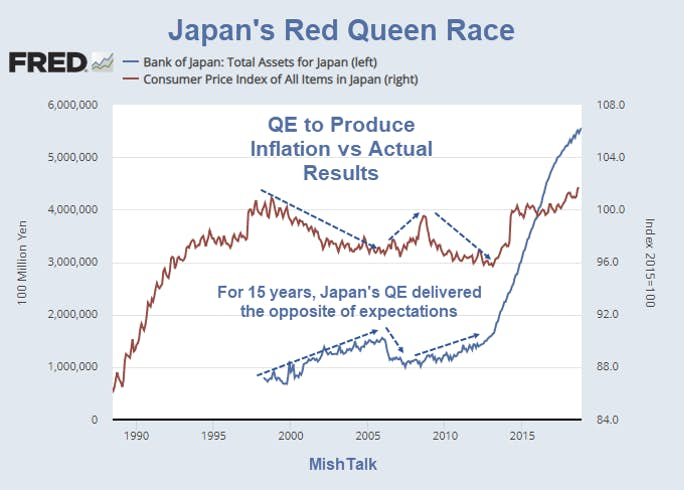

Let's check in on Abenomics and Japan's effort to produce inflation via QE.

For 15 years Japan's QE efforts delivered the exact opposite of intentions. Inflation actually rose when QE tapered.

In 2013, the tide finally turned but it took a rise in QE. Please note the scales is in 100 million yen. Thus QE is now about 555 trillion yen or $4.923 trillion.

Red Queen Race

The Red Queen's Race is an incident that appears in Lewis Carroll's Through the Looking-Glass and involves both the Red Queen, a representation of a Queen in chess, and Alice constantly running but remaining in the same spot.

"Well, in our country," said Alice, still panting a little, "you'd generally get to somewhere else—if you run very fast for a long time, as we've been doing."

"A slow sort of country!" said the Queen. "Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!"

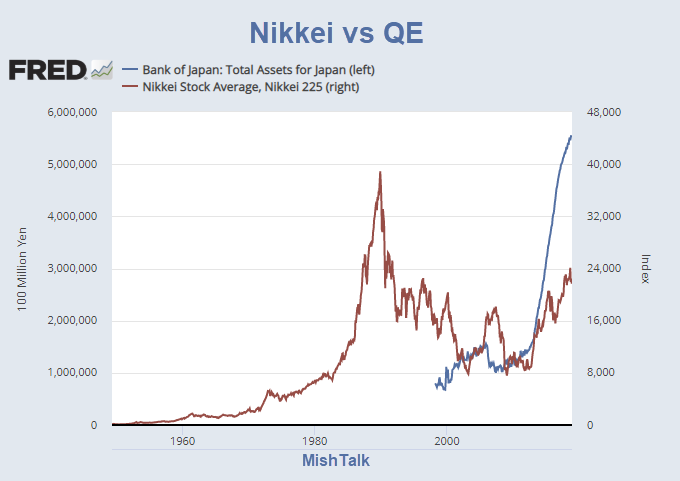

Nikkei vs QE

If that chart says anything at all, it's difficult to spot.

Importantly, it's wrong to give QE credit for anything given we do not know what would have happened in the absence of it. The only thing we can say for sure is that 15 years of trying generally produced the opposite results.

Even on the assumption that QE is finally working, it's taken 555 trillion yen to produce those results and the Nikkei is still far below its peak.

The Nikkei is 21,678 today. The Nikkei hit 38,915 in 1989.

What's Coming?

I do suspect that at some point these sorts of financial shenanigans will "succeed" beyond Japan's wildest expectations with Japan intervening to stop massive inflation.

All it will take is an attitude changes that's arguably long overdue.

A yen-hedged Nikkei bet (WisdomTree Japan Hedged Equity (NYSE:DXJ)) is one way to play. I am in that trade and have been for some time.

Mike "Mish" Shedlock