging markets, which are another compelling growth catalyst for Kellogg in the years ahead. Since 2000, Kellogg’s international investments include a joint venture in China, a joint venture in Africa, the acquisition of United Bakers Group in Russia, Bisco Misr in Egypt, and Parati in Brazil. The result of these investments is that the emerging markets now represent 20% of Kellogg’s total sales. This is a major positive development for Kellogg, as emerging markets like China, India, Russia, and Brazil represent high-growth opportunities. Through the first three quarters of 2018, Kellogg’s organic sales increased 7.8% in Latin America and 4.9% in its Asia-Pacific segment.

Investors continue to be disappointed with Kellogg’s financial performance, which explains the sluggish share price over the past five years. However, Kellogg is still generating growth. For 2018, Kellogg still expects 5% net sales growth, and 7%-8% earnings-per-share growth. These growth rates indicate the company is performing relatively well, but the stock price has not yet reflected this. As a result, value investors have the opportunity to buy Kellogg at a measurable discount to fair value.

Kellogg: An Undervalued Dividend Stock

Kellogg is expected to generate earnings-per-share of $4.30 in 2018. Based on this, the stock trades for a price-to-earnings ratio of 14.5. This is a fairly low stock valuation for a profitable, growing company. Kellogg’s stock valuation is nearly at its 10-year low. Fair value for Kellogg should be a price-to-earnings ratio of 16-17, which is more in-line with its industry peers. Therefore, a rising price-to-earnings ratio could generate annual returns of 3%.

In addition, Kellogg’s earnings growth and dividends will contribute to shareholder returns. Kellogg should be able to achieve an annual growth rate of at least 5% over the next five years. Lastly, Kellogg pays a dividend of $2.24 per share. This represents an attractive yield of 3.6%, which is significantly higher than the market average. The S&P 500 Index has an average dividend yield less than 2% right now.

The combination of a rising price-to-earnings ratio, earnings growth, and dividends could provide total returns of more than 11% per year over the next five years. This is an attractive expected rate of return for a relatively low-risk stock. Kellogg has a defensive quality, which is that the company should be able to maintain profits during a recession. People will always need to eat, regardless of how the global economy is performing. As a result, Kellogg will likely continue to pay its divide din good economies and bad.

Final Thoughts

Kellogg stock has been a disappointment going back several years. But past performance is no guarantee of future results, and in this case, Kellogg’s long turnaround has given way to a bright future. The company has repositioned itself in multiple growth categories, mainly snacks. It also has a leading presence in the high-growth emerging markets. With a secure 3.6% dividend yield and double-digit expected returns, Kellogg is an attractive stock for value and income investors, particularly if the market enters a downturn.