Kamada Ltd. (NASDAQ:KMDA) and partner Kedrion Biopharma and announced that FDA has approved Kedrab [rabies immune globulin (Human)] for post-exposure prophylaxis against rabies infection. The company will launch Kedrab in the United States in early 2018. Kamada has a strategic agreement with Kedrion Biopharma for the clinical development and marketing of Kedrab in the United States.

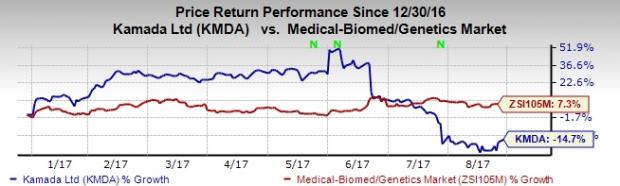

Shares of the company have declined 14.7% against the Zacks classified industry’s gain of 7.3% on a year-to-date basis.

Kedrab is a human plasma-derived immunoglobulin (HRIG) and is the first product that Kedrion Biopharma has developed throughout its clinical development and has commercialized in the U.S. Kamada has been selling the HRIG product outside of the U.S for more than 10 years under the brand name KamRAB.

Rabies is a deadly, but entirely preventable disease. Thetreatment of rabies represents an annual market opportunity of over $100 million in the United States of which Kamada expects to capture a significant market share. However, the company has not included revenues from Kedrab in its guidance of reaching $100 million in total revenue in 2017.

Zacks Rank & Stocks to Consider

Kamada currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in health care sector include Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) , Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and Aduro BioTech, Inc. (NASDAQ:ADRO) . While Alexion and Regeneron sport a Zacks Rank #1 (Strong Buy), Aduro carries Zacks Rank#2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alexion Pharmaceuticals’ earnings per share estimates have moved up from $5.57 to $5.61 for 2017 and from $6.90 to $6.92 for 2018 over the last 30 days. The company delivered positive earnings surprises in all the trailing four quarters, with an average beat of 11.12%. The share price of the company has increased 12.5% year to date.

Regeneron’s earnings per share estimates have increased from $12.84 to $14.78 for 2017 and from $15.32 to $16.21 for 2018 over the last 30 days. The company pulled off positive earnings surprises in two of the trailing four quarters, with an average beat of 10.11%. The share price of the company has increased 30.1% year to date.

Aduro’s loss estimates per share have narrowed from $1.46 to $1.32 for 2017 and from $1.41 to $1.24 for 2018 over last 30 days. The company came up with positive earnings surprises in two of the trailing four quarters, with an average beat of 2.53%.

More Stock News: This Is Bigger than the iPhone! It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market. Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Alexion Pharmaceuticals, Inc. (ALXN): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Kamada Ltd. (KMDA): Free Stock Analysis Report

Original post

Zacks Investment Research