On Aug 21, we issued an updated research report on leading quick-service hamburger restaurant chain Jack in the Box, Inc. (NASDAQ:JACK) .

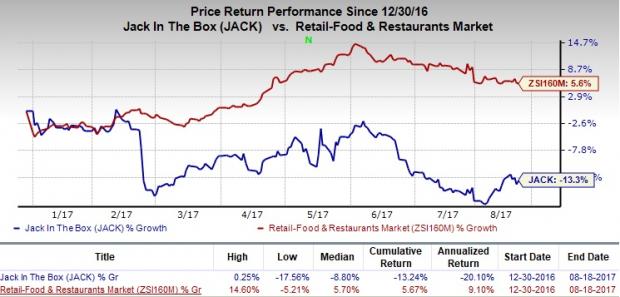

Jack in the Box’s shares have widely underperformed its industry year to date. The company’s shares have declined 13.3% against the industry’s gain of 5.6% in the same period.

Additionally, Jack in the Box has been witnessing an unflattering movement in its earnings estimates trend, reflecting ongoing pessimism in the stock’s prospects. Over the last month, current quarter earnings estimates have moved down 7.1% due to seven downward revisions versus none upward. Meanwhile, current year consensus estimates have revised 3.8% downward due to eight negative revisions versus none in the opposite direction.

A Soft Industry Backdrop Pressurizing the Top line

Over the past few quarters, the U.S. restaurants space has not been too enticing. Despite economic growth, somewhat lower energy prices and higher income, consumers increased their spending only modestly on dining out, which resulted in low consumption.

Moreover, as consumers demand high-quality products at lower prices, it is pushing grocery stores to decrease their food prices in order to remain competitive. This, in turn, is resulting in a bigger gap between food-at-home and food-away-from-home indices.

Consequently, same-store sales growth has been dull in a difficult sales environment. Traffic too has been weak. In fact, the second quarter of calendar 2017 marked the sixth consecutive quarter of negative comp sales for the restaurant industry as a whole, thereby continuing the somber mood.

Resultantly, Jack in the Box’s sales has come under pressure. Comps at the Jack in the Box company stores were down 1.6% in second-quarter fiscal 2017, while comps at company-owned Qdoba restaurants declined 1.1%.

Furthermore, the company lowered its comps outlook for 2017 and now anticipates the same to decline 2-2.5% at Qdoba company restaurants but inch up 0.5% at Jack in the Box system restaurants.

Higher Costs & Heightened Competition

Jack in the Box reported a year-over-year decline in earnings in third-quarter fiscal 2017 as its margins were pressurized. Margins were negatively impacted by costs related to the 31 restaurants that were franchised, wage rate increases, commodity cost inflation, particularly in beef as well as higher repairs and maintenance costs.

Going forward, nationwide wage increases and higher healthcare costs under the Affordable Care Act are expected to continue hurting this restaurant operator’s margins. However, commodity cost inflation is anticipated to prevail, in addition to expenses related to the company’s remodeling initiative as well as unit expansion. Meanwhile, widespread marketing schemes are projected to increase overall expenses.

While all these expenses are likely to weigh down margins and thereby earnings, the company’s revenues are expected to be pressurized by heightened competition.

In fact, Jack in the Box has been experiencing increased competitive pressure in breakfast and lunch day parts as many other restaurateurs have introduced aggressive value offers.

While other restaurant chains including Yum! Brands, Inc. (NYSE:YUM) , McDonald’s Corporation (NYSE:MCD) and Domino’s Pizza, Inc. (NYSE:DPZ) have opened their outlets in the emerging markets, Jack in the Box seems to be slow on this front. Thus, limited international presence might be a big disadvantage for the company and hurt its competitive positioning.

Sales-building Initiatives Offer Some Respite

Despite the prevailing headwinds, Jack in the Box’s several initiatives offer some respite.

The company makes regular menu innovations and provides limited period offers (LPO) at both its brands to drive long-term customer loyalty. Its premium and value offerings, along with increased focus on breakfast menu to combat competition bode well.

Apart from menu innovation and remodeling efforts, Jack in the Box expects catering, marketing initiatives and delivery to boost comps at the Qdoba brand.

Qdoba is also developing a mobile app which will enable online ordering and mobile payment. The company is also redesigning its affinity program to bring back guests more often and to provide them with better control over reward points.

Meanwhile, Jack in the Box restaurants are currently 85% franchised. The company plans to increase its franchise restaurants to around 90% by fiscal 2018. We believe, franchising a large chunk of its system will lower general and administrative expenses, and thereby boost earnings.

Strategic Review of Qdoba Brand Could Prove Beneficial

The Qdoba brand has become more of a drag in recent quarters given poor restaurant level execution and a choppy sales environment.

Keeping in mind the recent performance of the brand, and given that the overall valuation of the company is being impacted by having two different business models, management has retained Morgan Stanley & Co (NYSE:MS). LLC. This was done in order to assist the board in its assessment of possible alternatives with respect to the brand, coupled with other ways to boost shareholder value.

Though management continues to believe in the brand’s potential, this strategic review by Morgan Stanley should aid in taking the requisite steps in better managing the company.

However, it is to be noted that there is no guarantee that the evaluation process will result in a transaction. Also, the company has not set a timetable for conclusion of the process.

Currently, Jack in the Box carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Yum! Brands, Inc. (YUM): Free Stock Analysis Report

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Jack In The Box Inc. (JACK): Free Stock Analysis Report

Original post

Zacks Investment Research