Some think it's important to watch copper's price action because it could send important macro messages about global growth or the lack thereof. Since 2011, Ole “Doc Copper” has been very weak, no question about it. During this weakness, the S&P 500 has continued to move higher. So has copper's price action lost its relevance?

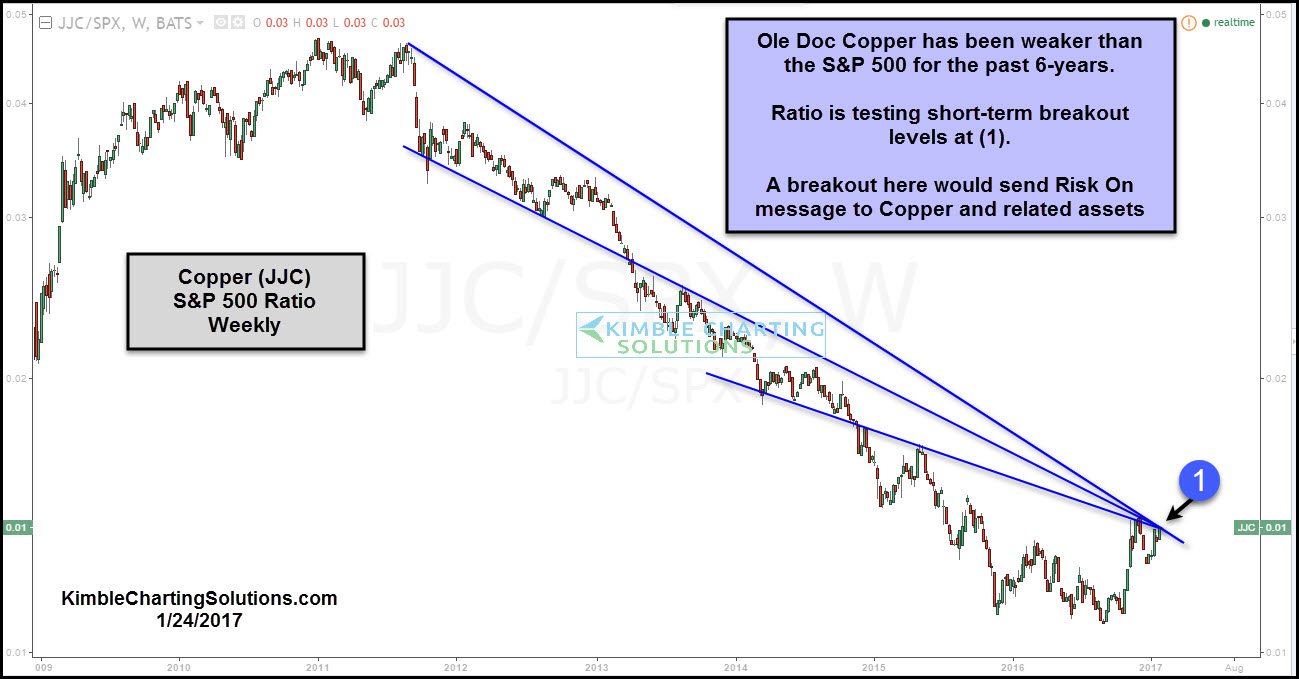

Below looks at ratio of JJC to the S&P 500.

Copper has clearly been weaker than the S&P 500 since 2011 and the long-term trend remains down, as the ratio continues to create a series of lower highs and lower lows.

The short-term trend is attempting to turn higher as the Copper/SPY ratio tests a cluster of resistance at (1).

If a breakout happens, here's my advice: long Copper and Short the S&P 500, if one is comfortable with a pair trade. If a breakout does take place, other potential beneficiaries could be FCX, RIO or JJC.

Even though Ole Doc Copper may not have sent a valuable message to the S&P 500 over the past 6 years, I think that if a breakout takes place at (1), investors should be aware of opportunities that could present themselves in the hard-hit sector.