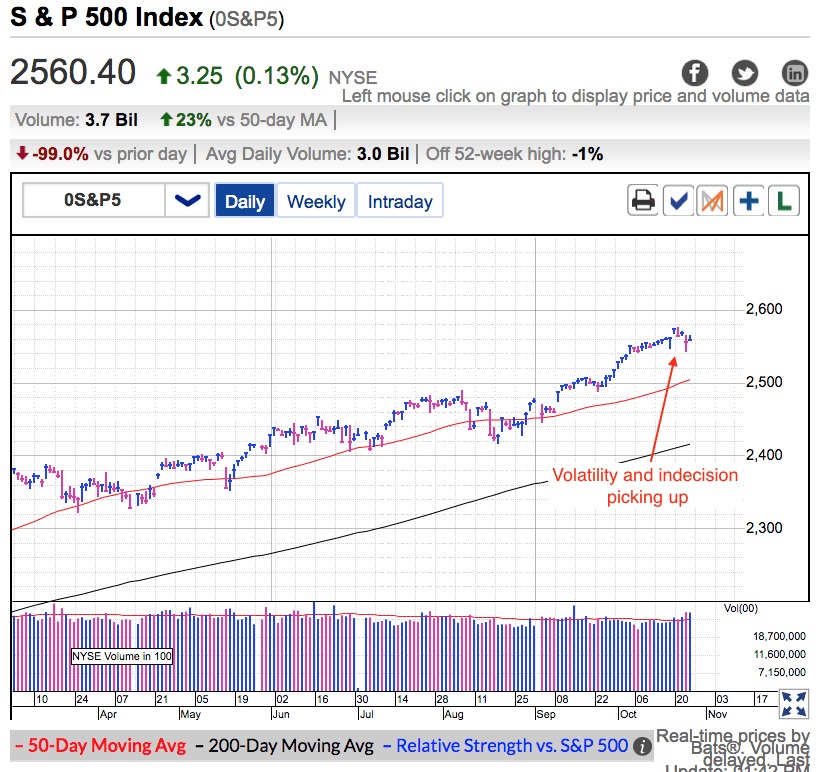

The S&P 500 inched higher Thursday, but for all practical purposes this was another flat session. We smashed through 2,540 earlier this month, but have been struggling to add to those gains ever since.

Volatility has been picking up over the last several days, producing the largest intraday swings since Trump’s war of words with North Korea. Most of these gyrations have reversed within hours, but the transition from calm, one-way moves higher is a material change in behavior.

Previously the Bulls were firmly in control and Bears were helpless to stop them. But this uptick in volatility tells us Bulls are losing their grip and Bears are growing stronger. Volatility often increases just before a reversal in direction. We saw that during the North Korean lows and could be witnessing the same thing now as the latest rally runs out of steam. Markets go up and markets go down, that’s what they do. There is nothing wrong with a healthy and normal pullback to support there.

After Thursday’s close, GOOGL, AMZN, and MSFT put up strong results. Without a doubt parts of the tech sector are doing very well. But this strength doesn’t seem to be carrying over to the broad market as overnight futures are only up a tenth of a percent. If tech earnings were poised to launch us higher, we would see a larger reaction in the futures.

But this isn’t a surprise. There is only one thing that matters to this market and that is Tax Reform. The House passed the Senate’s budget. Last Friday the market surged to record highs when the Senate passed their budget, but today market was much cooler to the House doing the same thing. That’s because 20 Republicans voted against the budget in protest over cuts to state income tax deductions.

Everyone loves tax cuts and the market has been rallying on that positive sentiment. But now we are transitioning to the debate over what taxes will be raised in order to pay for all those lovely tax cuts. Interest expense, 401k, and state income tax deductions all find themselves on the chopping block. On Thursday twenty Representatives demonstrated their displeasure with the proposed changes. Trump already said he was opposed to cutting 401ks. And let’s not forget our president is a real estate mogul. Anyone think he will sign a bill that eliminates interest deductions for his business and real estate loans? Yeah, me neither.

November 1st is when we are supposed to see this widely anticipated bill for the first time. If the healthcare debate is anything to go by, there is a good chance this bill will be delayed coming out of committee. Once it finally sees the light of day, it will get shredded by special interests. If there was one thing Republicans could agree on, it was their disdain for Obamacare. Yet even with that unity driving them, they still couldn’t repeal it. What is going to happen when populist moderates, fiscal conservatives, and pro-business Republicans duke it out? It won’t be pretty and it won’t be fast.

Expect the hope of Tax Reform to give way to despair over political infighting. There is a good chance Republicans will pass something…..eventually. But it definitely won’t be as grand as many are hoping for. In the meantime, expect the stock market to give back a chunk of recent gains as it consolidates and allows the 50dma to catch up. This is definitely a better place to be taking profits than adding new money.