The Japanese yen weakened broadly last week and stocks extended the rebound from prior week's low and recovered nearly 70% of loss in the past few weeks. Indeed, S&P 500 had the largest weekly gain since January 2013 on better than expected earnings, as well as stabilization in markets sentiments. Meanwhile, New Zealand dollar was the second weakest major currency following weak inflation trade data. Meanwhile, European majors were generally weak too. Sterling was under pressure most of the week after dovish BoE minutes and retail sales but recovered as Q3 GDP met expectation. Aussie, Canadian and dollar were the strongest currencies but it should be noted that these three were bounded in range against each other. It's more of the weakness in others that drove the markets.

An important question is whether the correction in stocks were finished and yen would extend last week's decline. Technically, we maintain that 2019.26 is a medium term top in S&P 500, on bearish divergence condition in daily MACD. While rebound from 1820.66 might extend, the consolidation pattern from 2019.26 isn't completed and would continue. Thus, upside potential in S&P 500 is limited and we'd expect strong resistance above 2000 level to bring reversal. Break of 1909.38 will target 1820.66 and then 38.2% retracement of 1343.35 to 2019.26 at 1761.06. With this outlook in consideration, the rise in yen crosses would face strong resistance ahead and there would be reversal to revisit recent lows soon.

Dollar will face the test of FOMC policy decision this week. Fed is widely expected to finally ended the quantitative easing program as planed. With the completion of the program, there will be significant changes to the statement, taking away all those paragraphs regarding the purchase as well as tapering. The biggest question is whether Fed would finally drop the language of "considerable time" regarding keeping rates low after ending QE. Dollar traders will also look into the first estimate of Q3 GDP. Technically, there is no change in the view that dollar index is in consolidation from 86.74. The timing of upside breakout would depend on the FOMC statement or next week's employment data. Meanwhile, any interim decline should be contained by 38.2% retracement of 78.90 to 86.74 at 83.74 and bring rebound.

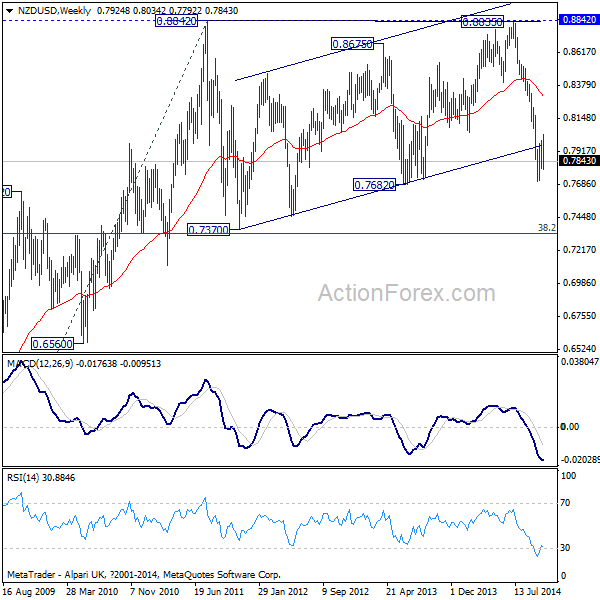

Another key market moving event could be RBNZ rate decision. The central is widely expected to keep the OCR unchanged at 3.50 and maintain a tightening bias. However, recent economic data has been rather disappointing, in particular the much lower than expected Q3 CPI reading. Should RBNZ sound more neutral in this week's statement, or hint at prolonging of the pause in the tightening cycle, NZD/USD could tumble through recent low of 0.7707. As the fall from 0.8835 is viewed the the third leg of the long term consolidation pattern from 0.8842, break of 0.7702 will likely trigger sustainable down trend towards 0.7370 support.

Here are other highlights for the week ahead:

- Monday: German Ifo, Eurozone M3; US pending home sales

- Tuesday: US durable goods, S&P Case Shiller house price, consumer confidence

- Wednesday: Japan industrial production; UK mortgage approvals; Canada IPPI, RMPI; FOMC

- Thursday: RBNZ; German CPI, unemployment; US GDP

- Friday: Japan CPI; Australia PPI; BoJ; Canada GDP; US Personal income and spending, Chicago PMI, U of Michigan sentiment.

Regarding trading strategies, our AUD/JPY short is staying in red as yen pulled back while Aussie struggled to find a direction. Nonetheless, we we're expect limited upside potential in stocks and thus yen crosses, we'll stay short in AUD/JPY first and put a stop at 96.00 to guard against other losses. The focus is back to dollar long this week even though, as mentioned above, we're unsure whether the greenback will have upside breakout this week or next. The mildly bearish outlook in EUR/AUD and EUR/CAD suggests that Euro is a better choice to sell against dollar. While we stayed cautiously bullish in EUR/GBP, we're not too confident considering the deep pull back from 0.8046. Thus, we're sell EUR/USD on break of 1.2500 level this week. If the breakout doesn't happen, we'll review the level to sell EUR/USD again next week.