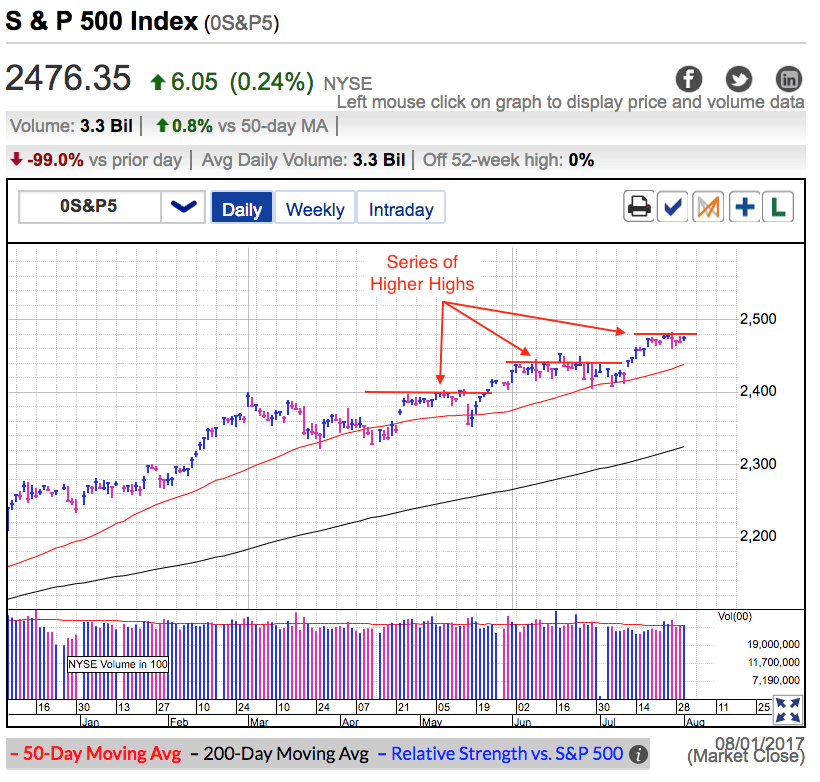

The S&P 500 added modest gains Tuesday. This strength largely puts last week’s “collapse” in the rear-view mirror. Sharp selloffs are breathtakingly quick and this is the fourth day we’ve held 2,460 support. If this market was vulnerable, we would have tumbled by now.

This resilience won’t surprise regular readers of this blog. Confident owners have ignored every other reason to sell stocks this year and nothing changed last week. In fact there really wasn’t any news driving Thursday’s dip. It was simply a case of reactive traders overreacting to each other.

Once this brief bout of weakness passed, hours later dip buyers were back at it. If confident owners showed zero interest in selling rate-hikes and political dysfunction at home and abroad, why would they all of a sudden be spooked out of the market for no reason at all? Answer is they weren’t and that’s why Thursday’s selling reversed so quickly.

While conventional wisdom tells us to fear complacency, what it often leaves out is periods of complacency last far longer than anyone expects. Without a doubt this bull market will die like every other that came before it. But that doesn’t mean we cannot go higher in the meantime. These failed selloffs tell us the path of least resistance remains higher and smart traders keep doing what is working.

That said, this is the most nervous I’ve been since the 2009 lows. Last year’s paranoid, half-empty outlook has given way to this assume everything will work out, half-full outlook on the world. Markets are normally nervous and tend to fear the worst, but this market is anything but nervous. But this doesn’t come as a surprise. After years of regretting every defensive sale, traders have learned to ignore the outside noise.

If sequesters, Greek collapses, Brexits, rate-hikes, Chinese bubbles, and all the other noise didn’t matter, then surely nothing going on right now is worse than that. Right now most owners are more afraid of being left behind than they are of losing money. While this cannot last forever, it will as long as confident owners don’t sell, supply stays tight, and prices remain firm.

Assuming everything will work out is typically the right decision and is why I’m a big fan of buying dips, but eventually we come across something that turns out worse than feared. I have no idea what will take us down, or when it will happen, but I know it is coming. I’m not ready to give up on this market because it is acting so well, but I am standing close to the door and ready to jump at the first signs of trouble.

Normally a nervous market is priced at a discount and that compensates us for taking the risk of owning stocks. Unfortunately this market is priced for perfection and that leaves little margin for error. The path of least resistance remains higher, but this is the most dangerous the market’s been in nearly a decade.

The biggest advantage of being a small trader is we can close our positions in minutes. We don’t need to predict what will happen ahead of time because we have the luxury of being able to wait for the market to tell us what it wants to do. While it is tempting to argue with an overvalued, complacent market, resist that urge. Keep doing what is working, but stay vigilant and be ready to react when something changes.

Previously I thought Trump’s inability to enact meaningful tax reform would be the undoing of the Trump rally. But given how little the market reacted to the GOP's inability to agree on anything makes me think the market really doesn’t care about tax reform. If legislative progress was important, Trumpcare’s crash-and-burn would have taken some air out of this market. Instead we continue hanging out near the highs. Same goes for the expanding Trump/Russia investigation. Maybe these will matter at some point, but right now the market doesn’t care and neither should we.

Keep doing what is working. Stick with your buy-and-hold positions. These minor fluctuations are too small to swing-trade effectively, but it is wise to keep some cash ready for the next big trading opportunity. Even though this market is painfully boring, I expect things will liven up when big money managers return from summer vacation and start positioning for year-end.

We are up approximately 10% year-to-date, but I don’t expect us to finish here. Volatility will pick up this fall, I just don’t know whether that means underperforming money managers will be forced to chase price higher into year-end, or if the wheels will fall off the Trump rally and we come crashing back to earth. Most likely we will witness a chase into year-end, but remain wary of anything that doesn’t go according to plan. Complacency means most owners will be slow to react to changing conditions. That will give us plenty of time to get out before things get ugly.