It’s the Fed’s interest rate day and the Bank of Japan has just hiked its rates. What’s next?

The key thing to remember is that gold (and the rest of the precious metals sector) tends to move erratically around the Fed’s interest rate decisions, even if market expectations are quite clear. Consequently, any suspicious moves should be treated as particularly suspicious, and any breakouts are prone to invalidations.

Gold moved higher yesterday and so did silver. Miners’ move higher was barely visible – the latter are trading sideways after the previous sharp decline.

Did gold’s and silver’s breakout have important implications? No – today is the FOMC day, so it’s quite likely that the move higher here will be invalidated, especially if something makes the market thing that rate cuts are less likely.

Right now, the market is expecting the rates to be left unchanged today and then three rate cuts (on each of Fed’s remaining 2024 meetings) is expected. If today’s comments during the press conference indicate that the Fed might NOT cut rates three times this year, it will likely be viewed as hawkish and it could trigger a sell-off in precious metals and equities.

Technically, gold’s and silver’s breakouts are far from being confirmed – the above chart is not based on daily candlesticks (2-hour ones), so there’s plenty of time for these moves higher to be reversed.

Please note how little miners did, especially when compared to silver. This is in perfect tune with what I previously wrote about the GDXJ to SLV ratio.

I emphasized that the ratio is after a sharp rally and the RSI just moved above 70 and that when we saw that previously, that meant declines:

• in the ratio

• in miners (most importantly)

• in the rest of the precious metals sector (to a smaller extent, but still)

That’s what we saw in early 2022, in early 2023, and in late 2023. Those were indeed local tops followed by declines.

The above remains up-to-date. Yesterday, miners simply moved up less than silver, but in the near future, they are likely to decline more than silver.

So, we know that the FOMC-related tensions likely resulted in the recent upswing in gold and silver, and we know that they are unlikely to last. Now, let’s see what impact the rate hike by the Bank of Japan had on the USD/YEN currency pair.

It plunged. Yesterday’s small breakout was invalidated, and declines followed. The USD/YEN even moved below the previous high that held in early May.

Is this profoundly bearish?

Not yet.

The breakdown is not confirmed, and given that what could have happened to push the pair lower, just happened, it could be the case that the pair will now reverse and rally once again.

The previous uncertainty regarding the interest rate hike by the BoJ was that while a hike was likely, it wasn’t clear if it’s going to happen now or later this year. Now it’s a done deal.

As the hike happened, it’s now less likely that we’ll see it in the future. Consequently, the move that was “in the air”, is already done, and the uncertainty regarding it is over. The market moved, but now the previous trend can resume.

Technically, the USD/YEN corrected half of this year’s rally, which could be the reason for its rebound.

Japanese Stock Market Reaction

Theoretically, higher rates on the yen should be bullish for the yen and bearish for the USD/YEN pair, however, after the first-rate hike, the pair rallied, so it’s not clear if it will really work in this way going forward.

Perhaps the Japanese investors will want to buy dollars (bullish for the greenback) to buy the U.S. stocks, as higher rates on the domestic market can hit the local companies in a major way.

And indeed, something major is happening on the Japanese stock market.

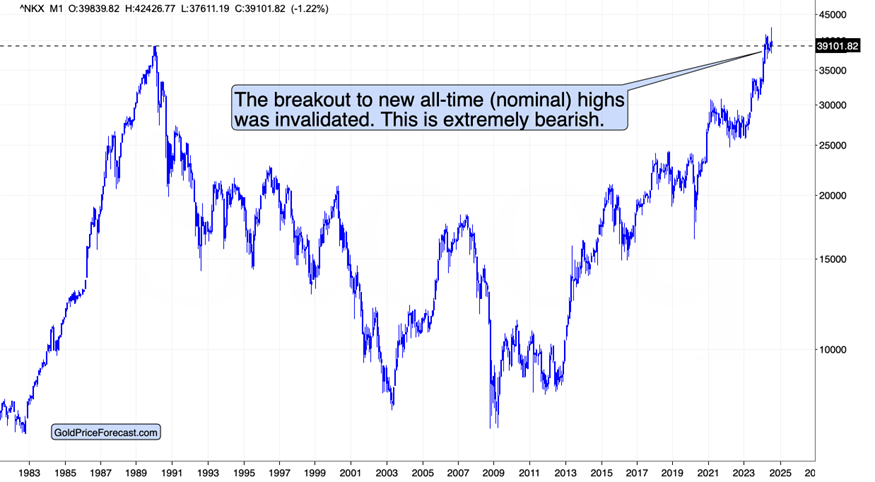

After finally breaking slightly above the previous all-time highs, Nikkei invalidated this move, flashing an extremely strong sell signal.

Right now, the index is trading slightly above the previous high, but the previous invalidation plus the fact that the rates were just hiked suggests that the rally is most likely over.

On a side note, this chart might be interesting to those, who say that stocks can only move up because they were moving higher in the recent years.

That’s what people thought at the end of the 1980s, too, with regard to the Japanese stocks.

After that top, stocks have been declining for about 18 years, and people waited about 34 years just to get even – and they got even only in nominal terms, which means that they still lost a lot of capital in real terms.

So, can the U.S. stocks slide once the AI bubble bursts?

Of course.

It could be the case that investors fearing this decline will want to get out of the Japanese stock market – and out of yen, which would put a downward pressure on the value of this currency – pushing the USD/YEN and the USD Index higher.

At the same time, higher rates in Japan mean that the yen carry trade is much less favorable, which puts a strain on multiple leveraged markets at the same time. And by all leveraged markets, I mean pretty much all the markets, including commodities and gold.

My point here is: viewing the rate hike in Japan as something bullish for gold is incorrect. In one way it could lower the value of the USD Index, but it doesn’t have to, and through unwinding the yen carry trade mechanism, the impact on the precious metals market is likely to be negative.

This might not play out immediately, as markets will still be taking their time to act on this information, but this should NOT be ignored.

Also, falling stocks in Japan could easily trigger falling stocks in the rest of the world.

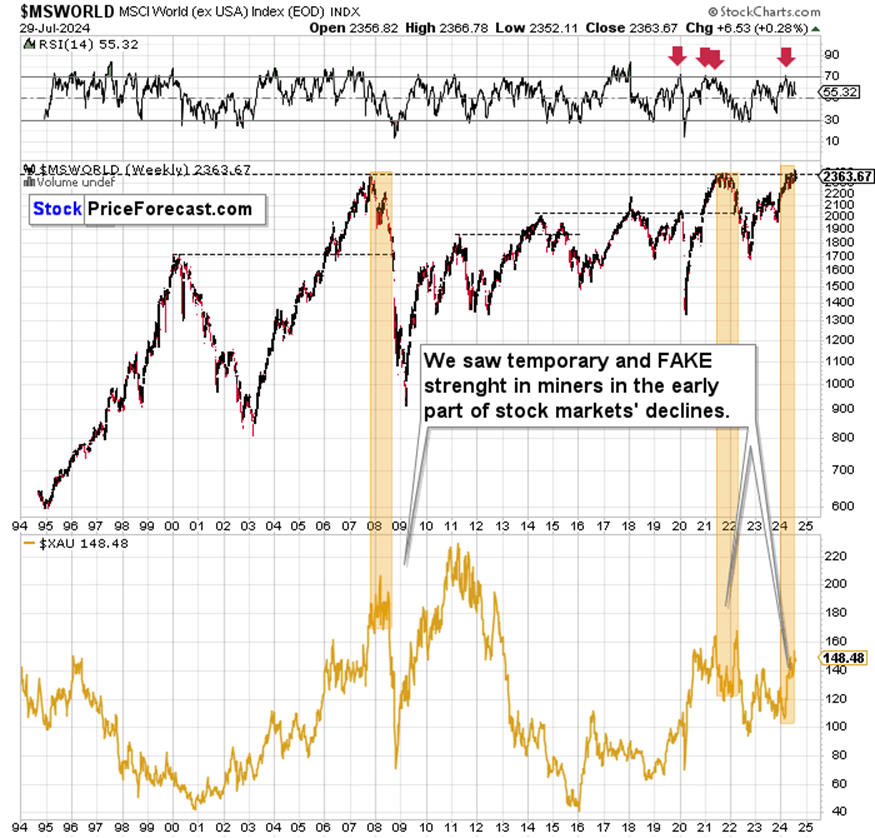

The world stocks are likely to slide based on the extremely strong resistance that they encountered – the 2007 and 2021/2022 tops.

Both previous declines from those levels had a very negative impact on the mining stocks (lower part of the chart), and the same is likely to happen this time.

Junior mining stocks are likely to be affected to the biggest extent, which creates an exceptional opportunity in them right now (in shorting them now, and then buying them AFTER the big drop).