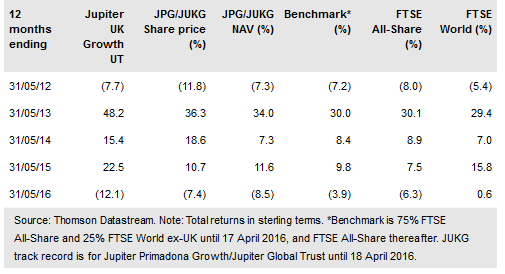

Jupiter UK Growth Trust (LON:JUKG) adopted its new strategy, name and manager in April 2016, having previously been a global portfolio.

Manager Steve Davies has built a successful track record on the Jupiter UK Growth unit trust, and brings to JUKG the same contrarian, high-conviction, thematic and concentrated approach. Davies invests for capital appreciation in a mix of secular growth (c 65%) and recovery (c 35%) stocks.

While tilted to larger companies, most of the biggest FTSE 100 stocks are absent from the portfolio, and the unconstrained approach means weightings diverge widely from the FTSE All-Share index benchmark, from a 12.3% overweight in general retailers to zero weights in oil & gas and utilities, as well as c 8% in non-UK stocks.

There is a zero-discount management policy and the board views the investment strategy as highly scalable.

Investment strategy: Thematic and growth focused

JUKG’s manager, Steve Davies, has been running an equivalent unit trust (£1.6bn AUM) since 2009, aiming to achieve mid-cap style returns from a portfolio biased to more liquid large-cap stocks.

The JUKG portfolio is concentrated with c 35 holdings chosen for their capital growth potential (a mix of growth and recovery stocks, with up to 20% in overseas companies). Positions are sized based on conviction and holdings broadly fall into one of four themes: UK banks, UK domestic, global brands & travel, and ‘the connected world’.

To read the entire report, please click on the PDF file below: