It was another wild trading session overnight for the futures, which were down well over 1% at one point. The S&P 500 futures fell to around 3065, only to bounce back to 3125, and now back to 3100. The moves overnight seemed extreme, and perhaps this has to do with quad witching on Friday because other markets were not this volatile.

Today we will get continuing and initial claims at 8:30 AM.

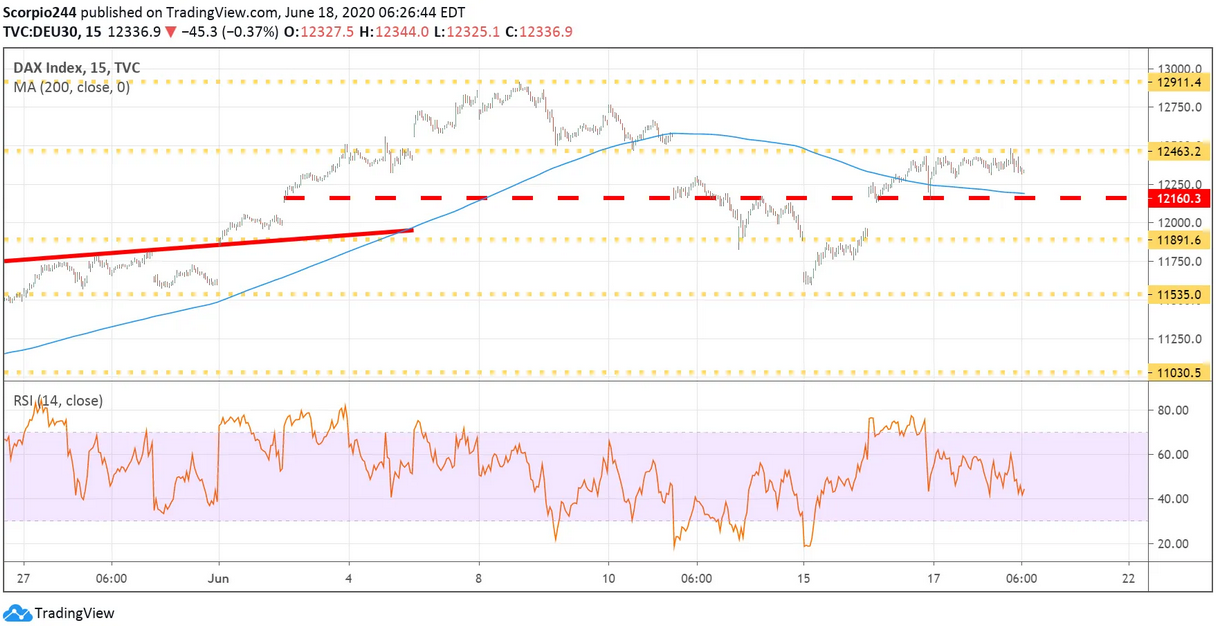

Germany

The German DAX is interesting, just look at that chart below how the index has been halted at 12,460. The index looks as if it wants to move lower and fill that gap around 11,800.

S&P 500

The S&P 500 (NYSE:SPY) is trading up slightly by ten basis points. What has become clear is that the $314 region is fierce resistance, and $311 has to hold, or there may room to fall to around $306.

For the QQQs, the significant level of resistance comes at $245.

10-Year Yields

10-year yields are starting to move lower, and this needs to be watched, there is the potential to push towards 65 basis points.

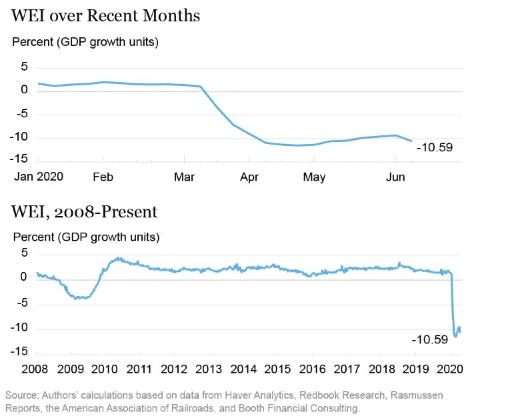

In the meantime, the NY Fed’s Weekly Economic Index is actually suggesting that economic trends that were positive are now turning lower again. This Index will update later today, should be monitored.

Tesla

Tesla (NASDAQ:TSLA) is catching a bid today after Jefferies (NYSE:JEF) raised its price target on the stock to $1200 from $650. The stock has been moving higher in a trading channel, with an upside to around $1,100.

PayPal (PYPL)

PayPal Holdings (NASDAQ:PYPL) saw its price target at Citi raised to $186 from $145. That is certainly not the direction I thought PayPal was headed in. For now, the stock is at the upper end of the trading range, with the potential to fall back to $156.

Shopify

RBC Capital raised its price target on Shopify (NYSE:SHOP) to $1,000 from $825. Yeah, so I just don’t know about this one anymore. The stock just doesn’t go down. I guess we will find out soon if it makes a new higher, or the stock is finally beginning to trend lower.