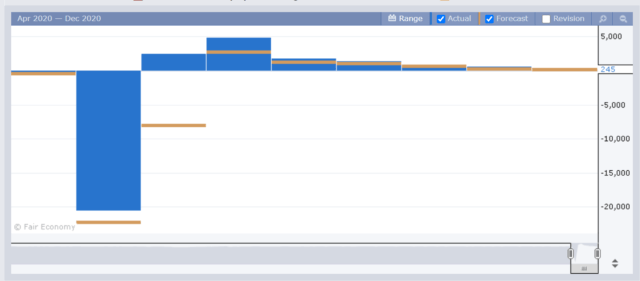

The monthly jobs report came out this morning, and although the unemployment rate dipped a little, and almost a quarter million jobs were added, the pace of job growth is quite clearly diminishing with every passing month. The jobs added was about one-third what was hoped would be the case.

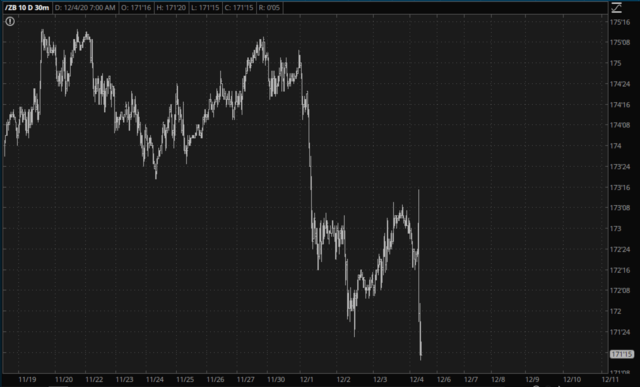

Even so, the fact that the devastating effects of the pandemic were ever-so-slowly healing gave cause for celebration, with equities at lifetime highs and interest rates strengthening. (Apparently the good people of Earth haven’t quite connected that rising interested rates in a world buried as never before in debt isn’t a great combination). Bonds, naturally, are sinking like a rock.

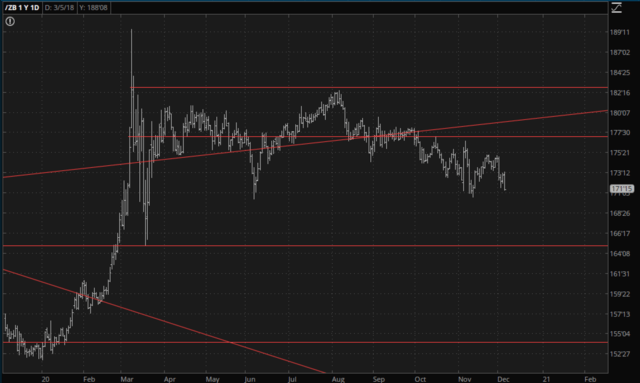

And, looking at the longer-term ZB, there’s not a whole hell of a lot supporting thing thing. After peaking in early March, U.S. bonds have been decidedly unpopular, except among the ravenous buyers inhabiting the Eccles Building.

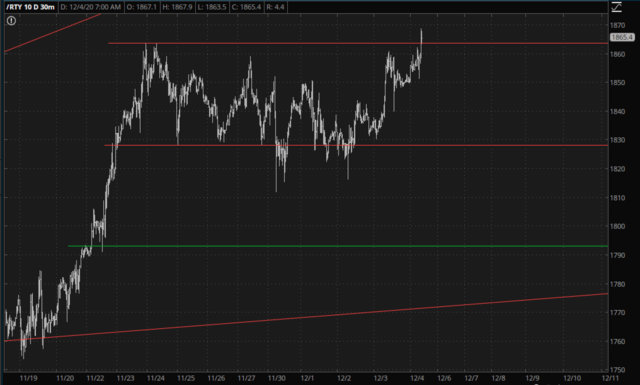

The best news for equity bulls is what’s going on with the small caps. The Russell2000 (NYSE:URTY) has been range-bound for a while, but it seems to be breaking free. It has crossed above the 1864 level, which is the upper boundary of the small but well-formed bullish base.

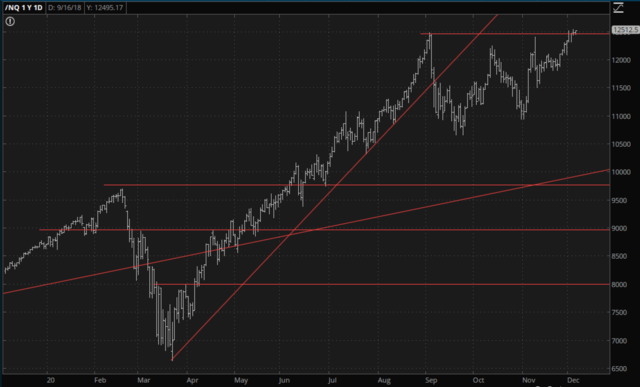

Similarly, the Nasdaq 100 is at lifetime highs and is above a bullish base.

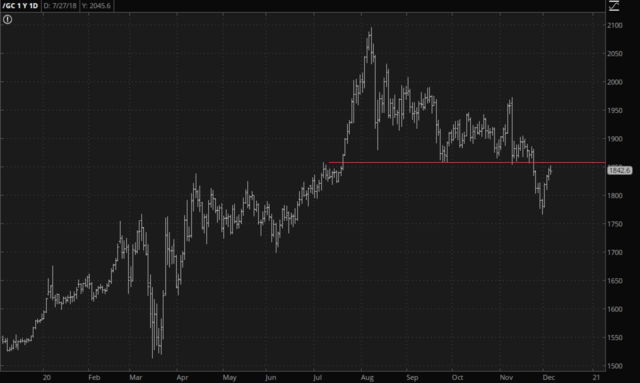

One of the few assets that remains vulnerable right now appears to be gold, whose strength in recent days has done little but to push it up against the large, failed right-triangle pattern defined as everything above the red horizontal. As I’m typing this, gold has already flipped from green to red.

The most consistently bearish thing for the past eight months, of course, has been volatility, which has been smothered to death. It is hard to believe we were in the mid-80s in mid-March. It feels like about 20 years ago.