Jack In The Box Inc (NASDAQ:JACK) late Monday posted mixed fourth quarter results and offered a somewhat tepid outlook for 2017.

The San Diego-based company reported adjusted Q4 net income of $1.03 per share, which was significantly better than the $0.88 expected by analysts. Revenues rose 12.5% from last year to $398.42 million, slightly worse than Wall Street’s $398.58 estimate.

Looking ahead, JACK forecast full-year 2017 earnings-per-share (EPS) to range from $4.55 to 4.75, which could miss the $4.75 estimate of analysts.

Same-store sales, a key measure of a restaurant chain’s health, rose 2% across all Jack in the Box system stores. Jack in the Box stores saw a 0.5% increase in same-store sales, with a 3.5% rise in the average check size. At the company’s Qdoba burrito chain stores, same-store sales rose +0.8% system-wide. Those gains were driven by higher traffic and rising catering demand.

JACK forecast Q1 same-store sales to grow 2% to 4% at Jack in the Box system restaurants, up from a +1.4% gain last year. At Qdoba, the company sees same-store sales of “approximately flat to up +1%” at Qdoba company restaurants, which indicates a slowing growth rate from last year’s 1.5% increase.

For the full year 2017, Jack in the Box sees same-store sales increasing about 2% to 3% at Jack in the Box system restaurants, and similar growth at Qdoba company restaurants.

The company commented via press release:

We are happy with the progress we made on our key strategic initiatives during the year, as we made significant headway on reducing our G&A, increased our borrowing capacity to support our capital structure goals, and began implementing plans to increase the franchise mix at Jack in the Box to over 90% of the system.

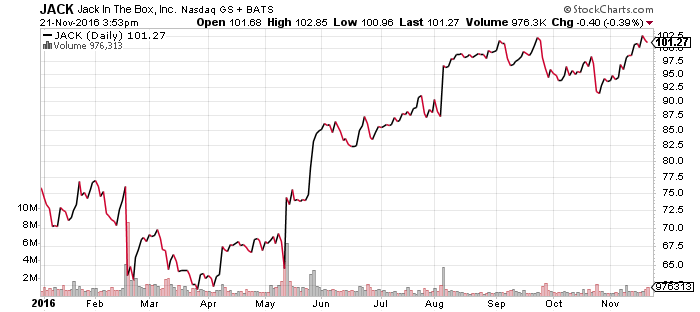

Jack in the Box shares fell $1.90 (-1.87%) to $99.75 in after-hours trading Monday. Prior to today’s report, JACK had risen 32.23%, more than four times the return of the benchmark S&P 500 during the same period.