And you thought the U.S. political scene was wild and crazy. In Italy, over the weekend, the sitting President used his constitutional powers to block the creation of a legally elected government which already controls the Parliament. This will force new elections which will likely give the populist parties even more power and guarantee an even larger shift away from the EU. We will quickly need an Italian name for Brexit on steroids. And if you own assets in Italy, your portfolio is going to need something much stronger than steroids to keep it afloat. Meanwhile, the euro moves one step closer to becoming a broken currency that will only further benefit European manufacturing exports and tourism, while sending inflation straight up. Who is going to tell Merkel and Macron to cancel their summer vacation plans?

There is unfortunately much more to worry about globally. The U.S. steel tariffs expire this week and in another reversal, the Administration has now decided to implement tariffs on China. Speaking of which, has anyone seen the U.S. Treasury Secretary since last week when I suggested he had the upper hand in the Chinese trade negotiations? Since hitting the news shows on Monday, he has disappeared. Like completely. I was wrong to suggest that the White House was turning over a new leaf on the trade negotiations. It is clear that no one outside the Administration (or maybe even inside) has any knowledge as to what is being considered or implemented. Like the Colorado weather, just wait 6 hours and it can change wildly.

In other countries, the Turkish lira is trying to halt its steep slide, Brazil is feeling social unrest pressures from a soaring U.S. dollar, Argentina continues to see volatile investment flows and Spain is having its own Presidential political problems. All of these rising global tensions is creating a sudden flight to safety sending U.S. Treasuries, German Bunds, the yen and the Swiss franc sharply higher.

For a world, which two weeks ago was betting on rising U.S. rates and bonds breaking a 10-year trendline, this can be painful if you are not positioned correctly. One investor group on edge right now are the many U.S. equity portfolio managers who are overweight financial stocks. This sudden move lower in interest rates, coupled with an ever-flattening yield curve and now rising question marks on euro periphery assets, will place those positions at risk.

Also the soaring U.S. dollar will put pressure on their lending books exposed to U.S. exporters as Europe ramps up their factories. On the flip-side, U.S. Small Caps continue to remain in the driver seat as long as the U.S. economy holds together. So, hope you enjoyed the long weekend because it will be a long grind in the markets until the next three-day weekend in 14 weeks.

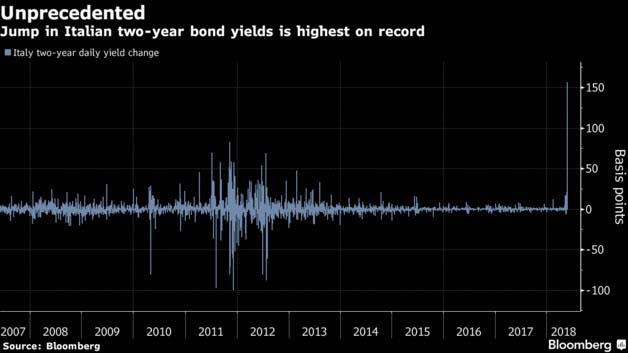

You pay attention to any market that has its biggest move on record…

Today’s spike in two-year Italian yields is outpacing anything seen during the euro-zone crisis in 2011 and 2012. The yield on two-year notes is up around 150 bps at 2.40%, having touched 2.83%, the highest level since 2012.

(@business)

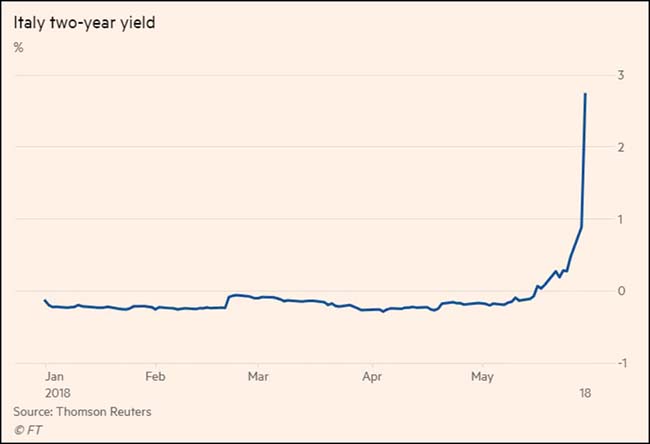

And not just a big move, but a doubling in interest rates…

Italy’s bond market suffered a steep sell-off on Tuesday, sending the yield on the country’s two-year bond to the highest level in more than four years as concerns about political turmoil in the eurozone’s third-biggest economy intensify. The yield on two-year Italian debt broke through 2.7 per cent for the first time since 2013, reaching as high as 2.73 per cent — up nearly 2 percentage points from Monday’s market close.

The yield on 10-year debt hit 3.388 per cent, up 70 bps from the previous close. Yields rise when prices fall. Investors have been selling Italy’s bonds and equities after the country’s president, Sergio Mattarella, frustrated a bid by the Five Star Movement and League to form a coalition government. Investors fear that his move will trigger new elections that might give a more explicitly Eurosceptic mandate to the two populist parties.

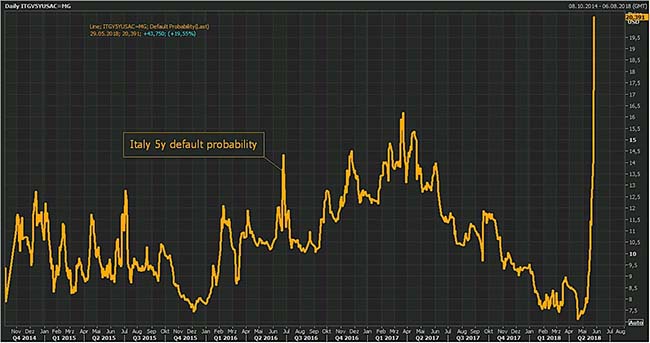

Even the chance of default has soared in Italy…

@Schuldensuehner: Markets spooked by “political coup” in #Italy. Default probability has jumped to 20%.

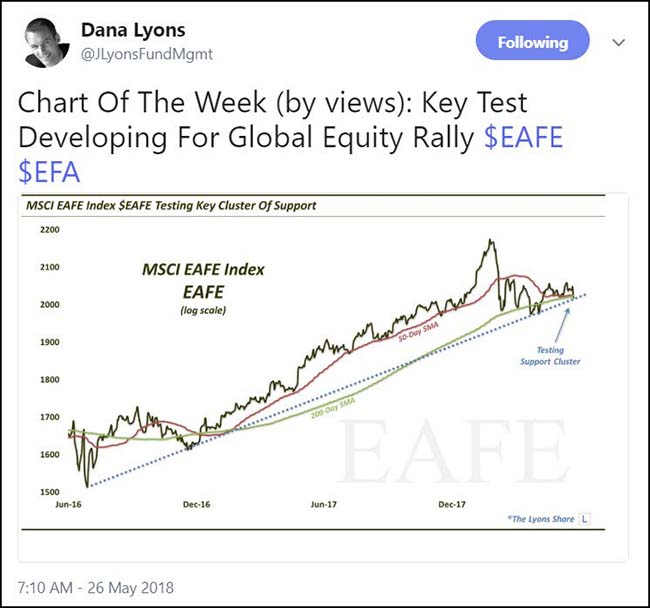

Dana’s chart of trendlines and moving averages is now broken…

U.S. dollar pain in Brazil…

The strong U.S. dollar and falling Brazilian real has sent the cost of fuel surging leading to trucker strikes across the country which has shut down the economy…

Brazil’s President Michel Temer late on Sunday announced measures to try to end a week-long truckers’ strike that has paralysed Latin America’s largest economy and threatened to undermine his government.

The measures, which included a cut in the price of diesel, came as the economic cost of the strike mounted — petrol was unavailable across much of the country and poultry producers were forced to cull 64m birds for lack of chicken feed.

“Throughout this week, my government has always been open to dialogue,” the president said in a terse announcement on national television, conceding a cut of R$0.46 ($0.12) per litre, or an average of about 12 per cent.

The strike started a week ago and has gathered momentum after fuel costs in Brazil soared, hit by a perfect storm of rising international oil prices and a sharp depreciation in the real.

In spite of calling in the army on Friday to guarantee deliveries for essential services, such as petrol for airports and security forces, Mr Temer has been unable to end the strike. On Sunday, strikers were showing little sign of giving in, challenging the president’s authority.

To confuse you even further, the White House unfroze the tariffs on China on Monday morning…

The Administration’s lack of strategy or defined goals was especially evident in the President’s seesaw on China this week.

On Monday he boasted that a weekend deal to withdraw tariffs was “one of the best things to happen to our farmers in many years!” The next day he complained that he was “not satisfied,” then tweeted Wednesday that “Our Trade Deal with China is moving along nicely, but in the end we will probably have to use a different structure in that this will be too hard to get done and to verify results after completion.”

So clearly the long investing bet on tariff confusion is trading vessels and shipping fuel…

A ship carrying sorghum is literally riding the waves of the fractious relationship between China and the U.S. over trade.

The bulk carrier RB Eden was loaded with the grain at Archer-Daniels-Midland Co.’s terminal in Corpus Christi, Texas, and was initially bound for Shanghai. When China announced a 179 percent tariff on imports of sorghum in mid-April, it performed a U-turn in the Indian Ocean, according to vessel data tracked by Bloomberg, and sailed back around southern Africa toward Europe.

The vessel’s destination was changed to Cartagena, Spain, but according to the data, it never docked. On May 18, China scrapped its anti-dumping and anti-subsidy probe into sorghum.

The same day, the RB Eden began sailing back toward the Atlantic. It’s currently bound for Singapore.

(Bloomberg)

Steel tariffs hit our trading partners this week, so expect sharp retaliation…

U.S. high yield credit has held in well. Will it continue?

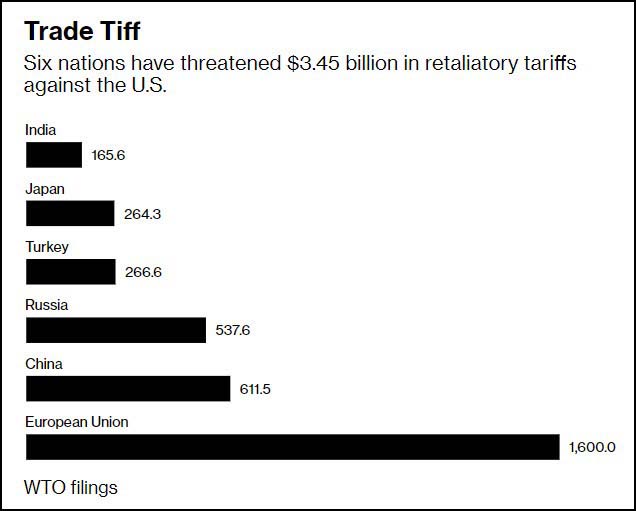

President Donald Trump’s maximalist approach in recasting his nation’s trade relations may soon hit U.S. farmers and manufacturers, as America’s trade partners prepare retaliatory tariffs that could generate $3.45 billion in revenue.

In just the past week, the European Union threatened $1.6 billion of additional levies in response to U.S. tariffs on metal imports; Russia prepared $537.6 of added duties; Turkey $266.6 million; Japan $264.3 million; and India $165.6 million, according to filings with the World Trade Organization. China already imposed $611.5 million of additional retaliatory tariffs.

(Bloomberg)

The impact of rising labor and material costs on Toll Brothers hit hard last week…

For the three months to end of April, revenue came in at $1.6bn, a 17 per cent jump from the prior year period as the company sold more houses at higher prices.

However like other sectors across corporate America, Toll Brothers is also being squeezed by higher construction material costs and labour shortage.

Gross margin fell to 22.5 per cent during the quarter from the 24.3 per cent reported in the prior year period as prices for everything from lumber to transport and labour rose.

As a result net income fell 10.3 per cent to $111.8m, or 72 cents per diluted share, confounding Wall Street expectations of 76 cents a share.

“Labor is tight,” chief executive Douglas Yearley said during a call with analysts. He said labor probably accounts for 20-30 per cent of the cost increase the company is seeing, with the rest attributed to higher lumber and construction material prices.

(Financial Times)

“There can only be one”…

(Thorn EMI Screen Entertainment)

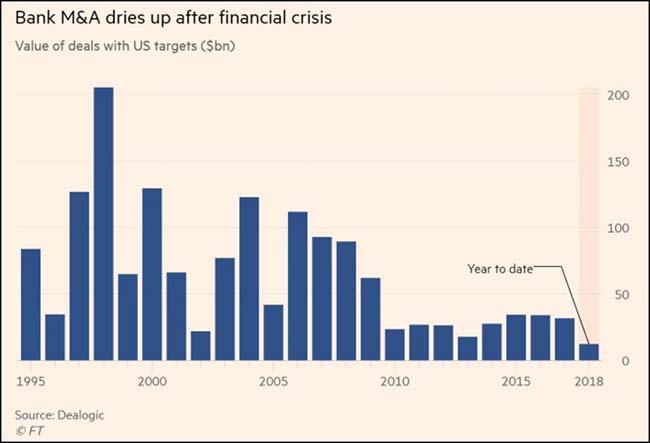

Has the ‘Highlander’ theme returned to M&A for banks?

The US’s banks have largely sat out the mergers and acquisitions wave of recent years. While deal records have fallen in almost every other sector, big banks have done almost nothing, shrinking rather than expanding. And merger activity among small and mid-sized banks — some 5,607 of them, at last count — has been subdued.

But when Fifth Third Bancorp (NASDAQ:FITB) of Cincinnati revealed its $4.7bn swoop for Chicago’s MB Financial on Monday morning, shares in other Chicago-area banks began to move, too. Wintrust, a similar-sized bank based in Rosemont, Illinois, ended the day up almost 4 per cent, while First Midwest of Itasca closed up 3 per cent.

The implications were obvious: after years of thin activity in bank M&A, this deal could mark a turn.

The conditions for dealmaking look better than at any time since the financial crisis. Higher interest rates and lower taxes have pumped up bank profits, giving management teams stronger platforms from which to contemplate doing something radical. Data released on Tuesday by the Federal Deposit Insurance Corporation showed that net income across the banking industry rose 27 per cent from a year earlier in the first quarter, to a record $56bn.

Shareholder activists have also begun to flex their muscles, calling for fresh ways to boost returns at Ally Financial Inc (NYSE:ALLY), Comerica (NYSE:CMA), Citigroup (NYSE:C), Morgan Stanley (NYSE:MS) and Regions Financial (NYSE:RF), among others.

And then — most importantly — there is the shifting regulatory landscape.

(Financial Times)

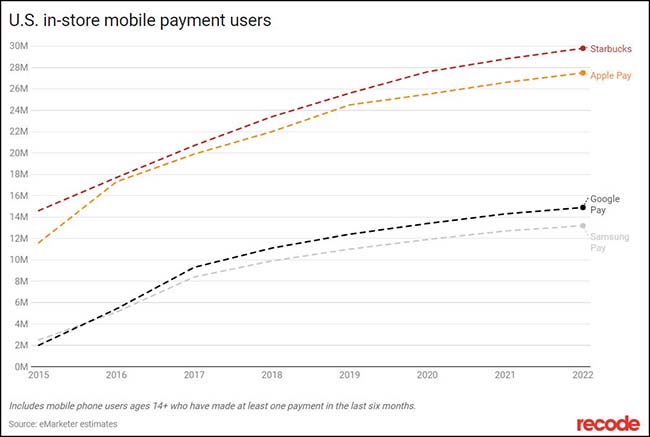

So how long until a technology or financial company acquires Starbucks (NASDAQ:SBUX) to get its hands on its mobile payments app?

By the end of this year, a quarter of U.S. smartphone users — 55 million people — over the age of 14 will make an in-store mobile payment. More than 40 percent of those people will have done so through Starbucks’s mobile payments app, according to new data from research firm eMarketer.

The Starbucks app, which launched before the other three top payments apps — Apple (NASDAQ:AAPL) Pay, Google (NASDAQ:GOOGL) Pay and Samsung (KS:005930) Pay — has long been the most successful payments app. It’s likely going to maintain that lead over the next few years.

The Starbucks app lets users pay with their phones and earn credits toward future purchases. That usage is significant: Starbucks said its mobile order-and-pay system accounted for 12 percent of all U.S. transactions in the quarter ended April 1.

(Recode)

You should have listened to her…

(Quartz)

Peak Denver?

It is easy to see why the hostile business climate in Seattle has reversed its population growth. Denver’s is a bit trickier. The business climate is still healthy, but the cost of living has definitely taken its toll. It will be interesting to watch the effect on our local real estate and apartment rental prices.

In the first three months of 2018, Denver posted a “net outflow” of Redfin users for the first time, meaning that more Denver-based Redfin users were searching for homes in other metro areas than Redfin users elsewhere looking to move in. Of all Denverites using Redfin, 20 percent were searching for homes in another metro, up from 15 percent during the same time period a year earlier. Nationally, 23.9 percent of Redfin.com users looked to relocate to another metro area last quarter, up from 19.8 percent a year earlier.

(Redfin)

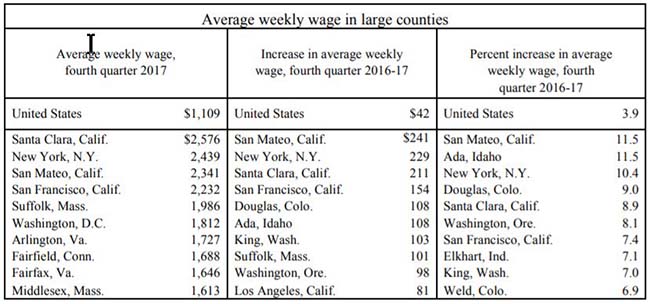

If you are curious where average weekly wages are highest and growing the fastest…

(Bureau of Labor Statistics)

Classrooms must have air conditioning…

The first study putting numbers to those thoughts you had while melting across that summer afternoon classroom desk.

We provide the first evidence that cumulative heat exposure inhibits cognitive skill development and that school air conditioning can mitigate this effect. Student fixed effects models using 10 million PSAT-takers show that hotter school days in the year prior to the test reduce learning, with extreme heat being particularly damaging and larger effects for low income and minority students. Weekend and summer heat has little impact and the effect is not explained by pollution or local economic shocks, suggesting heat directly reduces the productivity of learning inputs. New data providing the first measures of school-level air conditioning penetration across the US suggest such infrastructure almost entirely offsets these effects. Without air conditioning, each 1°F increase in school year temperature reduces the amount learned that year by one percent. Our estimates imply that the benefits of school air conditioning likely outweigh the costs in most of the US, particularly given future predicted climate change.

(NBER)

If you need screen time away from the markets, ‘Killing Eve’ gets two thumbs up from my household…

“Killing Eve” is proving the television thriller can still surprise.

In the BBC America series, Sandra Oh is Eve, an intelligence agent bored with her job until she becomes fixated on Villanelle, an assassin (played by Jodie Comer ) with a penchant for flamboyant killings. It becomes a two-way obsession when Villanelle starts stalking Eve.

Its sixth episode, the latest one for which complete viewing data were available, drew 941,000 total viewers, including those who watched it within three days of its airing. Over the same period, 3.6 million viewers watched the night’s most popular cable series, AMC’s “Fear the Walking Dead.” But “Killing Eve” is a rare example of a serial TV show whose audience has steadily grown after its debut.

From its April premiere through its first six episodes, ratings increased every week. Overall, they rose 77% among 25- to 54-year-old viewers. BBC America says it is the only new ad-supported scripted series to show such consistent growth in more than a decade.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI