On Sep 1, Juniper Networks Inc. (NYSE:JNPR) was upgraded to a Zacks Rank #1 (Strong Buy).

Why the Upgrade?

The upgrade can primarily be attributed to the recent launch of its new security solution Juniper Contrail Security as well as the company’s better-than-expected second-quarter 2017 results.

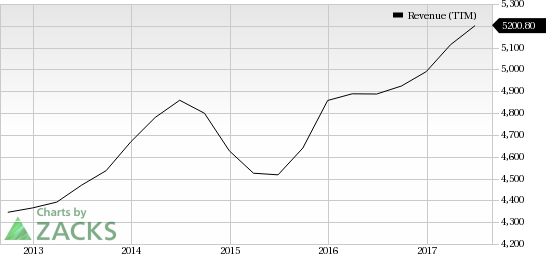

In the last quarter, Juniper’s earnings increased 14% from the year-ago quarter to 57 cents per share. The figure was ahead of management’s expectation of 54 cents (+/- 3 cents). Revenues, which increased 7.2% year over year to $1.31 billion, comfortably surpassed the Zacks Consensus Estimate and management’s expectation of $1.28 billion (+/- $30 million). The year-over-year revenue growth was much better than management’s expectation of 5%.

Juniper stock has lost 2.3% year to date, outperforming the 2.6% decline of the industry it belongs to.

Growth Catalysts

We believe Juniper’s latest introduction, Contrail Security has boosted the growth potential of the company. The security solution ensures protection for applications that are deployed in volume-loaded heterogeneous cloud-based environments. Hence, this new launch coupled with Juniper’s existing Software Defined Secure networks (SDSN) will drive the company’s top line going forward.

Notably, Juniper has witnessed accelerated demand and adoption of its SDSN platforms. In the second quarter, the platform was enhanced with security enforcements, which now protect data transmission and computing on enterprise networks as well as public and private clouds from breaches.

Juniper added many prominent names to its customer base during the last reported quarter. CloudSeeds selected Juniper’s Contrail Networking software-defined networking (SDN) solution. Coloclue adopted Juniper’s NVF Solution. i3D.net also selected Juniper’s SDSN platform for network security.

Can it Sustain the Momentum?

The company recently unveiled Cloud-Grade Networking, which covers telemetry, automation and machine learning processes. This is also expected to drive the top line in the near term. We anticipate strong adoption of Juniper’s cloud-based products (particularly in data center), growing demand for its switching product (the QFX line) and stringent cost control along with shareholder friendly initiatives to help the stock maintain its momentum in the long run.

Key Picks

Other stocks worth considering in the broader technology sector include Motorola Solutions (NYSE:MSI) , Infineon (OTC:IFNNY) and Applied Optoelectronics (NASDAQ:AAOI) . While both Infineon and Applied Optoelectronics sport a Zacks Rank #1 (Strong Buy), Motorola carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Motorola Solutions, Infineon and Applied Optoelectronics is 5.2%, 14.6% and 17.5% respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Juniper Networks, Inc. (JNPR): Free Stock Analysis Report

Motorola Solutions, Inc. (MSI): Free Stock Analysis Report

Infineon Technologies AG (IFNNY): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Original post

Zacks Investment Research