Investing.com’s stocks of the week

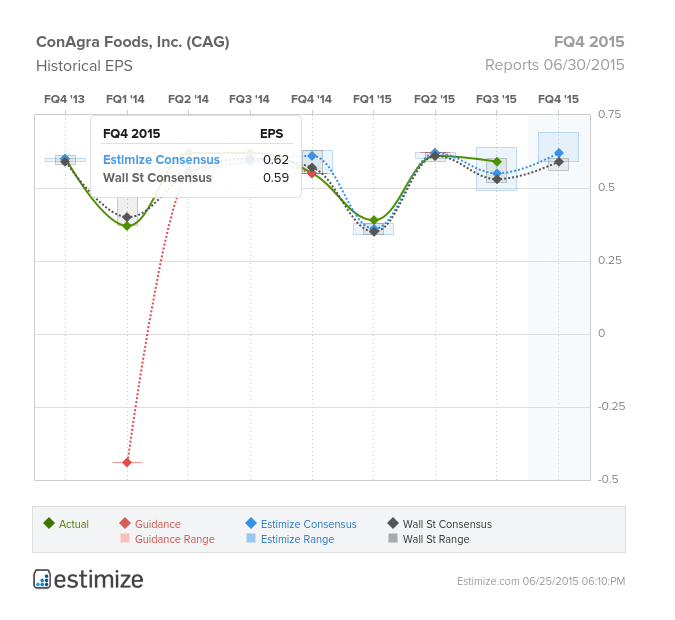

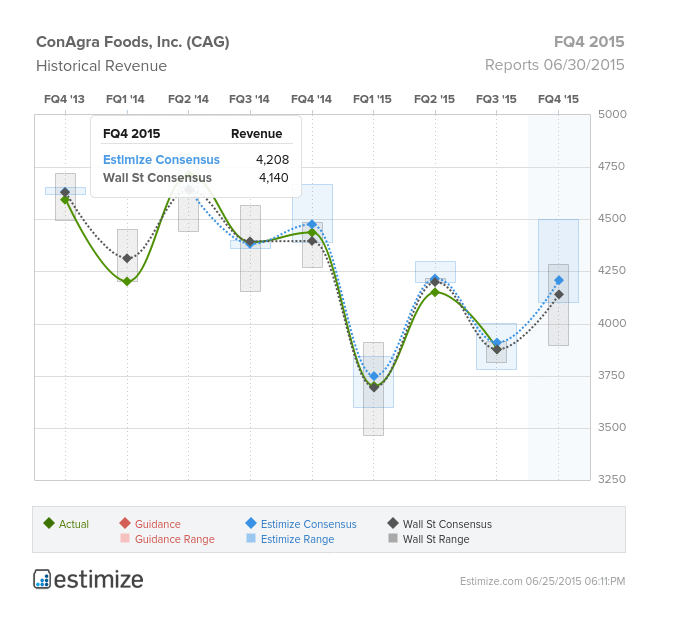

ConAgra Foods (NYSE:CAG) reports its FQ4 ‘15 results this morning and it is likely to draw a great deal of attention due to the recent activist stake accumulated by JANA Partners. Wall Street is predicting flat earnings QoQ of $0.59 compared to the Estimize community which predict a slightly higher figure of $0.60. Estimize has also predicted higher revenues than Wall Street with an estimate of $4.167B compared to Wall Street’s $4.140B.

ConAgra operates its business through three different segments: Consumer Foods, Commercial Foods, and Private Brands. ConAgra sells its products through a range of distribution channels and focuses on retail such as grocery and convenience stores. Its operations are predominately focused in North America.

Recently, ConAgra was brought into the spotlight when New York based activist investor JANA Partners, disclosed to the market that they had taken a 7.2% (approx. $1.2B) stake in the company. ConAgra’s management have made clear to the market that they have no intention of discussing the recent developments until the FQ4 ’15 results are released. In addition, JANA are yet to disclose their full intentions to the market. However, JANA is well known for its skill at taking activists stakes leading to either split offs or outright sales. This was recently demonstrated when JANA targeted PetSmart (NASDAQ:PETM) in the latter stages of 2014, which they then sold to a private equity firm 5 months later.

ConAgra’s earnings have been struggling for some time as the public becomes more health conscious and moves away from ConAgra's consumer- oriented brands (which include Hutns, PAM, Chef Boyardee, Bertolli and Blue Bonnet among others). In addition to this, increasing competition is driving down margins. The lack of earnings growth has been reflected in ConAgra’s share price up until the recent announcement involving JANA. Before the announcement was made, ConAgra’s stock had underperformed the S&P 500 by 40% over a five year period.

The report later today, as well as the days following will be very interesting as the market will not only get a better understanding of ConAgra’s business performance, but will also receive guidance on what both JANA and ConAgra’s management intend on doing moving forward.