Yen opens the week generally lower following rebound in Asian equities. In particular, Japanese Nikkei is up over 3% and reclaimed 15000 handle as additional boosted by news regarding the Government Pension Investment Fund, or GPIF. It's reported that the $1.2T GPIF will raise the allocation target for local equities from 12% as much as 25%. Meanwhile, holdings of foreign securities would be raised from 23% to 30%. Meanwhile, domestic bond holding would be lowered from 60% to 40%. The new allocation exceeded markets expectations, which expected share holdings to be around 20-22% only. Also from Japan, BoJ governor Haruhiko Kuroda said today that the economy will continue to "recover moderately as a trend" with the effect of the April sales hike likely to "gradually subside". Meanwhile, he expected core inflation to say around 1.25% "for some time".

Released from UK, the Rightmove house price index rose 2.6% mom, 7.6% yoy in October. The economic calendar is light today. German PPI is expected to rise 0.0% mom, drop -1.0% yoy in September. Eurozone current account surplus is expected to widen to EUR 21.3b in August. Canada wholesale sales is expected to rise 0.2% mom in August. Also to be watched are German Bundesbank's monthly report and Fed board member Jerome Powell's speech.

Looking ahead, there are a number of key events to watch for. To start with, Aussie will look into a bunch of Chinese data on Tuesday including GDP and RBA minutes, then CPI on Wednesday. Canadian dollar will look into BoC rate decision and retail sales. Sterling will look into BoE minutes, retail sales and GDP. Eurozone will release PMIs on Thursday. New Zealand will release CPI. All of these could be market moving. Here are some highlights for the week:

- Tuesday: China GDP; RBA minutes; Swiss trade balance; UK public sector net borrowing; US existing home sales

- Wednesday: Australia CPI; Japan trade balance; BoE minutes; Canada retail sales, BoC rate decision; US CPI

- Thursday: New Zealand CPI; China PMI manufacturing; Eurozone PMIs; UK retail sales; US jobless claims

- Friday: German Gfk consumer sentiment; UK GDP; US new home sales

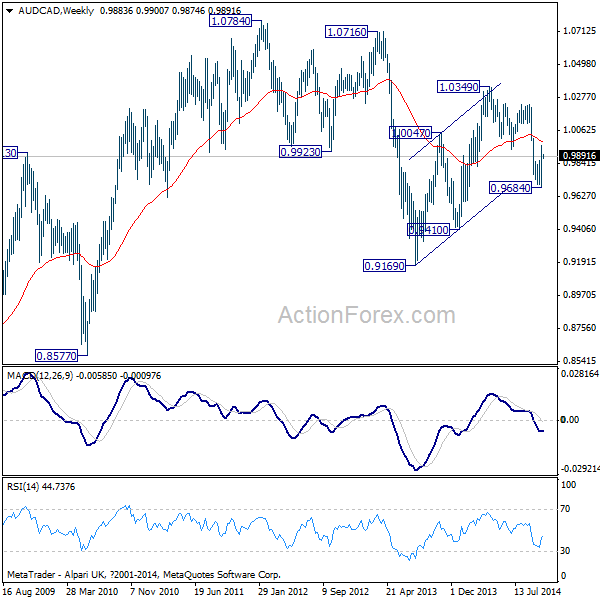

Some volatility could be seen in AUD/CAD this week considering the number of important events scheduled. The cross formed a short term bottom at 0.9684 and recovered. Some consolidations could be see above there in near term. Nonetheless, we're maintaining the view the corrective rise from 0.9169 has completed at 1.0349 already. Fall from 1.0349 is either a leg inside a sideway pattern or resuming the fall from 1.0784. Thus, we'd expect strong resistance around 55 weeks EMA (now at 0.9987) to limit upside and bring fall resumption. Below 0.9684 will target 0.9410 and then 0.9169.