Johnson & Johnson (NYSE:JNJ) was founded in 1886. Since that time, Johnson & Johnson (JNJ) has grown to become the largest health care business in the world.

The company has a market cap of $276.7 billion, generates over $70 billion a year in sales, and $16 billion a year in profits.

You may have heard about the 3 most important aspects of real estate – location, location, location. Johnson & Johnson has its own 3 most important aspects – stability, stability, stability. Johnson & Johnson is perhaps the most stable ‘blue chip’ dividend growth stock investment around today. The company’s investor relations page gives a few amazing statistics about the companies consistency:

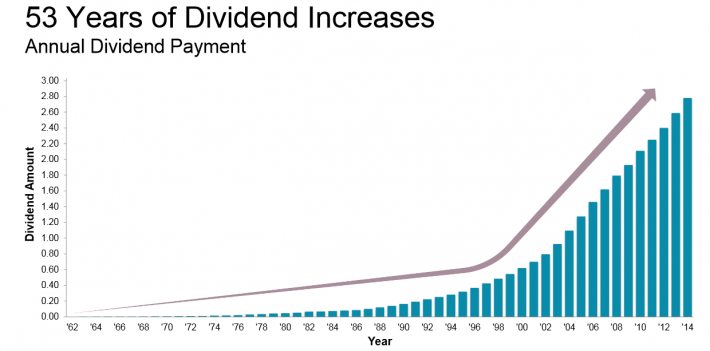

“Our consistent performance has enabled us to deliver an exceptional track record of growth that few, if any, companies can claim: 31 consecutive years of adjusted earnings increases and 53 consecutive years of dividend increases.”

There is a lot of (well deserved) discussion about the 52 Dividend Aristocrats – stocks that have paid increasing dividends for 25 or more consecutive years. Johnson & Johnson is a Dividend Aristocrat twice over.

Johnson & Johnson is a member of a far more exclusive group; the ‘gold standard’ of dividend stocks. Johnson & Johnson is a Dividend King. Dividend Kings are stocks with 50+ consecutive years of dividend increases. The image below shows the company’s dividend growth history:

Johnson & Johnson’s stock price standard deviation shows just how stable and respected the business is. The company has a stock price standard deviation over the last decade of just 16.2%. This is the lowest of any large cap stock in the Sure Dividend database. The next two lowest are utilities; Southern Company (NYSE:SO) and Consolidated Edison (NYSE:ED) have long-term stock price standard deviations of 17.8% and 16.7%, respectively. Johnson & Johnson’s stock is less volatile than even high quality utilities.

Business Overview & Competitive Advantage

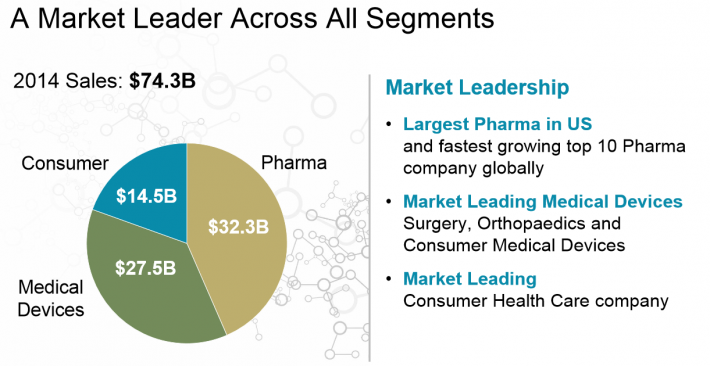

The secret to Johnson & Johnson’s stability is its wide diversification within the health care industry. The company operates in 3 segments: Consumer, Pharmaceutical, and Medical Devices. The image below shows the relative size of each segment for Johnson & Johnson.

If one segment has a ‘down’ quarter – and by down I mean being slightly less profitable, not losing money – then it is likely that another segment is outperforming. Johnson & Johnson’s diversification within the health care industry helps give it such stable cash flows.

A stock must have a strong competitive advantage (or several) to realize positive earnings growth for 31 consecutive years, and positive dividend growth for over 50 years. Johnson & Johnson’s has 3 broad competitive advantages that differentiate it from its competitors:

- Size/scale competitive advantage

- Research & development competitive advantage

- Brand competitive advantage

Johnson & Johnson’s size/scale competitive advantage is a result of it being the largest player in the health care industry. The company’s long history gives it excellent connections with suppliers and governments around the world. The company can keep input costs low by buying in far larger quantities than competitors can.

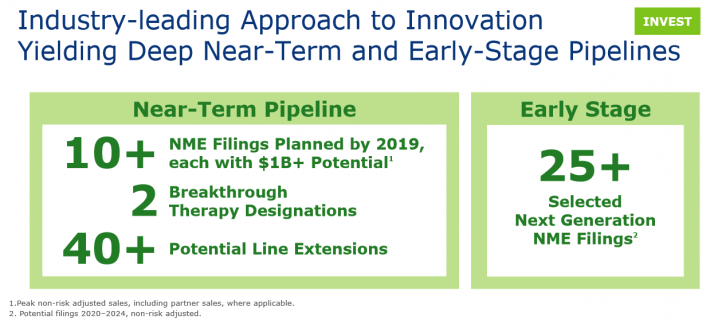

The company’s large size gives it a bigger research and development budget that its peers. The company spent an industry leading $8.5 billion on research and development in 2014, and another $8 billion in 2013. This spending has produced tangible results. Johnson & Johnson generates about 25% of revenue from products it has developed in the last 5 years. The company’s pharmaceutical portfolio in particular is benefitting from large research and development spending, as the image below shows:

Johnson & Johnson commands premium pricing through its well known consumer brands. The company owns the following well-known consumer health brands (among others):

- Tylenol

- Band-Aid

- Zyrtec

- Listerine

- Johnson’s

- Neutrogena

- Aveeno

- Motrin

The company supports its consumer brands and pharmaceuticals with large advertising spending. In 2014, Johnson & Johnson spent $2.6 billion on advertising. The company spent $2.5 billion in 2013.

Current Events & Growth Prospects

Johnson & Johnson posted 6.7% constant-currency adjusted earnings-per-share growth in its most recent quarter. The company has grown earnings-per-share at 6.1% a compound rate of 6.1% a year over the last decade. Recent results were in line with historical average growth – just what one would expect from a highly stable business.

Going forward, Johnson & Johnson’s biggest growth driver will likely be its pharmaceutical segment. Pharmaceutical sales have grown at 13.1% a year from 2012 through 2014. Johnson & Johnson’s large research and development spending will drive further growth in the pharmaceutical division.

Financial pundits have been calling for the breakup of Johnson & Johnson recently. Spin-offs are typically good for shareholders. If the company were to split into three smaller businesses (one for each segment), it is difficult to say whether shareholders would be better served or not.

Those who wanted to own the ‘whole business’ could still do so by not selling any of the three spin-off companies. Those who want to focus just on Johnson & Johnson’s faster growing pharmaceutical segment, or more stable consumer segment, could do so. In the final analysis, a split-up would probably be beneficial for shareholders in the long-run, but is not in any way necessary to make Johnson & Johnson an excellent investment choice.

Valuation & Final Thoughts

Johnson & Johnson currently trades for an adjusted price-to-earnings ratio of 16.6. The company appears somewhat undervalued at current prices. The company has a 3% dividend yield and should grow earnings-per-share at around 5% to 7% a year going forward, for total returns between 8% and 10% a year.

Total returns of 8% to 10% a year mean Johnson & Johnson offers investors returns that are around the S&P 500’s long-term historical average of 9% a year. The difference is, Johnson & Johnson is an incredibly stable business with an extremely low stock price volatility. Simply put, Johnson & Johnson offers investors market-matching returns with lower risk.

An investment that offers similar returns to the overall market, but with less risk should trade at or above the price-to-earnings multiple of the S&P 500. The S&P 500 is currently trading for a price-to-earnings ratio of 21.1, versus 16.6 for Johnson & Johnson. This is why Johnson & Johnson appears undervalued at current prices.

Johnson & Johnson’s combination of a 3% dividend yield, solid total return potential, long history of success, and an extremely low stock price volatility make it a Top 25 stock. The company makes an intriguing investment for risk-averse investors looking for growing income.