Jamie Dimon let us know he was fed up with Washington last week. Nothing happening and no focus on getting anything done. You really cannot blame him. But what is even better is that he is making an example for our elected officials by offering 4 ways to trade his JPMorgan (NYSE:JPM) stock. Listen in to his analysis.

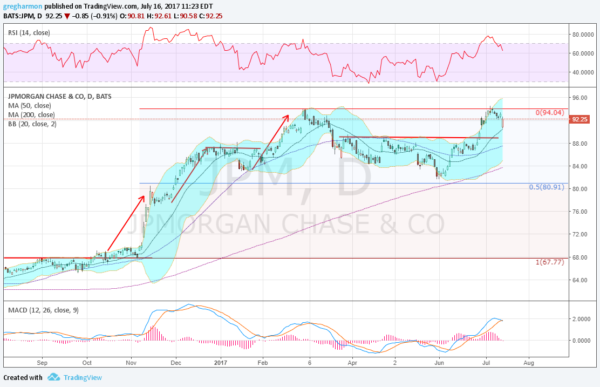

The stock started higher after the election along with other financials, completing a 3 Drives pattern with a top in February. It retraced nearly 50% of the move higher over the next 3 months, finding support just over the 200 day SMA at the start of June. It moved back higher from there, to resistance at 89 and then continued to the prior top at 94. It pulled back slightly ahead of earnings last week, and then gapped down to the 20 day SMA at the open Friday morning, following the report. The stock was bought all day Friday and closed the gap to finish own less than 1% on the day.

The Hollow Red candle shows that intraday strength and supports a short term bottom. The RSI pulled back from an overbought condition and remains strong in the bullish zone, while the MACD is close to a cross down. These need to hold for a reversal in price. There is support at 90.75 and 89 then 86. Resistance higher sits at 94 and then there is free air above. A Measured Move would give a target to 98.75 on continuation higher. Short interest is low at 1% and the company is expected to report earnings next October 12th.

The July options chain shows large open interest this week at the 90 strike on both sides and then at 95 on the call side and 87.5 on the put side. August options show a very large slug of open interest at the 92.5 call strike and the next biggest at 90 on the call side. The September options show open interest building from 90 to a peak at 97.5 on the call side. And October options, the first after the next report, have biggest open interest at 95 and 100.

JP Morgan, Ticker: JPM

Trade Idea 1: Buy the stock on a move over 92.25 (continuation) with a stop at 90.

Trade Idea 2: Buy the stock on a move over 92.25 and add an August 90/85 Put Spread (70 cents) for protection, selling a September 97.5 Call (71 cents) to fund it.

Trade Idea 3: Buy the August/October 95 Call Calendar ($1.54).

Trade Idea 4: Buy the October 85/95 bull Risk Reversal ($1.06).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into July options expiration and the height of summer earnings, sees the equity markets looking very strong.

Elsewhere look for Gold to continue its recent move higher while crude oil bounces in a channel. The US Dollar Index continues to look weak while US Treasuries continue their consolidation in a channel. The Shanghai Composite remains in a slowly rising uptrend as Emerging Markets (NYSE:EEM) continue their break out to the upside.

Volatility looks to remain at extremely low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM and QQQ. Their charts support this view as well on both the daily and weekly timeframes. Use this information as you prepare for the coming week and trad’em well.

* It is possible that Jamie Dimon said none of this.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.