A long-term leading sector could be testing a price point, which if it slips, could move a long way and impact the broad markets.

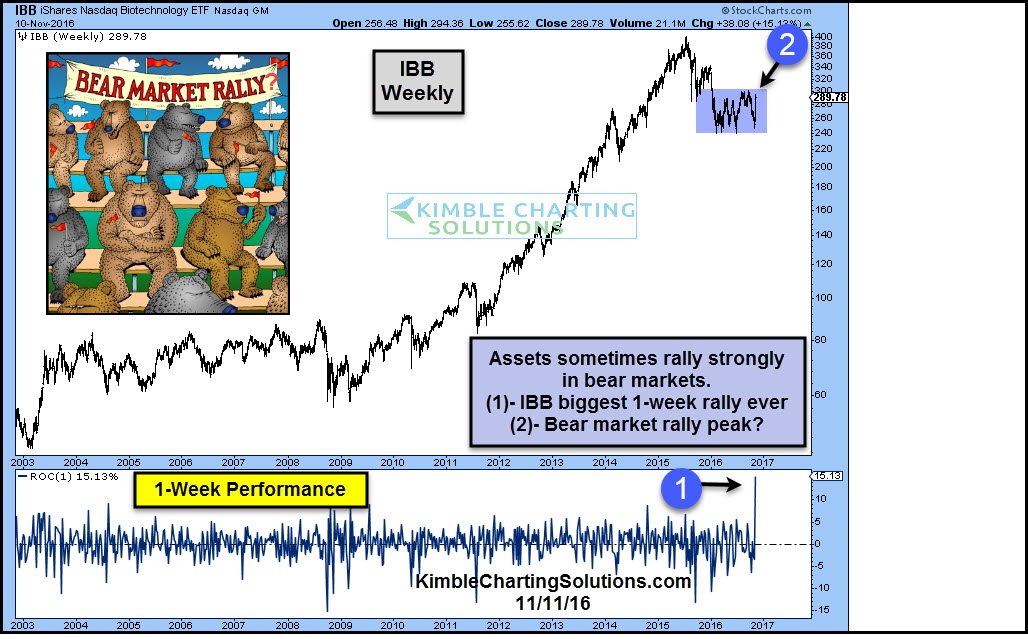

Below looks at Bio-Tech ETF (NASDAQ:IBB) over the past few years. IBB was a huge upside leader until last summer. Once it peaked, the broad market moved higher, but not in a big way.

IBB has created a series of lower highs since last summer along line (1). The recent rally was sharp and it tagged falling line (1) without a breakout taking place.

Even though IBB beat the S&P 500 from the early 2000s through 2015, it rarely had any big 1-week rallies. Sometimes assets have their biggest rallies during bear markets. The chart below was published a couple of weeks ago and shows that IBB just experienced it strongest 1-week rally in the past 15 years.

What IBB does at falling resistance line (1) in the top chart could influence the broad markets going forward. Even if you do not own Biotech, don’t overlook how important its price message could be and its potential impact on the broad markets.