Many believe that investors should "listen" to junk bonds, largely due to the fact that they sometimes act as a leading indicator for the stock market itself.

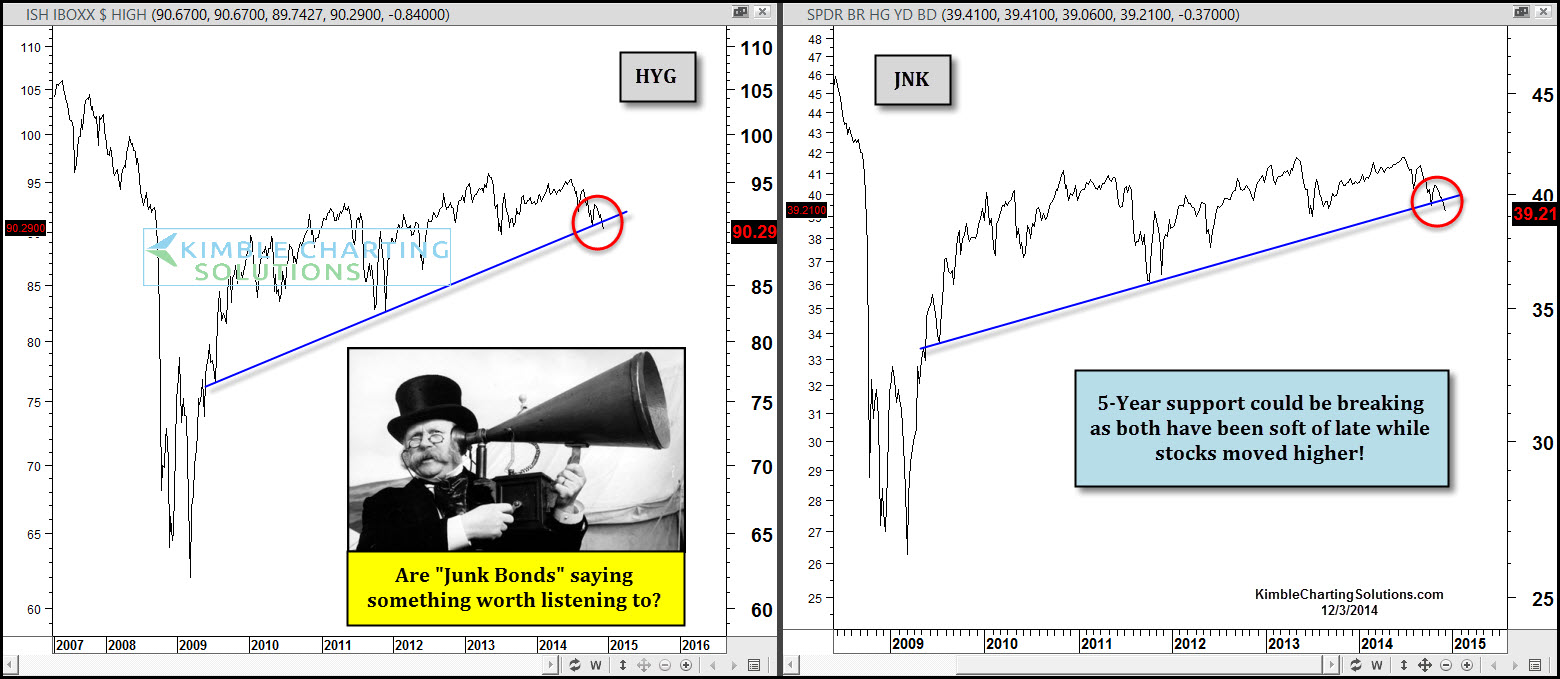

The 2-pack above takes a look at the two largest Junk Bond ETF's. Both (ARCA:JNK) and (ARCA:HYG) could be breaking 5-year support -- they've been a little soft, lately -- while the S&P 500 has hit all-time highs.

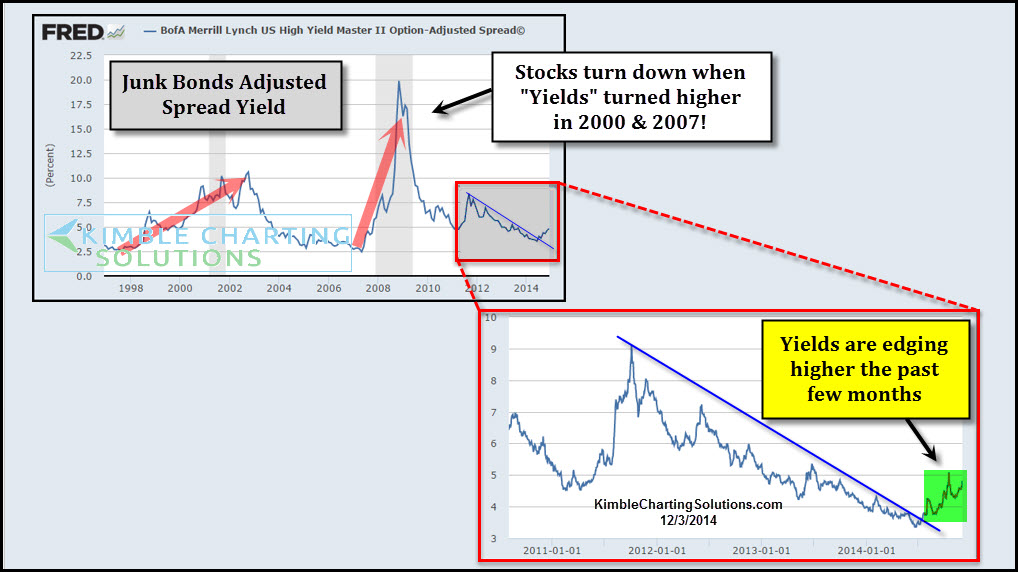

Another way to look at junk bonds is to examine yields versus prices. The chart below comes from Federal Reserve of St. Louis.

When yields started moving higher back in 2000 and 2007 (upper left chart), junk bonds and the S&P 500 turned soft. From 2011 to just a few months ago, yields continued to fall, which is often a good message for stocks.

The lower right chart shows that yields have recently turned higher, breaking above a falling resistance line.

Are junk-bond ETF's sending an early cautionary message to the stock market? Personally I DO NOT believe that investors should adjust portfolios solely upon the action of junk bonds.

Should further weakness take place in this complex and our Shoe Box indicator and if the Advance/Decline line turns down at the same time, then I would feel the message from junk bonds would be worth listening to.