KBR Inc. (NYSE:KBR) award-winning spree continues, as the company recently announced that its global Government Service business, KBRwyle, has clinched a base operating support services deal worth $91 millionfrom the Naval Facilities Engineering Command (NAVFAC) Atlantic. The company will provide support services at various sites within the Kingdom of Bahrain as well as United Arab Emirates. Revenues related with the project will be booked as unfilled orders in Government Services business segment.

The Deal

Per the contract, KBR will offer services such as galley, housing, custodial, waste management, unarmed security force protection, grounds and landscaping, utilities, personnel movement, pest control as well as material handling. KBR is expected to perform the work over next eight years, subject to exercise of all option years. With this contract, KBR currently has on-going base operating support services work worth more than $1billion over the next eight years.

Growth Drivers

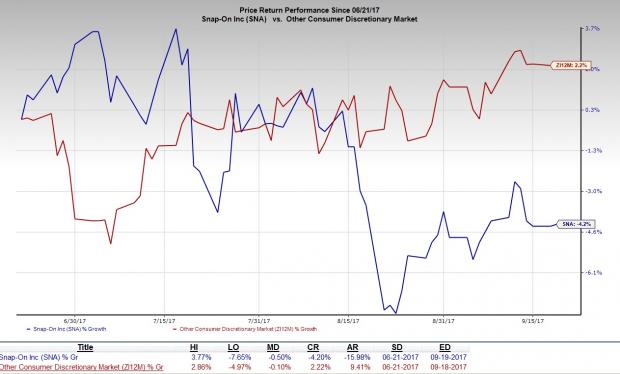

Some of the notable contracts secured by the Government Services business segment include Honeywell Technology Solutions (HTSI) and two established government services companies. HTSI was integrated into KBR’s wholly owned subsidiary — KBRwyle — augmenting its $2.5-billion government business. This strategic buyout fortifies KBR’s position as a government services organization. In the past three months, the stock has returned 21.1%, outperforming the industry’s average advance of 3.8%.

Currently, the Zacks Rank #3 (Hold) is banking on the strength of its Government Services businesses to optimize growth potential. The particular business is growing steadily, adding to KBR’s bliss. The company remains bullish about its prospects, primarily driven by lucrative contracts from the U.S. military and the new wins on work with the U.K. Ministry of Defense. Further, KBR anticipates growth across all its key markets in the United States, the U.K. and Australia, driven by continued opportunities across the lifecycle of projects.

Headwind

However, KBR’s business is being affected by the uncertain global political and economical conditions. Current volatility in the oil and gas markets, with oversupply continuing to strain the prices and spending levels, will hurt the company’s projects and orders. Further, reduced capital expenditure by key clients and currency fluctuations are fast eroding backlogs.

Stocks to Consider

Some better-ranked stocks from the same space are TopBuild Corp. (NYSE:BLD) , Owens Corning Inc (NYSE:OC) and Potlatch Corporation (NASDAQ:PCH) . TopBuild, Owens Corning and Potlatch each sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

TopBuild has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 10.4%.

Owens Corning has outpaced estimates in the preceding four quarters, with an average earnings surprise of 20.2%.

Potlatch Corporation has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 41.2%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

TopBuild Corp. (BLD): Free Stock Analysis Report

Owens Corning Inc (OC): Free Stock Analysis Report

Potlatch Corporation (PCH): Free Stock Analysis Report

KBR, Inc. (KBR): Free Stock Analysis Report

Original post

Zacks Investment Research