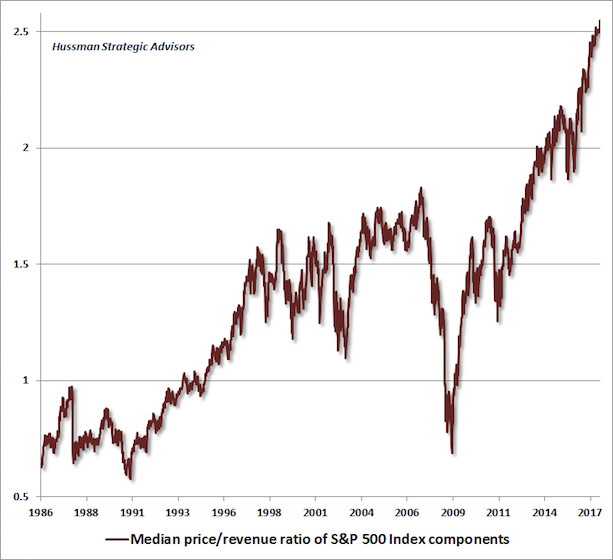

Based on the median Price to Sales for an S&P 500 company, the stock market is now officially the single biggest bubble in history.

A big hat tip to John Hussman for catching this.

Why does this matter?

Because, earnings, cash flow, book value, and other metrics can be easily massaged by corporates. As such, valuing a business based on its P/E, P/CF, or P/B multiples isn’t necessarily accurate.

Sales, on the other hand, cannot be fudged. Either the money came in the door or it didn’t. And if a company is caught fudging its sales numbers, someone is going to jail.

Which is why the fact that the median P/S multiple at an S&P 500 just hit an all time high is a MAJOR warning that stocks are in fact in a MASSIVE bubble.

You’ve been warned.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.