“Yesterday’s home runs don’t win today’s games.” – Babe Ruth

Wednesday saw some heavy weakness come into stocks in the afternoon and I reduced some positions since the action was telling me we would remain in a range trade at best and see weakness more likely.

Futures were weak overnight to confirm this but then we saw nice strength on Thursday in the end.

This market is just strong and that’s all there is too it.

We will likely see a range trade for a while yet before we see the next breakout higher so adding on weakness and playing range trades looks to be in store.

April is often a strong month but so far it’s not showing that, which is unfortunate.

The good news is the bull market is strong and should continue for a few years to come.

Metals continue to act great with many miners setup to move higher anytime, or some are already.

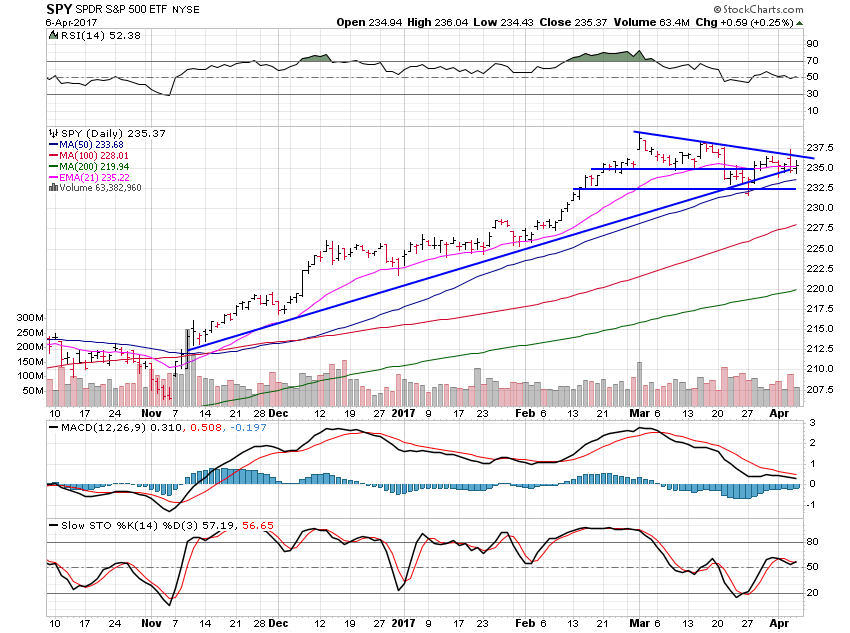

Let’s see how SPDR S&P 500 (NYSE:SPY) plays out.

I can’t get excited until we move and close above the downtrend line around 237 for the moment.

We can see 232.50 as the low end of this range and 235 as the mid level so trading off those pivots can work until we breakout higher most likely.

Often, bases last 6 to 8 weeks and this one is in week 6 now since the high in early March.