No doubt junk bonds have tanked over the past two years, diverging against the S&P 500.

Historically, when Junk is weak the broad market tends to struggle to move much to the upside.

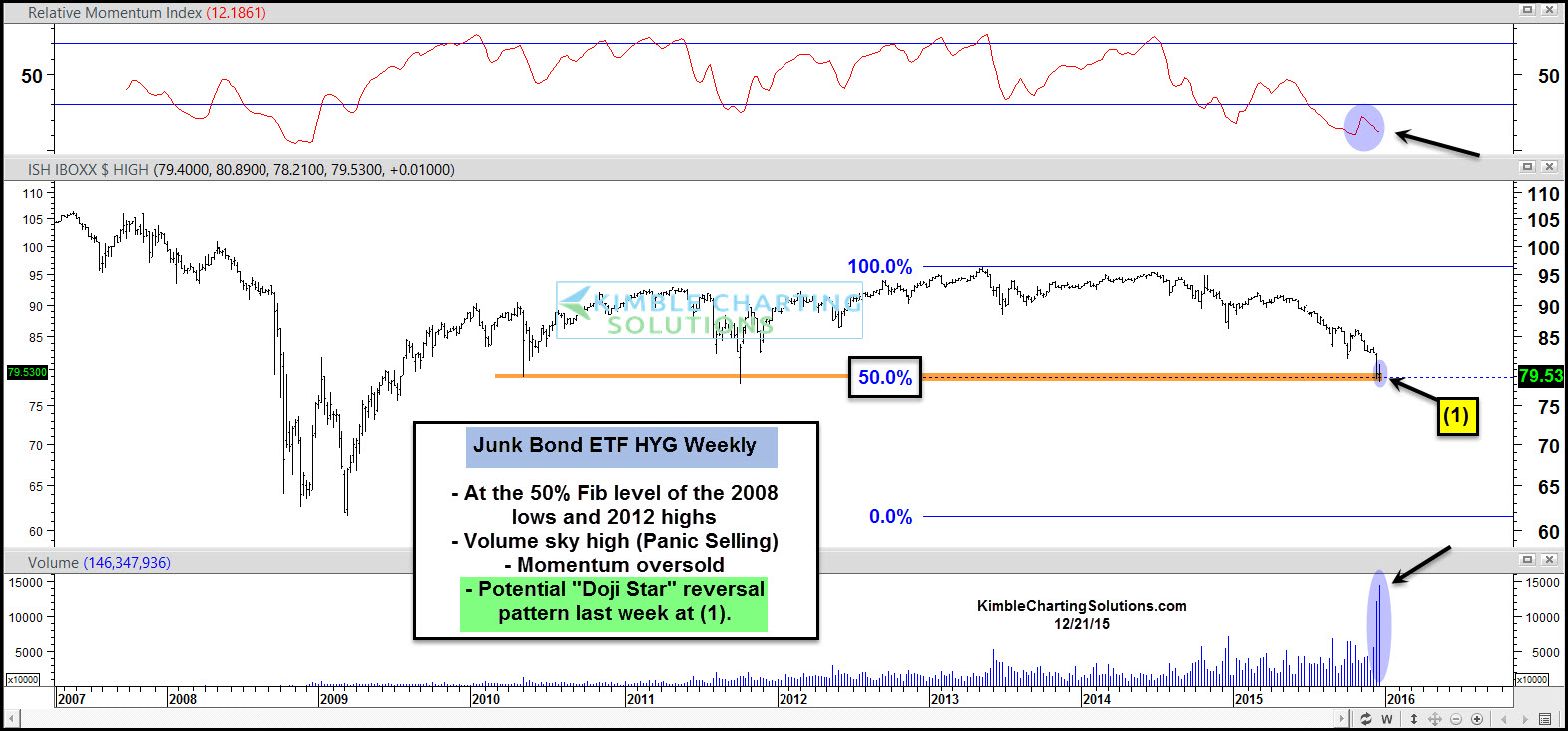

Junk-bond ETF (N:HYG) hit its 5o% Fib retracement level last week of the 2009 lows and 2013 highs. As it was hitting this Fib level, it was also hitting its 2010 and 2011 lows, as momentum was oversold. Volume has picked way up of late. Does it reflect panic selling in this hard-hit sector?

As all of this was taking place, HYG, might have created a “Doji Star” reversal pattern last week at support, at (1) above.

For sure one week does not make a trend. What HYG does at (1) should be important to this ETF and could well be important to the broad markets as well. Stay tuned friends, we humbly feel what happens here in the junk sector is important for this sector and stocks too.