Despite new highs in the Russell 2000, S&P 500 and Dow Industrials, the broad market still needs to see the iShares DJ Transport Average Index (ARCA:IYT) make a new high to reconfirm the uptrend via Dow Theory. One stock that can help out there is JB Hunt Transport Services Inc (NASDAQ:JBHT) which seems to have packed up its bay started the journey higher.

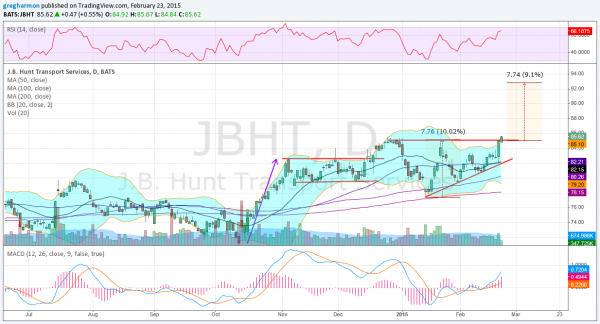

After a strong move off of the October low, J.B. Hunt settled over November and early December before a final move into year end. Since year end the price action has built an ascending triangle against resistance at the year end all-time high. With rising tightening support the price moved over the 20 and 50 day SMA last week and closed at the highs. Monday sees a break above the triangle, giving a target of 92.75.

The momentum indicators are backing the break out. The RSI is making a higher high as it drives into the bullish zone while the MACD continues to navigate upwards. Finally the Bollinger Bands® are opening to the upside to allow the stock to move.

You can use a stop $1 below the break out level at 85.00 for a reward to risk ratio of almost 5:1. If that is not enough for you, maybe try a March 85 Call (offered about $1.95 as I write) to juice up the return and define your maximum risk.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.