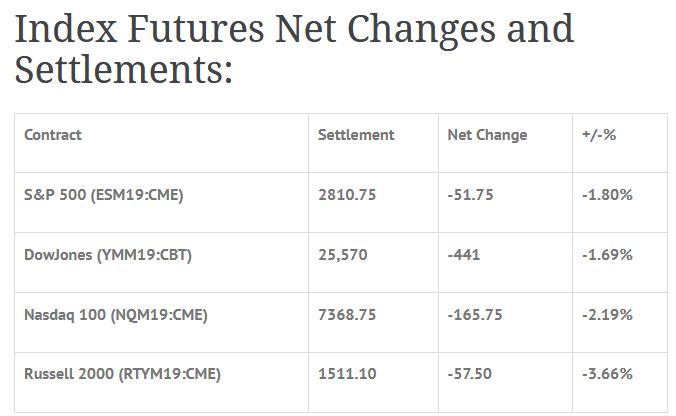

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 11 out of 11 markets closed lower: Shanghai Comp -1.97%, Hang Seng -2.03%, Nikkei -3.01%

- In Europe 12 out of 13 markets are trading lower: CAC -0.20%, DAX -0.26%, FTSE -0.45%

- Fair Value: S&P +4.84, NASDAQ +27.27, Dow +18.97

- Total Volume: 2.24mil ESM & 434 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Charles Evans Speaks 2:00 AM ET, Patrick Harker Speaks 6:30 AM ET, Chicago Fed National Activity Index 8:30 AM ET, and Dallas Fed Mfg Survey 10:30 AM ET.

S&P 500 Futures: ‘Yield Curve’ Inverts’ And Pre- Muller Report Spooks The #ES

During Thursday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2864.75, a low of 2842.25, and opened Friday’s regular trading hours at 2845.50.

Well, we saw a trend day up Thursday, and a trend day down Friday. That is very rare. The selling started just after the 8:30 bell, and was relentless all morning. The first stop on the way down was at 2830.00, then after a rally to 2843.50, it was straight down to 2809.25. There was a little back and fill up 2817.00, then as Europe was closing the ES made another move down to test the 20 day moving average at 2803.00, but didn’t quite make it that far.

The ES looked like it had bottomed out at 2806.50 and started to pop, in what looked like could have possibly been some weekend profit taking, rallying up 2819.75, but turned around and took another shot at the lows, this time trading down to 2809.75, and then started pushing higher again.

By 2:00 the ES had traded all the way back up to 2828.50. There wasn’t enough buying power to hold the rally into the close, however, and things turned south again, with force. When the 2:45 cash imbalance reveal came out showing just over $200M to buy, the futures were trading at 2809.00. The ES then went on to print 2805.75 on the 3:00 cash close, and 2810.75 on the 3:15 futures close.

In the end, the overall tone of the ES was extremely weak. In terms of the days overall trade, total volume was high, with 2.2 million futures contracts traded. It was a wicked day that only got worse going into the close.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.