Back on deck to start the week with a clear mind… and nose!

Non Farm Payrolls Friday night was the highlight of a packed last few days which have actually been full of talking points. Between NFP, elections in both Australia and Japan, a Chinese data dump AND don’t forget the ongoing Brexit shenanigans, are all having an impact on Forex and Indices markets throughout the tradingsphere.

Starting with NFP, and the number looks hottt!

“USD Non-Farm Employment Change: 287K v 175K expected”

…but as always, the number is just a single month’s headline beat. Nothing more, nothing less.

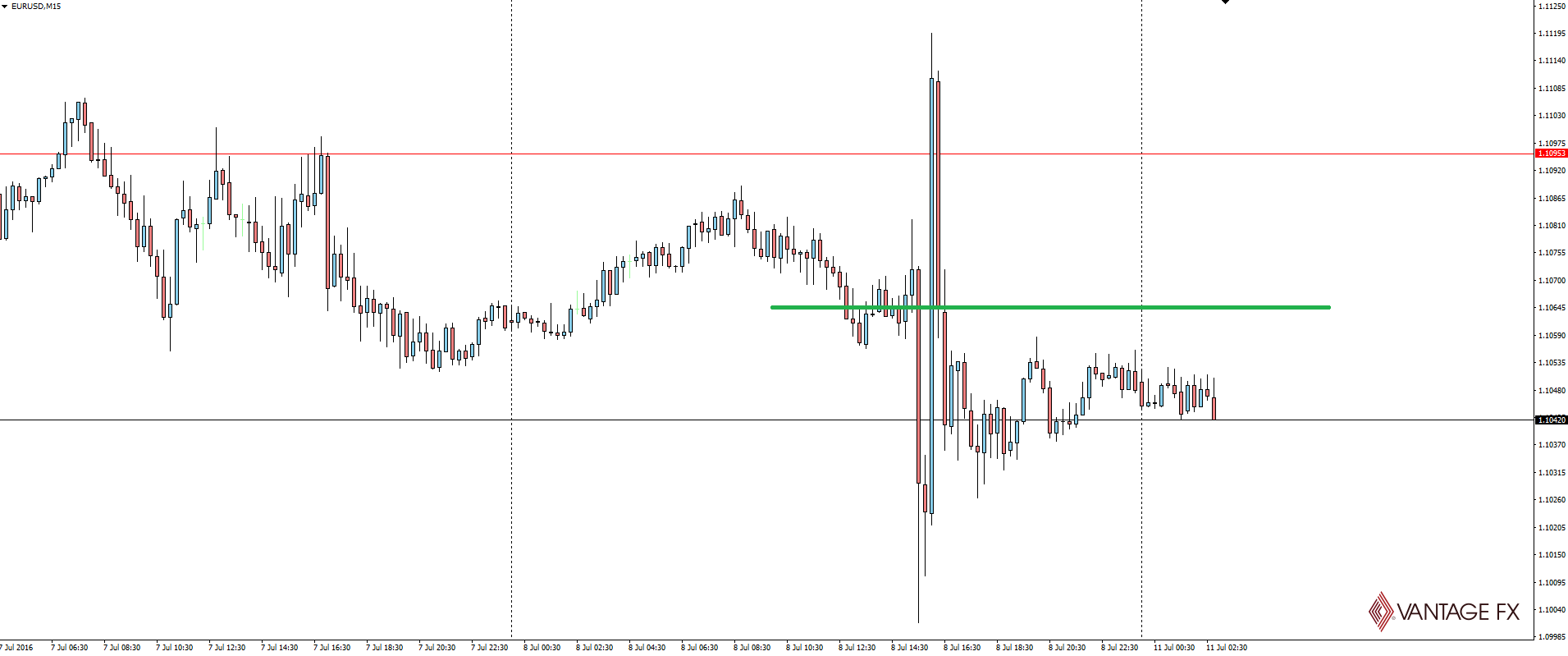

On Thursday, we spoke about EUR/USD into NFP with a focus on the US dollar and what a headline beat would do for expectations of a 2016 rate hike from the Fed. Thoughts on this scenario were that it would essentially still do nothing for the Fed and therefore nothing for price.

And a no reaction is where we settled after the usual NFP chop that the algos and punters enjoy playing on. Whether we now see a continued edging up of price along the trend line in that previous post is yet to be seen, but something we will be watching play out on Twitter, at @VantageFX.

Moving forward and we also saw Shinzo Abe’s Liberal Democratic Party gain a supermajority in the upper house. While this upper house vote didn’t affect Abe’s position as Prime Minister, it did have huge implications for the country’s economic and social standing.

So why is a supermajority significant?

“Amendments to the constitution require a two-thirds majority (supermajority) in both houses of the National Diet and a simple majority in a referendum.”

This result not only gives the green light for ‘Abenomics’ to continue, but also opens up the possibility of reforming the Japanese constitution and easing some of the post World War Two restrictions.

“We were given approval for our mandate to powerfully pursue Abenomics. We’d like to continue with our efforts to achieve what we’ve promised.”

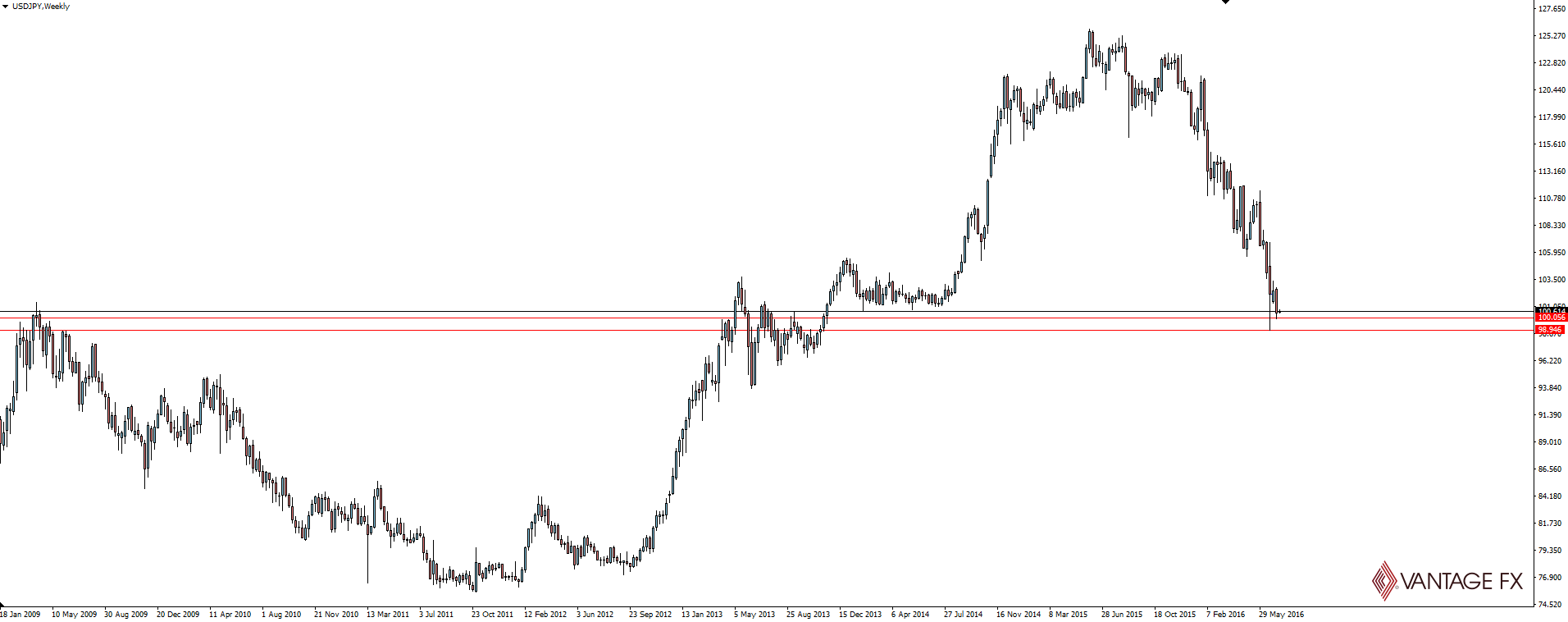

USD/JPY Weekly:

USD/JPY Daily:

With the elections out of the way and USD/JPY at these hugely significant technical levels, could this be the time that the BoJ steps in?

If I was short and these 99ish lows break, I don’t expect markets to relax and give up a momentum move on this pair. Beware the central bank with the itchy trigger finger!

Sticking with politics, and the weekend also saw the Australian opposition Labor party concede defeat, officially re-electing Prime Minister Malcolm Turnbull’s Liberal/National Coalition.

Having gone to the polls over a week ago, archaic manual counting processes and the tightness of the election (the real possibility of a hung parliament which relies on Independents and Greens to pass legislation through the lower house) haven’t been great for economic or market stability, reflected in Standard and Poor’s cut to the country’s credit rating OUTLOOK from ‘stable’ down to ‘negative’ last week.

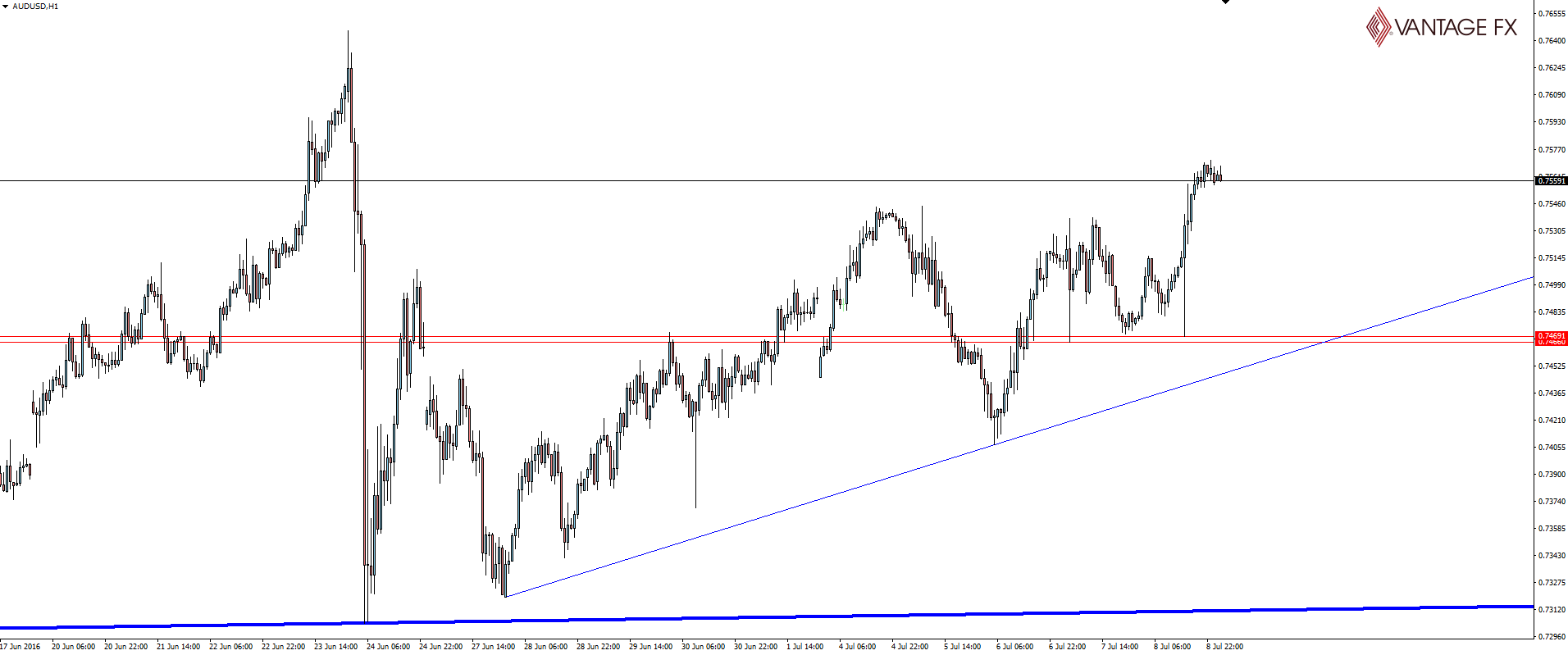

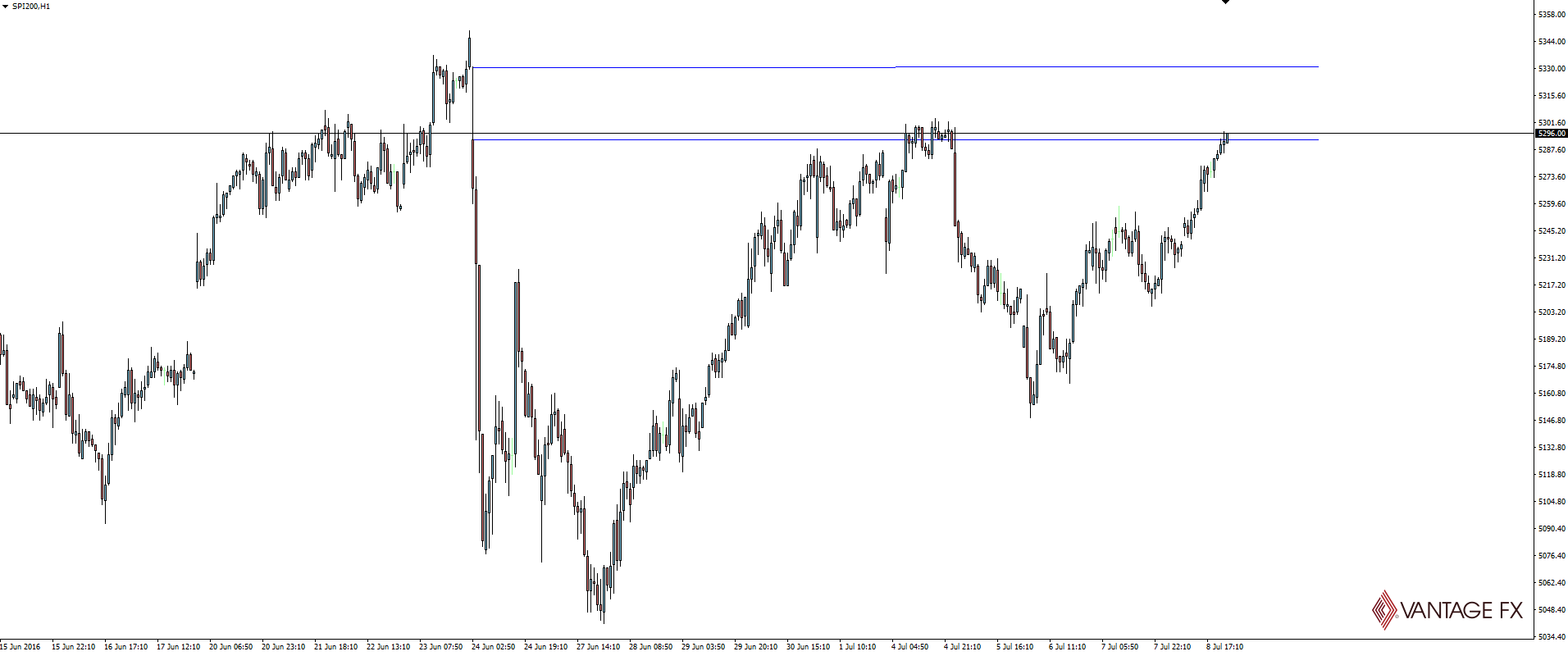

But the closer we get to the full makeup of the lower house, including Coalition deals with the Independents on passing legislation, the less likely it is that Australia will lose its AAA rating. A fact not lost on a bullish channelling Aussie or a bouncing SPI 200.

AUD/USD Hourly:

SPI 200 Hourly:

Sticking with the Aussie Dollar and the Chinese inflation data that was released on Sunday.

“CNY CPI y/y: 1.9% v 1.9% expected and 2.0% previously”

The drop, while expected, hasn’t been taken positively by Beijing:

“The global economic recovery remained complicated and grim.”

China’s trade minister Gao Hucheng made these comments on Saturday during G20 meetings in Shanghai, signalling there is yet more stimulus to come.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.