Brazil-based, Itau Unibanco Holding S.A. (NYSE:ITUB) received Brazil's antitrust authority Cade’s approval for the acquisition of U.S. bank, Citigroup Inc.’s (NYSE:C) consumer banking business in Brazil, announced in October 2016. The deal was inked for around $220 million (710 million reais).

The sale constitutes around $2.8 billion in assets for Citigroup in Brazil and includes credit cards, personal loans and deposit accounts, and Citi Brazil's retail brokerage business as well.

Following the completion of this transaction, Citigroup will continue operating corporate and investment bank, commercial and private bank businesses in the country.

Terms of the Approval

Cade approved the deal on the agreement under which Itau Unibanco would be forbidden from purchasing other financial institutions for 30 months. Notably, Cade would enter into a deal with the Brazilian bank which would restrict any further mergers for Itau.

However, Itau Unibanco’s buying stake in brokerage XP Investimentos SA is not under the purview of restriction. Notably, the deal is already under Cade’s review.

Conclusion

Backed by the acquisition of assets from Citigroup, Itau Unibanco reinstated its confidence in the Brazilian financial market and the value which it adds for its shareholders.

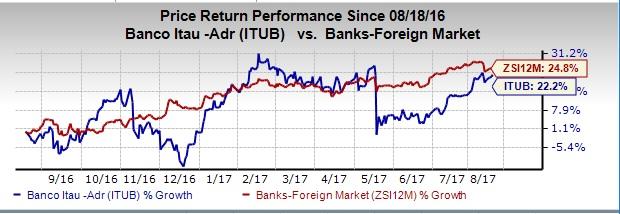

Itau Unibanco’s shares have jumped nearly 22.1% on the NYSE in the past year.

Both Citigroup and Itau Unibanco currently carry a Zacks Rank #3 (Hold).

Stocks to Consider

Shinhan Financial Group Co Ltd (NYSE:SHG) has been witnessing upward estimate revisions for the last 30 days. Further, the stock has surged nearly 27.2% over the past year, on the NYSE. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

KB Financial Group Inc (NYSE:KB) has been witnessing upward estimate revisions for the last 30 days. Over the past year, the company’s share price has been up more than 50% on the NYSE. It also flaunts a Zacks Rank #1, at present.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Citigroup Inc. (C): Free Stock Analysis Report

Itau Unibanco Banco Holding SA (ITUB): Free Stock Analysis Report

Shinhan Financial Group Co Ltd (SHG): Free Stock Analysis Report

KB Financial Group Inc (KB): Free Stock Analysis Report

Original post

Zacks Investment Research